- Solana outperforms Ethereum and Tron in daily transactions and token demand, reflecting a growing interest in its ecosystem.

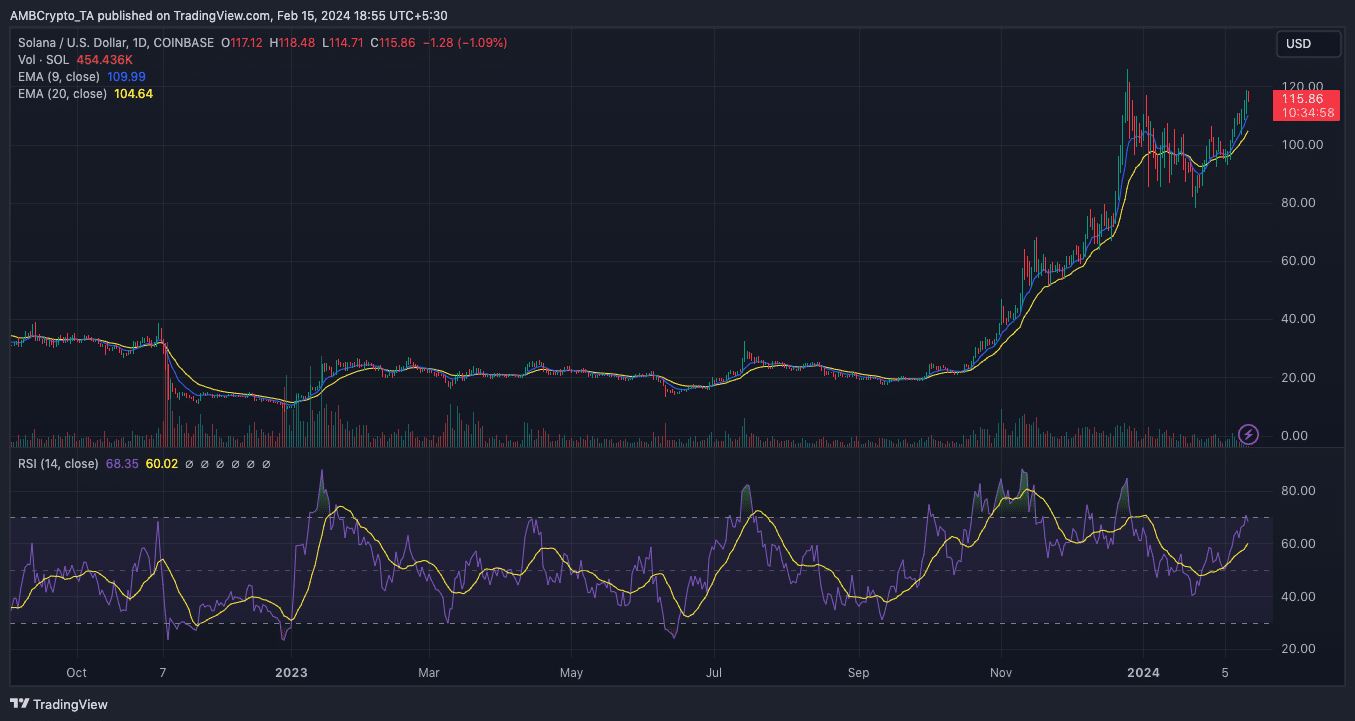

- The daily analysis of SOL/USD shows a possible correction, but a bullish crossover EMAs could point towards $140.

In the Layer One (L1) blockchain sector, Solana [SOL] stands out as the only one with increases in all its metrics, according to an analysis by The Block Research confirmed by ETHNews.

While Ethereum [ETH] and Tron [TRX] showed growth in stablecoin supply, Solana experienced a similar development. This phenomenon indicates an increase in interest in the crypto market.

3/ A decrease in inscription activity caused declines in daily transactions, user counts, and fees for most chains, except Solana, which maintained consistent demand across all key metrics. pic.twitter.com/ZkkIbqQyYd

— The Block Pro (@TheBlockPro__) February 14, 2024

The growth in the supply of stablecoins on various blockchains suggests that market participants have the necessary buying capacity to drive an increase in prices.

In termsof daily transactions, commissions and demand for its tokens, Solana has managed to outperform Ethereum and Tron. This phenomenon demonstrates that market interest in SOL and the tokens on its network is on the rise, which could be partially linked to its price performance.

SOL is currently trading at $110.91, marking a 98.47% increase in the last 30 days.

In comparison, during the same period, the price of ETH rose by 42.67%, and TRX increased by 27.35%.

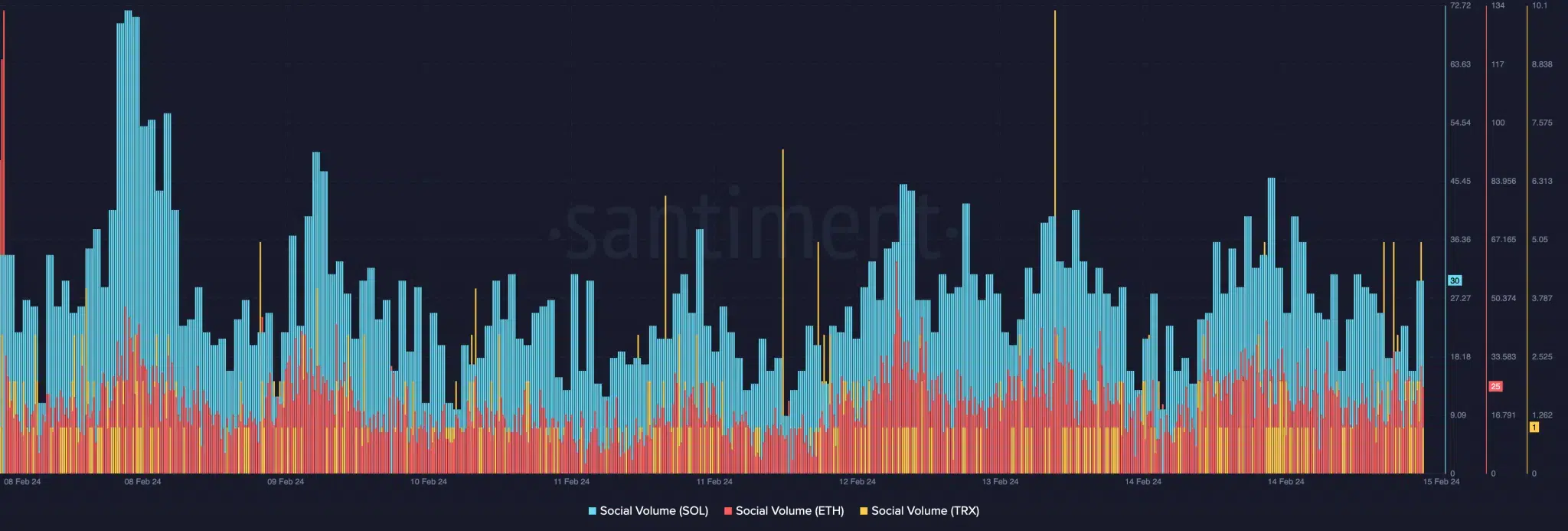

In terms of social volume, the data showed that Ethereum and Tron failed to catch up with Solana. At the time of writing, ETH’s social volume was 25 and TRX’s was even lower, while SOL surpassed them with a figure of 30.

Social volume refers to the number of text documents or searches related to a project.

It follows that Solana has positioned itself as one of the projects with the most attraction, leaving Ethereum behind in terms of interest.

Correction precedes advancement

The role of social metrics in determining the value of cryptocurrencies is clear. For SOL, an increase in social volume could drive its price up to $120 in the near term. However, an excessive increase in this metric could indicate a temporary spike, which in turn could result in a decrease in price.

Analysis of the SOL/USD pair on the daily chart shows that the 9 (blue) and 20 (yellow) exponential moving averages (EMA) are converging. This could indicate that the short-term rise is nearing its end. If the price of SOL falls below these EMAs, it would call into question the bullish outlook previously considered.

However, if the crossover of the EMAs continues to point upwards, SOL could reach $140. Currently, the Relative Strength Index (RSI) stands at 68.35, signaling robust buying momentum.