- Solana’s total value locked (TVL) soared over 1000% year-over-year, indicating strong growth in decentralized finance.

- Over 98 million new NFTs minted on Solana, a 54-fold increase from last year, showing expanding adoption.

Solana’s second quarter showed growth in the decentralized finance (DeFi) and non-fungible token (NFT) sectors, but challenges arose as the third quarter commenced.

. @solana Q2 2024 Financial Report

Solana's fees and revenue experienced significant growth in the second quarter, generating over $26M, a more than 42x increase YoY

The total SOL trading volume reached $292B, nearly 7x higher compared to the same period last year pic.twitter.com/TE2m7JYEEU

— Coin98 Analytics (@Coin98Analytics) July 6, 2024

Quarterly Growth and Setbacks

Solana’s Total Value Locked (TVL) witnessed a 1000% year-on-year increase in the second quarter, underscoring its expanding influence in the DeFi space.

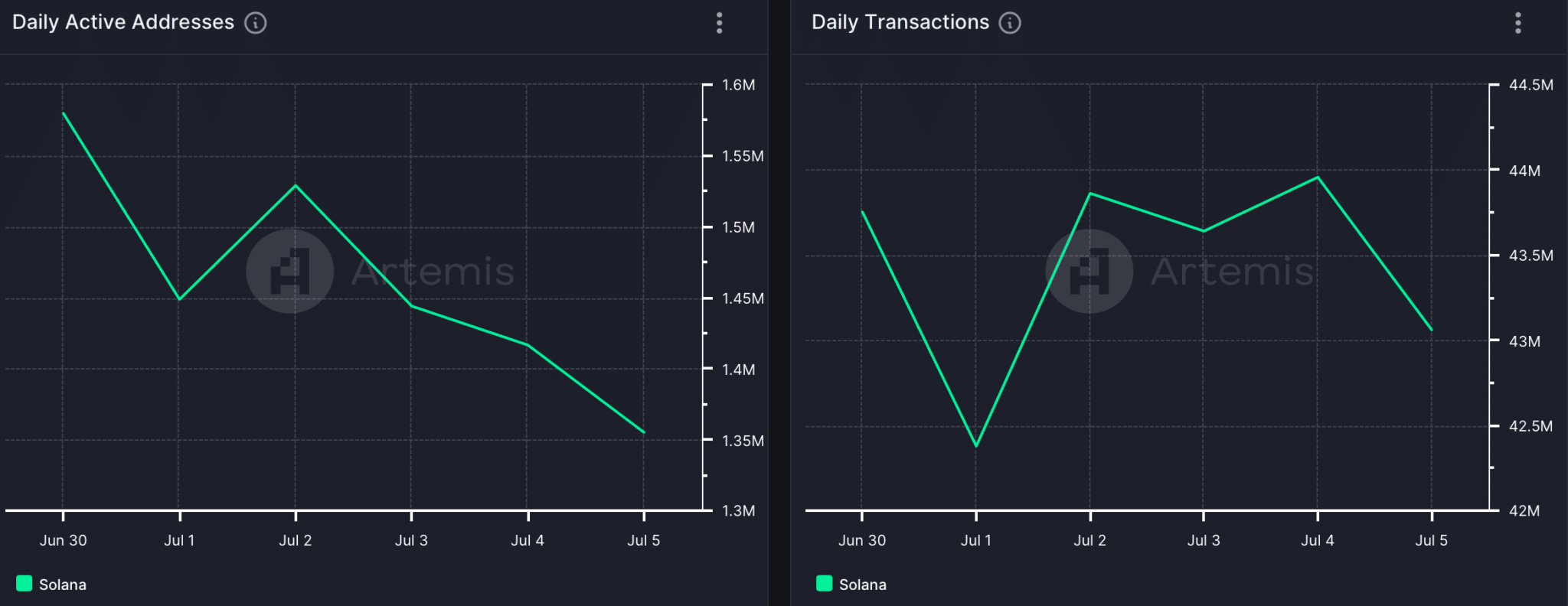

The blockchain also reported a substantial rise in daily active addresses and a surge in transaction volumes, reflecting heightened user engagement and network activity. Moreover, Solana facilitated the creation of over 98 million new NFTs during this period, indicating a robust participation in the digital assets market.

Revenue Insights

Financially, Solana experienced a noteworthy increase in network fees and revenue, collecting over $26 million, which marks a year-over-year growth. This financial success was paralleled by a trading volume that soared to $292 billion, demonstrating the platform’s increasing liquidity and market.

Current Quarter Challenges

As the third quarter unfolds, Solana has encountered some downturn. Key performance metrics such as daily active addresses and transaction volumes have seen a decline. This downturn has extended to the blockchain’s revenue and fees, suggesting a cooling off from the previous quarter’s high activity levels.

Market Position and Outlook

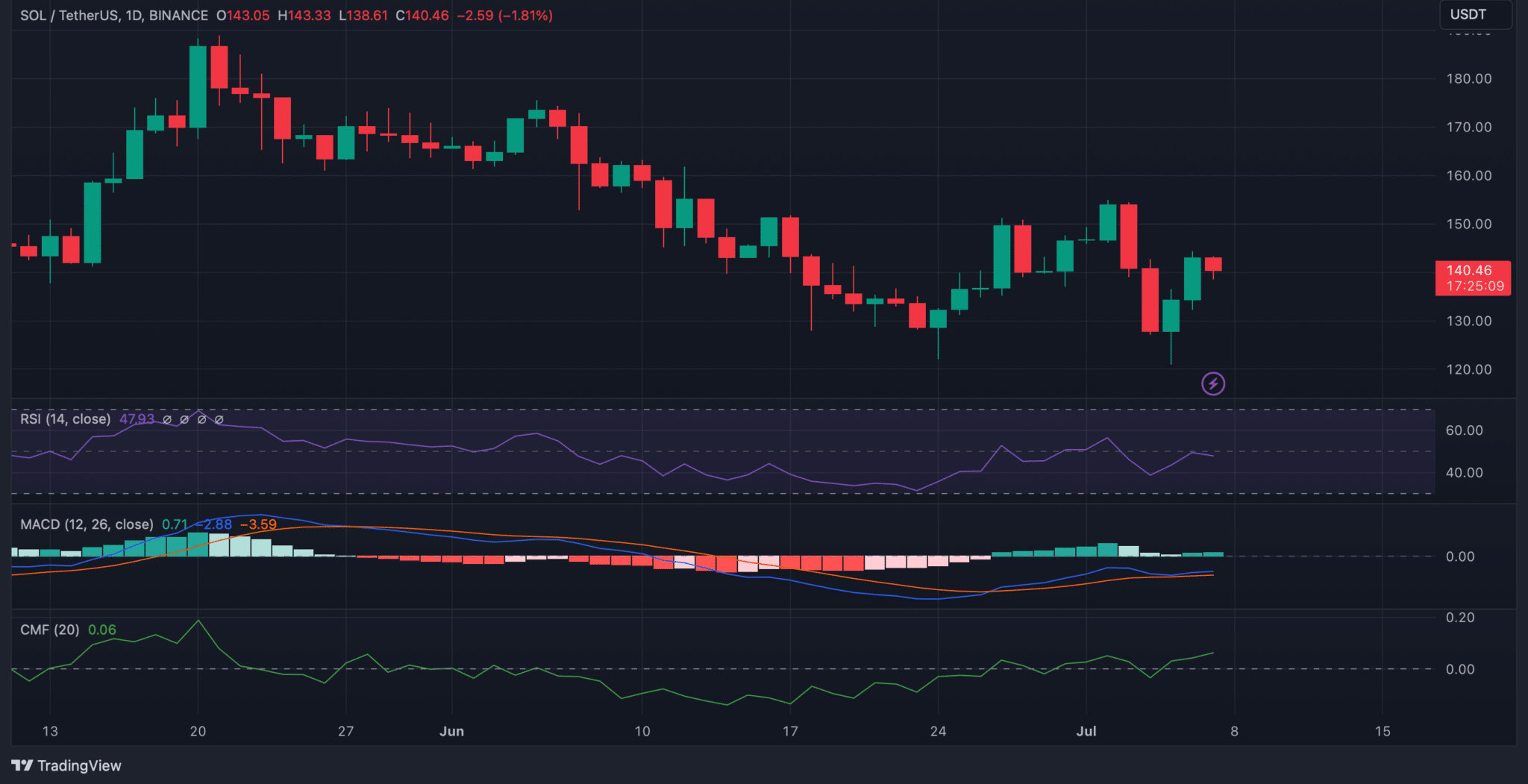

Despite these challenges, the price of Solana’s native token, SOL, has shown support, recovering from earlier losses. Currently, the token’s market valuation stands impressively, maintaining its position among the top cryptocurrencies.

Technical indicators on the daily charts suggest a cautiously optimistic outlook, with potential for further gains if market conditions stabilize.