- SEC solicits public comments on Ethereum ETFs, assessing fraud risks under proof-of-participation mechanism.

- Optimism and skepticism divide crypto experts over Ethereum ETF approval, influenced by recent bitcoin ETFs.

Did you know that the Securities and Exchange Commission (SEC) has once again put its decisions on Ethereum exchange-traded funds (ETFs) proposed by financial giants like Fidelity and BlackRock on hold? Yes, just as you read it.

This time, the SEC is seeking public input on the implications of Ethereum’s proof of stake mechanism, specifically as it relates to the risks of fraud and manipulation. Wondering what this means for the future of cryptocurrencies? Well, let’s break it down together.

A Look at the SEC’s Concerns

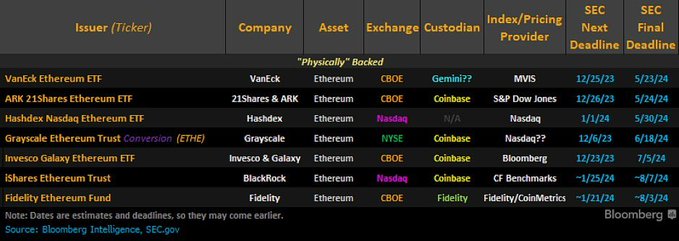

As previously reported by ETHNews, this isn’t the first time BlackRock has faced a delay with its Ethereum spot ETF, iShares Ethereum Trust. The SEC has extended an invitation to the general public to express its opinion on whether these types of financial products should move forward, focusing on concerns arising from the shift to a proof-of-participation mechanism.

According to a previous ETHNews report, this request for comments reflects the SEC’s effort to thoroughly understand the risks and benefits before making a final decision.

On the other hand, Fidelity’s proposal is also on hold, following the same public opinion solicitation path as BlackRock’s. This indicates a trend of caution on the part of the SEC towards the introduction of innovations in financial products linked to cryptocurrencies. But is there light at the end of the tunnel?

Despite these obstacles, there is a halo of optimism among some industry experts. The SEC’s recent approval of bitcoin ETFs has ignited hopes that spot Ethereum ETFs could be the next big milestone. However, as ETHNews previously noted, not everyone shares this enthusiasm, with some warning of lingering uncertainty surrounding the approval of these products.

Gary Gensler, the chairman of the SEC, has been clear that the approval of bitcoin ETFs does not necessarily signal an opening toward other cryptocurrency products. It underscores a meticulous evaluation of each proposed ETF on its own merits, taking into account the specific risks involved.

So what do you think – are we on the doorstep of seeing spot Ethereum ETFs in the market, or is this another sign of regulatory caution that will continue to shape the future of cryptocurrencies? The SEC is listening, and your opinion could be part of this landmark decision.