- USDT liquidity outpaces Bitcoin ETF AUM growth, facilitating cryptocurrency accumulation.

- Tether’s market cap reaches $104,056,161,009, despite speculation about reserve backing.

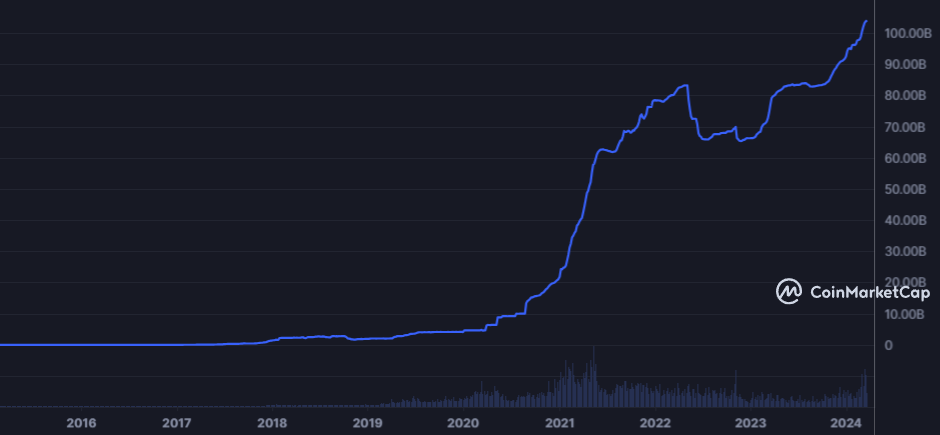

Since the start of March, Tether (USDT), the dominant stablecoin in the crypto ecosystem, has seen an impressive increase in its market cap, totaling more than $5.25 billion. This growth in stablecoin funding is an encouraging sign for overall market liquidity, as it provides essential support that can meet the demand for Bitcoin (BTC) and other cryptocurrencies.

Tether has added $5.25billion in March so far and no-one is talking about it

For perspective, the ETFs combined have added <$4billion in March so far pic.twitter.com/mNl7dxzvK1

— Alistair Milne (@alistairmilne) March 21, 2024

It is relevant to note that despite the remarkable growth in the Bitcoin cash Exchange Traded Fund (ETF) market this month, it has only managed to add less than $4 billion in net flow. The superiority of USDT liquidity over growth in ETF assets under management (AUM) indicates that there is sufficient stablecoin available to support the accumulation of BTC and altcoins on exchange platforms.

Currently, based on data from CoinMarketCap, Tether’s market capitalization stands at $104,056,161,009. This increase, from around $98.65 billion at the beginning of the month, reflects a steady upward trend, despite facing periods of consolidation throughout the month.

While speculation has arisen about the proper reserve to back this offering, Tether has consistently refuted these allegations, relying on the explicit support of Howard Lutnick, CEO of Cantor Fitzgerald and custodian of Tether.

Tether has played a pivotal role in strengthening the commercial integrity of the crypto market since its founding, as we mentioned on ETHNews. Recently, billions of dollars worth of transactions have been recorded involving USDT, and this stablecoin has become a key player in almost every crypto trading platform, offering unique trading pairs with most altcoins.

The company behind the stablecoin, Tether Holdings, is charting a new path by expanding its operations beyond issuing USDT. With a growing interest in becoming a Bitcoin mining entity and developer, with extensive investment in the sector, Tether is strengthening its link to Bitcoin.

This relationship has generated debates about market manipulation, challenges that the company has faced and vigorously tried to dispel over the past few years.