- In spite of a decline in the number of unique wallets, Solana has demonstrated increased stability and an active NFT market with a minor increase in transactions.

- Ahead of the FTX estate’s token auction, Solana’s price exhibits considerable fluctuation, which affects trading sentiment and market dynamics.

Since the year’s beginning, Solana (SOL) has exhibited exceptional resilience, with only one documented instance of downtime. Compared to the network’s prior years, this February 6th incident, which lasted for more than four hours, demonstrated a notable improvement in reliability.

NFT Market Buzz

Solana is still making waves in the Non-Fungible Token (NFT) space. According to transaction statistics spanning the previous three months, 6.82 million SOLs—or more over $1 billion—were exchanged. With over 25 million transactions made overall, this indicates a little rise in activity.

Solana has managed to maintain its position as the third-largest NFT transaction volume platform in spite of strong competition from prominent platforms such as Bitcoin and Ethereum.

It recorded transactions of $173.4 million in the last 30 days, with major collections like Mad Lads and Froganas driving the majority of the activity.

Market Dynamics at the Moment

Solana’s current market situation is a combination of opportunity and instability. CoinGecko has listed SOL’s price as $145.87. This represents a 7.53% decrease over the previous day but a strong position with a 12.41% gain over the previous week.

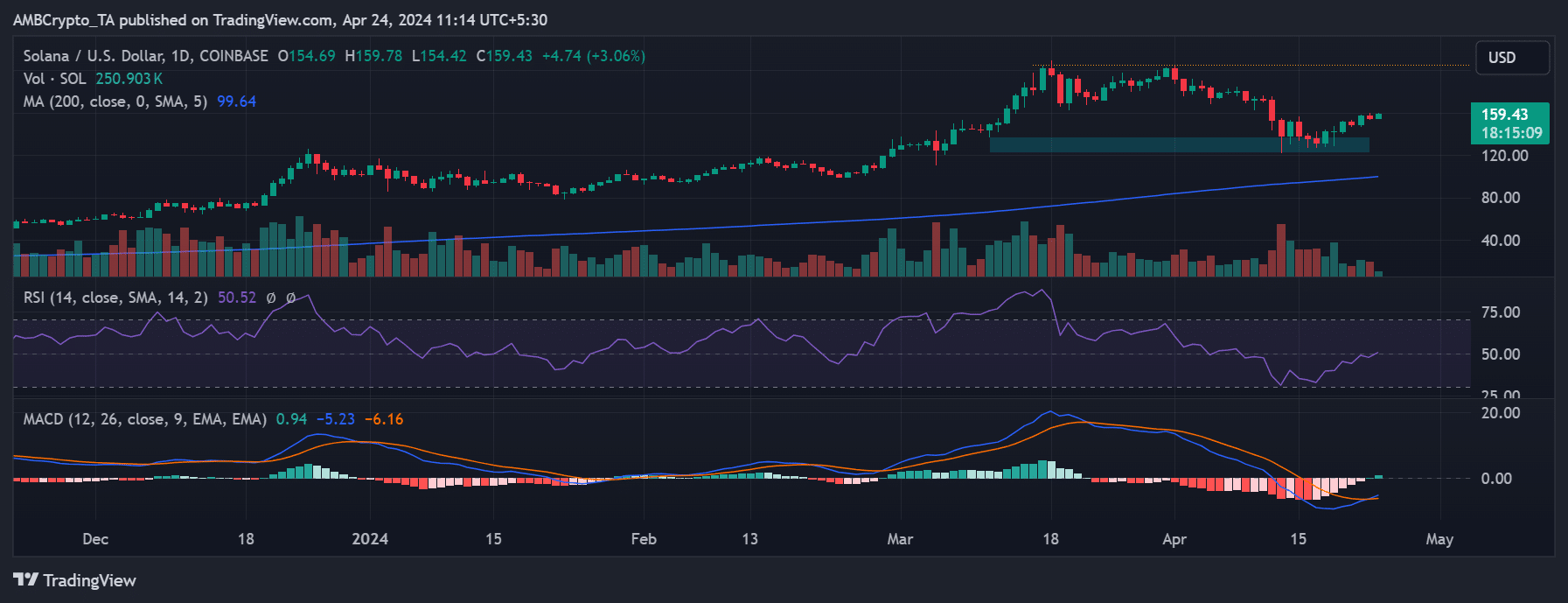

Also, in the last six days, Solana has carried out a number of efforts to try to rise, but each time it failed and still continued falling in steps.

SOL’s Relative Strength Index (RSI) at press looked a little higher than the median line, as analysis showed from daily chart trends.

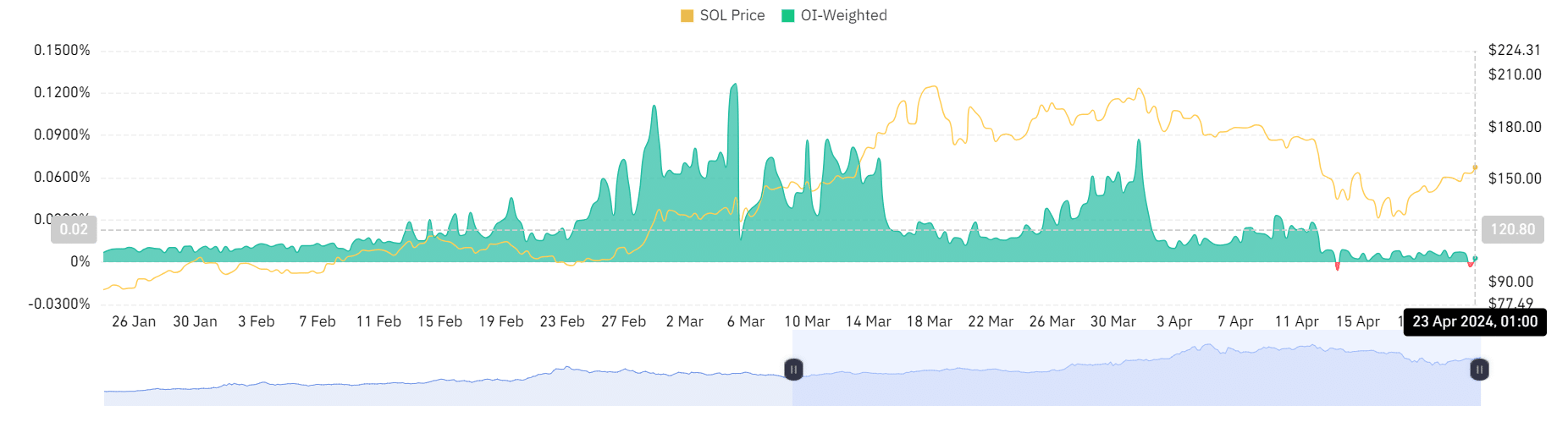

The market is becoming more speculative as a result of this price fluctuation and the impending auction of locked SOL tokens by the FTX estate, in line with what ETHNews previously disclosed.

Solana’s funding rate underwent a dramatic change recently, briefly falling into negative territory before rising marginally.

This reflects a cautious sentiment among traders who are closely watching the network’s ability to break through the neutral price barrier and overcome the resistance level set at $190. In the interim, support levels are seen to lie between $137 and $122