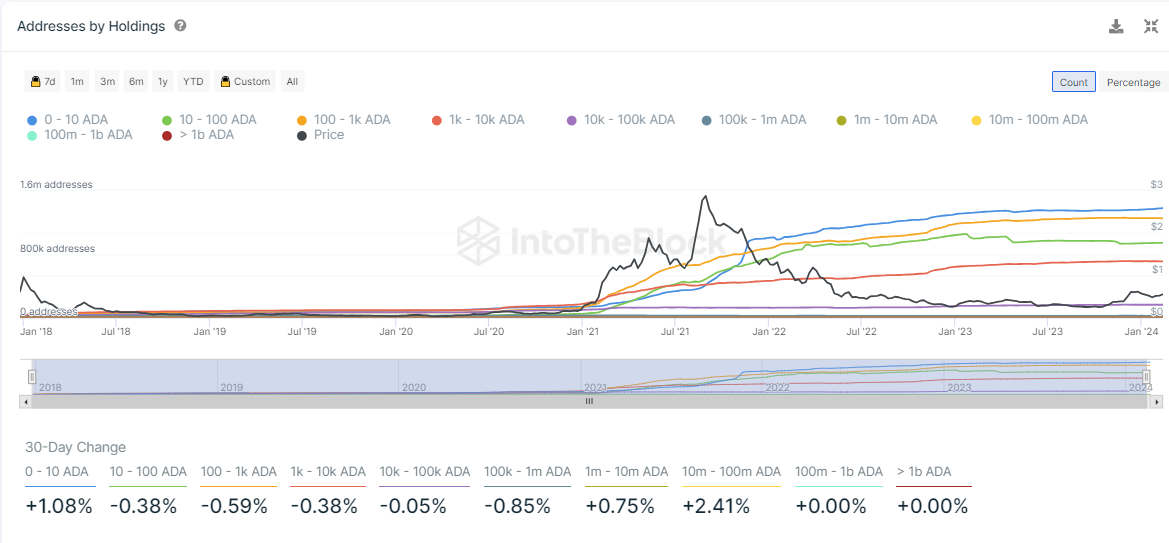

- The growing interest in Cardano is evidenced by a 1.06% increase in portfolios of 0 to 10 ADA, reflecting the attraction of new investors to the network.

- Despite a 0.54% drop in portfolios of 100 to 1,000 ADA, large investors with 1 million to 10 million ADA increased by 1.01%, showing strategic adjustments to the market.

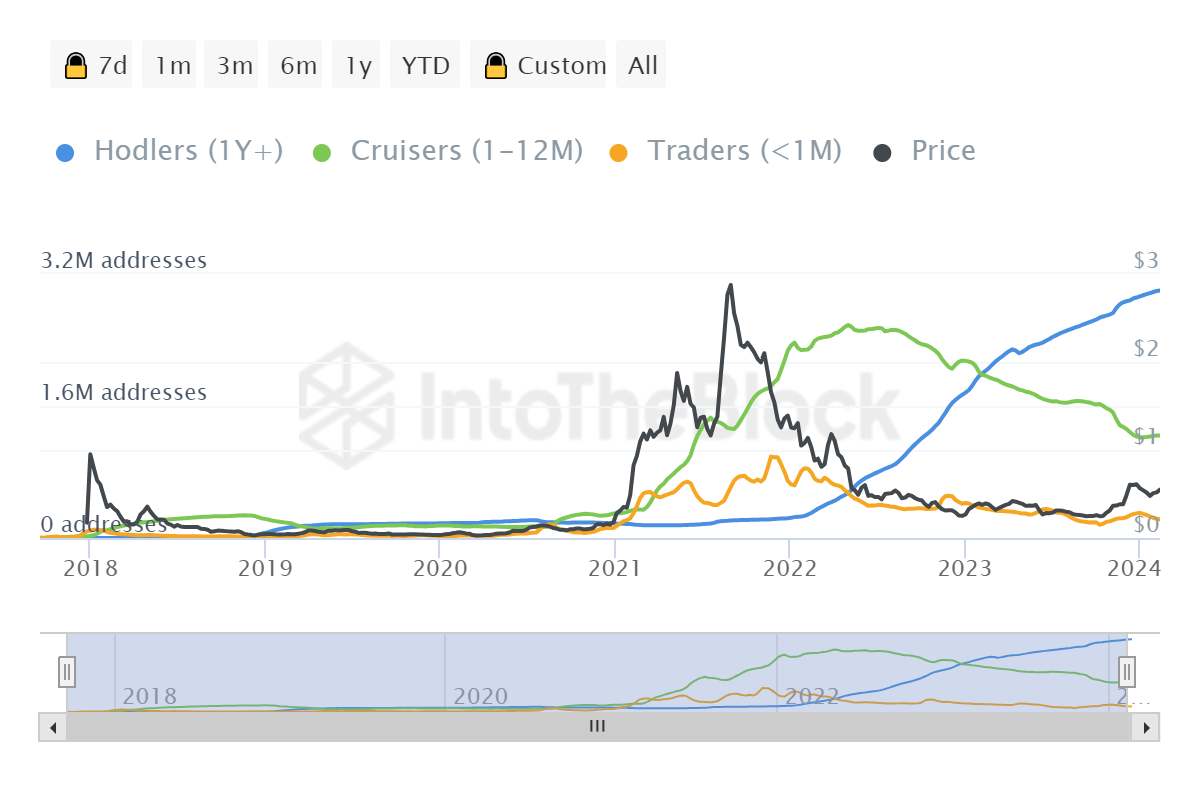

The recent increase in the creation of new Cardano (ADA) portfolios signals a growing interest in the network. While this increase is encouraging, it falls short of the previous high.

The total number of Cardano portfolios continues to grow, indicating a solid foundation for its ecosystem. The data also shows changes in portfolio holdings, with growing interest from smaller investors, while larger investors adjust their positions in response to market conditions.

According to IntoTheBlock, over the past 30 days, portfolios with between 0 and 10 ADAs increased by 1.06%, indicating an uptick in smaller-scale investors or newcomers.

Conversely, portfolios with 10 to 1,000 ADAs generally experienced a decline, with those with 100 to 1,000 ADAs seeing a 0.54% drop. Larger investors, especially those with between 1 million and 10 million ADAs, were known to see an increase of 1.01%.

The 10 million to 100 million ADA segment experienced even more significant growth, up 2.14%, suggesting a diverse investor base adjusting their positions in response to market dynamics.

Daily new portfolio creation has yet to reach the peak seen on February 2, with a record 5,414 new portfolios in a single day.

However, the total number of Cardano portfolios is approaching 4.6 million, with more than 1.3 million participating in the network’s test-of-participation consensus mechanism.

Cardano: Investor interest continues to grow

From February 22-24, the daily number of new ADA portfolios increased from 1,706 to 3,219, showing a remarkable jump in community acceptance and interest in Cardano.

This increase coincides with ADA’s current price of $0.5861, reflecting an increase of approximately 2% against the dollar and a 1.4% increase against Bitcoin.

The growing number of wallets signifies increased confidence and enthusiasm for Cardano’s potential

While the recent surge in new ADA wallets is promising, it is essential to consider this growth in the context of broader trends in the Cardano ecosystem.

The current daily creation of new portfolios falls short of the peak seen on February 2, when the network recorded 5,414 new portfolios in a single day.

Nevertheless, the total number of Cardano portfolios is approaching 4.6 million, with delegated portfolios – participating in the PoS network’s consensus mechanism – exceeding 1.3 million.

Analysis of investor sentiment and portfolio distribution over the past month reveals a 1.08% increase in portfolios with between 0 and 10 ADA, indicating an increase in small investors or investors new to the Cardano ecosystem.

In contrast, portfolios with holdings of 10 to 1,000 ADA generally declined, with those of 100 to 1,000 ADA down 0.38%.

In particular, larger investors, especially those with between 1 million and 10 million ADAs, experienced an increase of 1.01%, while the 10 million to 100 million ADA group saw a more significant increase of 2.14%.

What do analysts say about the trends?

Cardano’s (ADA) current price is USD 0.613, up 3.55%. Over the last week, ADA had a negative performance of -0.97%, but in the last month, it has experienced an increase of 26.86%.

Over the past six months, ADA is up an impressive 124.91%, and since the start of the year, it has gained 3.37%.

Some analysts project that ADA could retest the December 2023 highs, with expectations of reaching a price range of USD 0.70 to USD 1.00 in the near term.

Other analyses indicate possible bullish scenarios, with more ambitious projections, such as reaching USD 13 by November 2025, which would represent minimum gains of 2000%.