- Uniswap is advancing its development with comprehensive audits and security enhancements, seeking to strengthen the trust and efficiency of its platform.

- The increase in MEV bots and arbitrage transactions poses challenges, impacting market dynamics and the perception of Uniswap.

Uniswap, the benchmark decentralized exchange, is facing a watershed moment with its latest update – will it succeed in attracting a larger user base with these new features? Let’s delve into the details that define this important period for Uniswap.

The project is progressing through its early stages, from completing the code base to testing, optimizing gas usage, strengthening security and completing additional components.

However, this is just the beginning. The next phase looks even more promising, with the scheduling of comprehensive audits that include detailed professional assessments and audit competitions involving the community. This strategy reflects Uniswap’s commitment to security and efficiency, as well as its interest in staying open and connected to its user base.

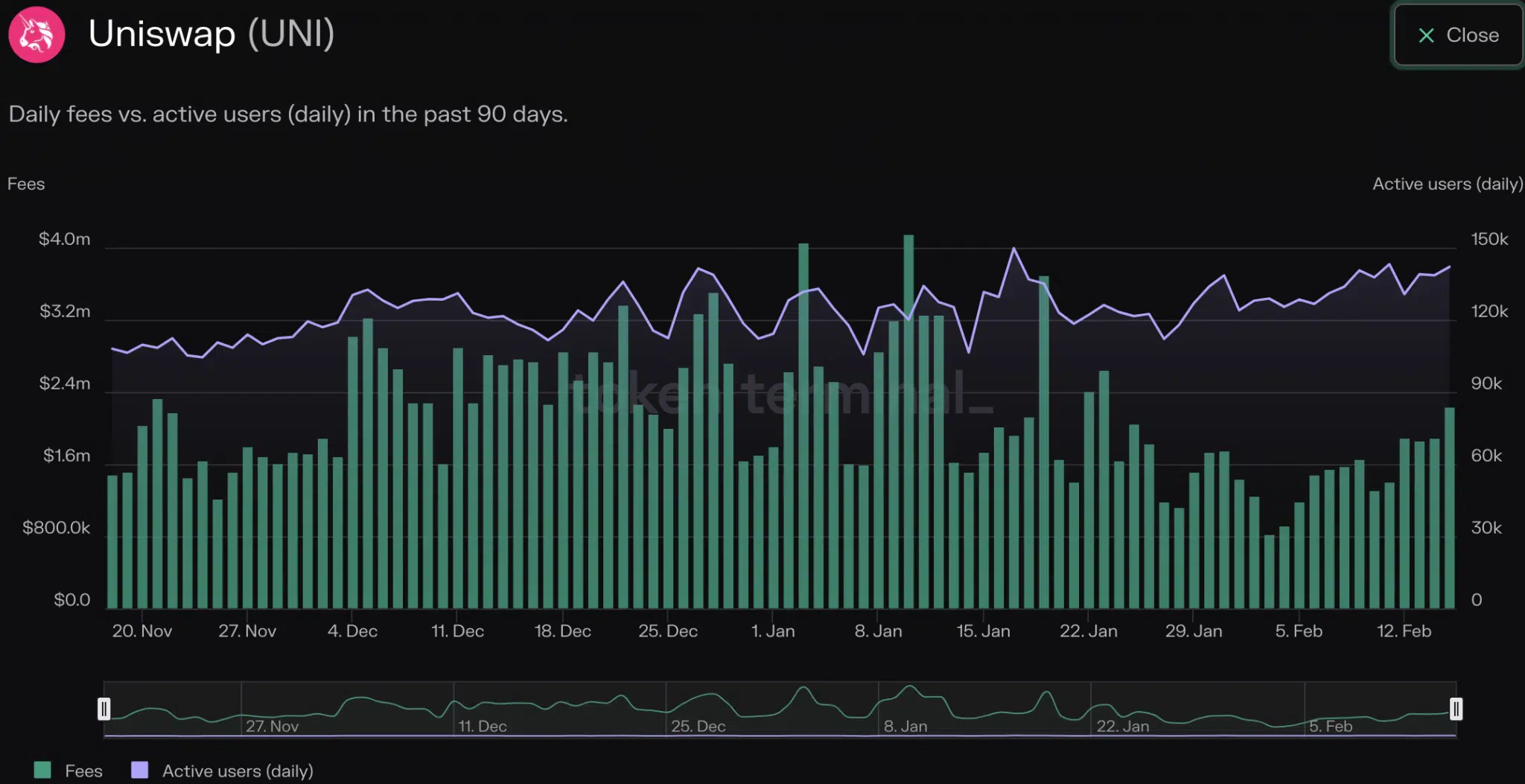

In recent months, Uniswap has experienced a remarkable growth in activity. The number of daily active users on the network increased by 26.2%, a sign of its rising popularity.

In addition, commissions generated by the protocol rose by 83% during this time, increasing the platform’s revenue and providing additional funds for its future development. These numbers not only evidence Uniswap’s success, but also suggest encouraging prospects.

However, there are challenges on the horizon, particularly with the increase in the number of MEV (Miner Extractable Value) bots and arbitrage transactions. MEV bots are dedicated to identifying opportunities in the order and execution of transactions to maximize profits.

Arbitrage trading, on the other hand, seeks to profit from price differences of the same asset on different platforms. These activities can add a layer of complexity and potential manipulations to the exchange environment in Uniswap, affecting transaction outcomes and market.

The rise of these bots and arbitrage trading presents a challenge for traders, who now face more competition and strategies such as front-running. This scenario begs the question of how it will impact the perception and future use of Uniswap.

Uniswap is striving to advance its infrastructure and security measures, while addressing the challenges emerging from automated business strategies. The platform is at an inflection point, looking at how to balance the introduction of new functionality while maintaining a fair and transparent trading environment.

For cryptocurrency enthusiasts and users, this represents a period of high expectations but also caution. Uniswap’s track record could set a model to follow in managing security, efficiency and fairness in markets increasingly dominated by automation.

The question remains: can Uniswap overcome these obstacles and continue to be the exchange of choice for the cryptocurrency community? The future will tell, but of one thing we can be sure: the road to advancement always presents challenges.