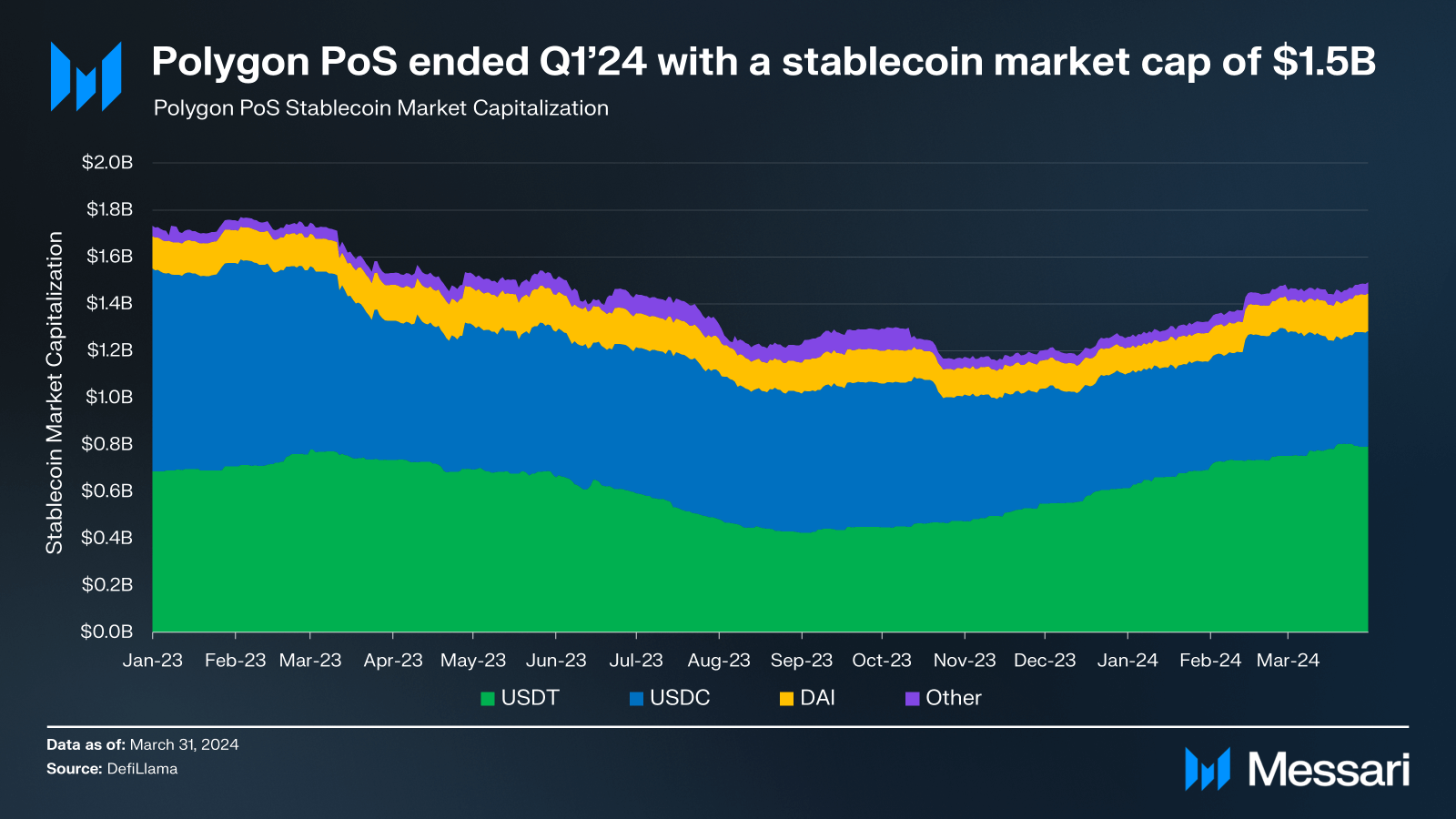

- Polygon’s stablecoin market cap surged to $1.5 billion, a 19% increase QoQ.

- Tether’s market cap on Polygon grew by 29% QoQ to $792 million, representing 53% of the total.

This quarter, Polygon’s stablecoin market cap has increased noticeably. As to the most recent Messari research, the stablecoin market cap of the Ethereum Layer 2 solution surged to a stunning $1.5 billion, a notable 19% increase from the previous quarter.

Tether’s Dominance on Polygon

According to Messari, Tether solidified its position as the top stablecoin on Polygon with a market capitalization increase of an astounding 29% QoQ to $792 million. On the network, this represented a noteworthy 53% of the stablecoin market capitalization.

Over this time, a number of noteworthy events have contributed to the surge in stablecoin acceptance on Polygon.

Sony Bank started investigating stablecoin usage on the Polygon blockchain in April with the goal of assessing their viability as a means of settling digital sales—including video games—across the Sony Group.

Furthermore, highlighting the Layer 2 network’s increasing importance in the stablecoin ecosystem is the announcement by Belgian software company Settlemint to create a stablecoin using Polygon.

The market cap of Polygon stablecoins rose 19% QoQ to $1.5 billion. With a market cap that increased by 29% QoQ to $792 million, or 53% of the entire stablecoin market cap, USDT maintained its top spot.

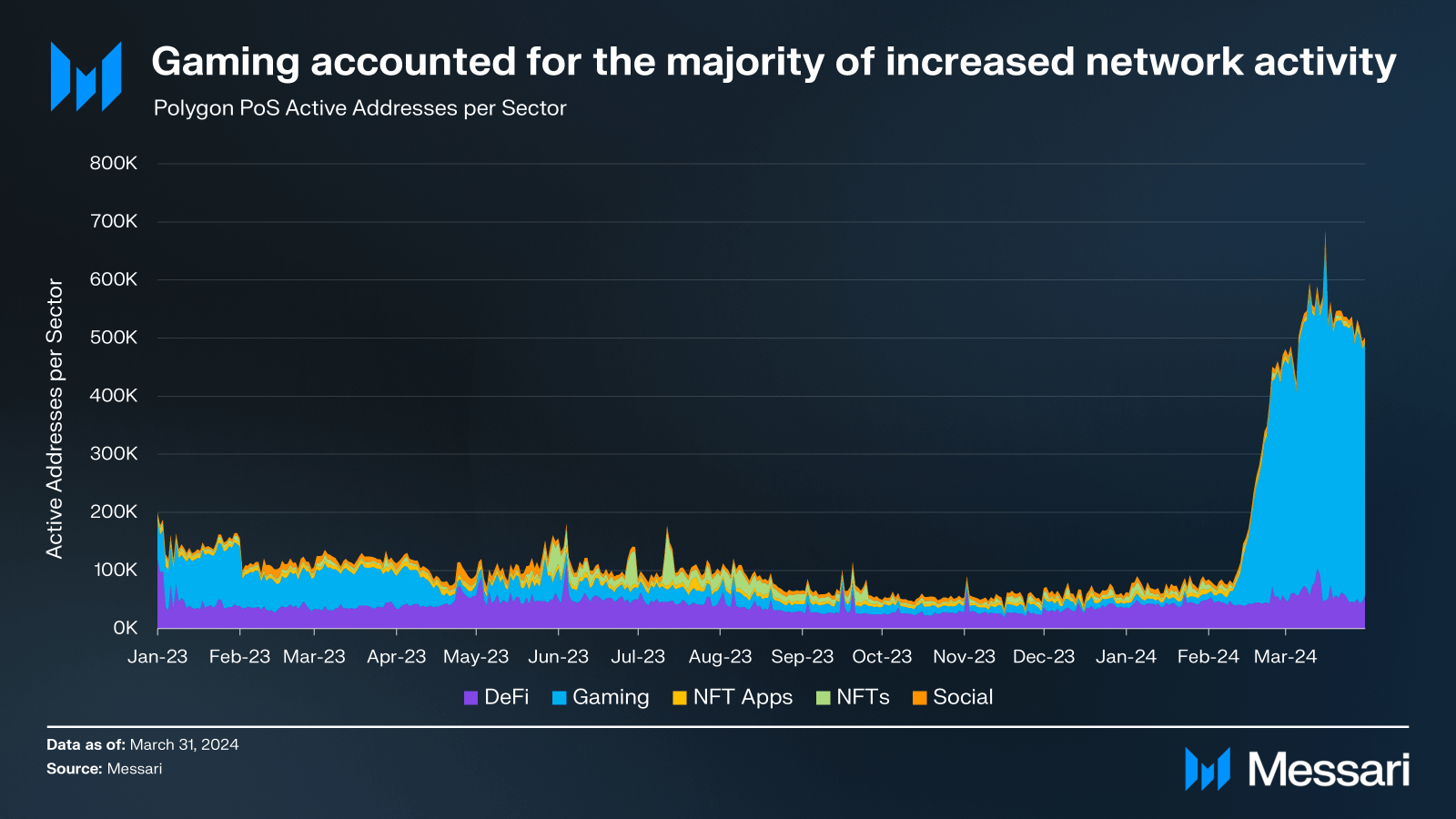

Gaming Sector Flourishes on Polygon

The first quarter of 2024 saw great success for Polygon’s gaming industry as well, echoing earlier coverage by ETHNews. Messari noted that there were 207,000 daily active addresses linked to gaming on the site, a 1,615% increase quarter over quarter.

The daily gaming transactions on Polygon also increased 469% QoQ to 734,000 transactions. The huge popularity of the MATR1X FIRE game was the main factor behind this increase in gaming activity.

Growth in DeFi and NFT Sectors

Beyond the gaming industry, Polygon’s decentralized finance (DeFi) ecosystem saw substantial expansion as well; daily active DeFi addresses climbed by 67% QoQ to 50,000.

Though activity in the social and non-fungible token (NFT) sectors increased during the same time, their size remained smaller than that of the gaming and DeFi domains inside the Polygon ecosystem.

MATIC Price Analysis and Regulatory Insights

CoinMarketCap data shows that MATIC was worth about $0.7011 at the time of writing, up just 0.04% in the last 24 hours. It did, however, also point to a bearish trend—down 2.23% during the previous seven days.

On the other hand, ETHNews reported that Kraken, the crypto exchange, is still providing USDT in the European market despite unclear regulations in the area.