- The debate around Uniswap’s governance proposal is shedding light on the challenges and opportunities of decentralized governance.

- The reaction of the market and large investors to UNI’s price dynamics highlights the intricate relationship between governance issues and investor confidence.

The digital currency sphere was abuzz as UNI, the native token of Uniswap, experienced a significant 77% increase in value following a critical proposal to modify its governance framework.

This surge propelled UNI to its highest value in two years, pushing its monthly gains to an impressive figure close to 80%. Yet, this upward trajectory was met with a swift 1.19% downturn in the next 24 hours.

Governance Proposal Sparks Community Engagement

At the heart of these significant price movements is a proposed change aimed at redefining how Uniswap’s governance operates. This proposal has captivated the Uniswap community’s attention, with ongoing discussions about its potential impact on the platform’s future and the likelihood of it being accepted by the community.

An intriguing revelation from Lookonchain, an on-chain analytics service, highlighted a notable concentration of governance power within Uniswap.

It was discovered that an individual community member controlled an alarming 64 million UNI tokens, spread over 31 wallets, making up 6.4% of all UNI in circulation.

This raised pivotal concerns about the decentralized governance model’s vulnerability to significant influence by individual actors. For a deeper dive into these developments, a detailed explanation is available in this Youtube video.

Observations on Market Behaviour and Large Holders

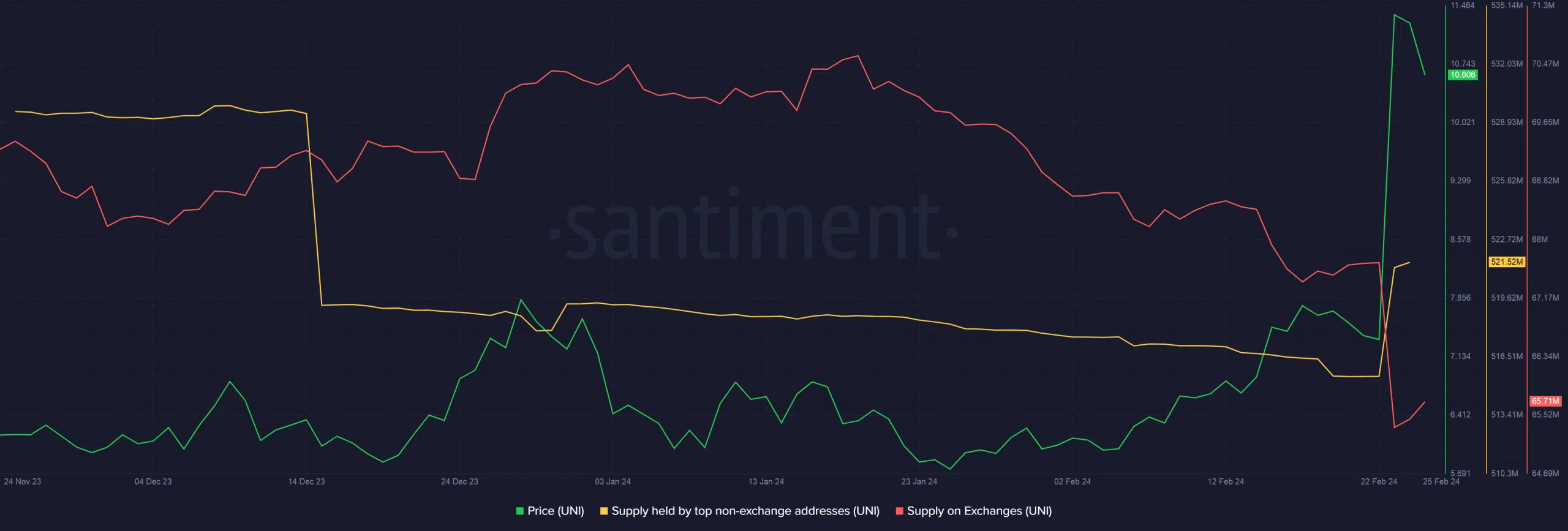

The market’s response to the price correction revealed interesting patterns among UNI stakeholders. An observed rise in the token’s exchange supply indicated that some investors were seizing the opportunity to realize profits.

In contrast, an increase in holdings among the largest non-exchange wallets suggested that some large-scale investors remain optimistic about UNI’s value, continuing to accumulate amidst market fluctuations.

Shifts in Derivatives Market Outlook

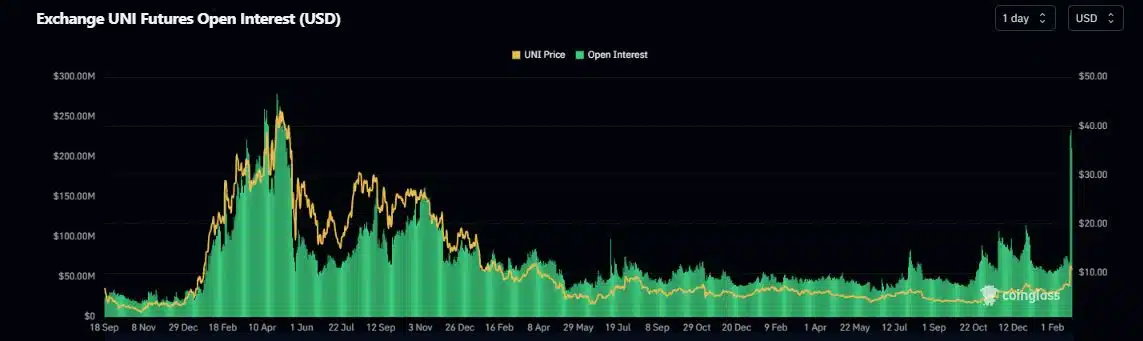

The fluctuations in UNI’s price also significantly impacted its derivatives market, with a notable increase in Open Interest (OI) for UNI futures, reaching a peak unseen since May 2021. This marked a heightened speculative interest in the token’s future price directions.

However, following the market correction, a cautious stance seemed to prevail among traders, as evidenced by a greater number of bearish short positions compared to bullish longs, indicating a more reserved market sentiment.

Can UNI Hit $15?

The goal price of $15, which is approximately a 50 percent increase from the present value, could be readily attained during the forthcoming bullish market trend, likely spurred by this year’s recent Bitcoin halving. Additionally, the development of the Uniswap platform will play a crucial role in initiating a bullish movement for this token.