- Ripple’s stablecoin expected to enhance XRP Ledger utility, providing a pivotal entry for DeFi opportunities across multiple blockchains.

- Early on-chain activities suggest positive market response, with a increase in XRP’s Open Interest following the stablecoin announcement.

Ripple, is preparing to launch a stablecoin tied to the US dollar, amidst its ongoing legal battle with the US Securities and Exchange Commission (SEC).

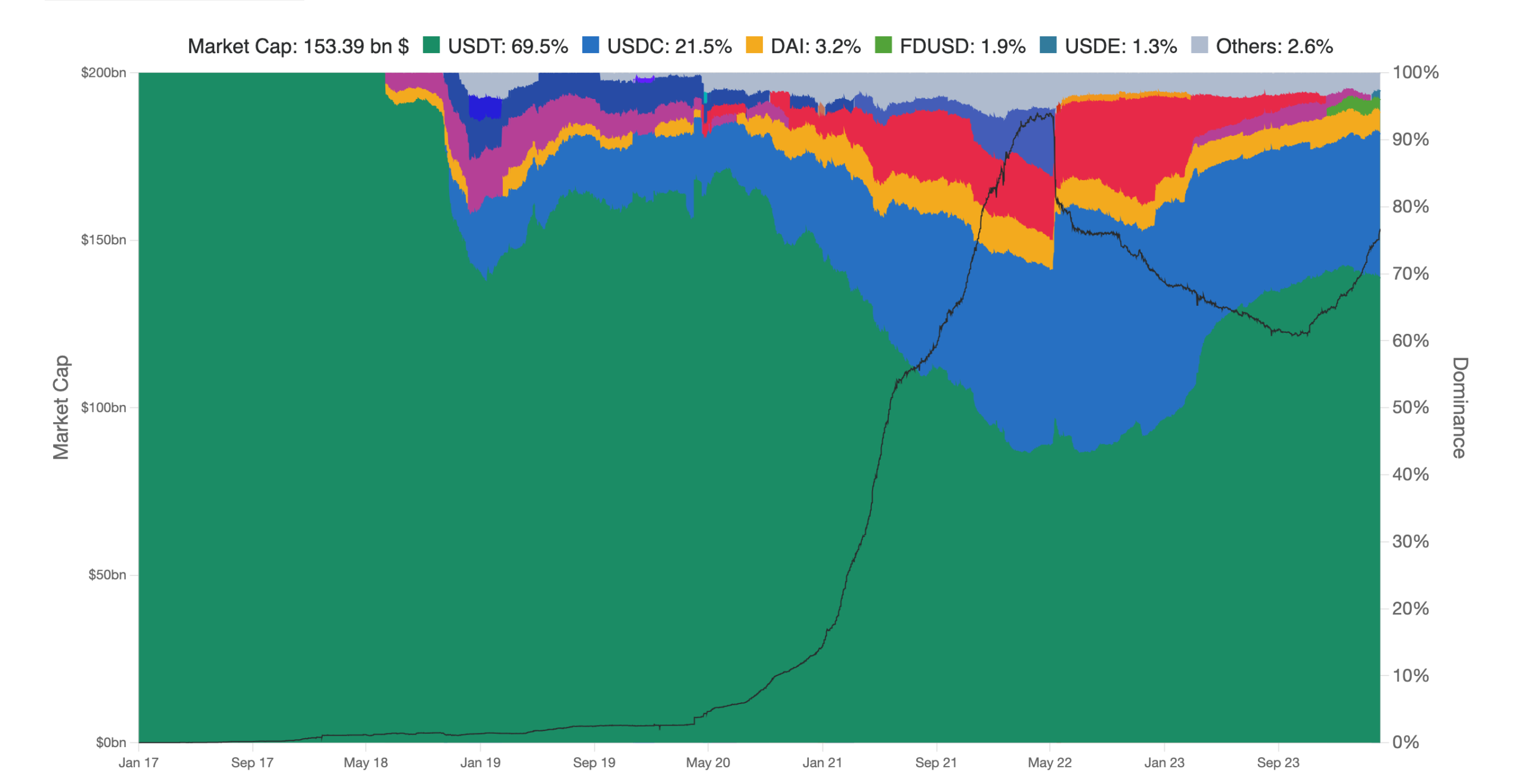

1/ The stablecoin market is booming – around $150B today, and projected to soar past $2.8T by 2028. There's a clear demand for trust, stability, and utility.

That's why later this year we’re launching a stablecoin pegged 1:1 to the USD on the XRP Ledger and Ethereum.…

— Ripple (@Ripple) April 4, 2024

Despite facing challenges with its native token, XRP, Ripple is moving forward with this venture, expected to debut later this year, marking a shift in the company’s market strategy.

The firm highlighted the growing stablecoin market, currently valued over $150 billion and predicted to rise beyond $2.8 trillion by 2028.

Ripple’s CEO, Brad Garlinghouse, emphasized that launching a stablecoin aligns with Ripple’s mission to bridge traditional finance with the crypto world. He pointed out the success institutions have found by collaborating with compliant, crypto-native entities like Ripple.

Related: Ripple’s Defense: CTO Reiterates XRP Ledger’s Compliance with Blockchain Standards

Ripple President Monica Long further detailed the stablecoin’s potential impact, noting it would serve as a key entry point for creating new opportunities in decentralized finance (DeFi) across various blockchains. The introduction of this “trusted stablecoin” is expected to spur further adoption and development within the XRP Ledger (XRPL).

With Tether’s USDT dominating over 69.5% of the stablecoin market and Circle’s USDC holding a 21.5% share, Ripple aims to offer a more reliable and efficient alternative. This move is anticipated to capture more value for the blockchain, attract new investors, and strengthen XRP’s position as a global payment solution.

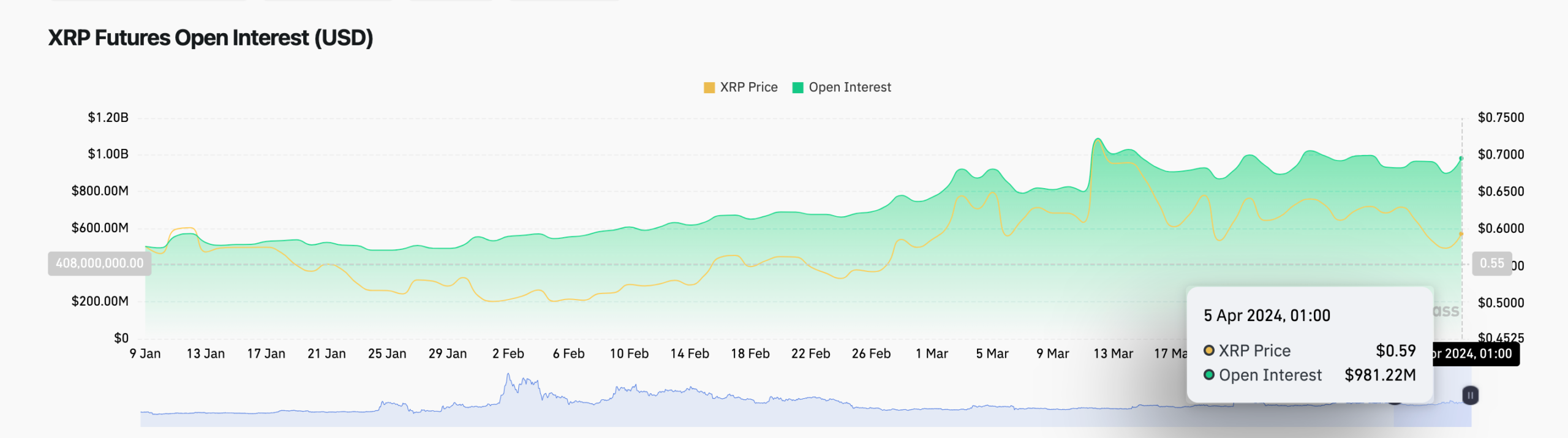

On-chain activities on April 4 indicated that XRP holders are optimistic about the price impact of the stablecoin launch.

Following the announcement, XRP’s Open Interest in futures derivatives markets increased from $899 million to $981.2 million within 24 hours, representing a 9% growth—surpassing the 3% price increase in the same timeframe. This suggests new capital entering the market, potentially setting the stage for sustained price movements.

Strategic investors view the gap between Open Interest growth and price increase as a bullish signal, indicating a willingness to invest in XRP’s future performance. If this trend continues and liquidity improves, XRP could potentially rally towards $0.70.

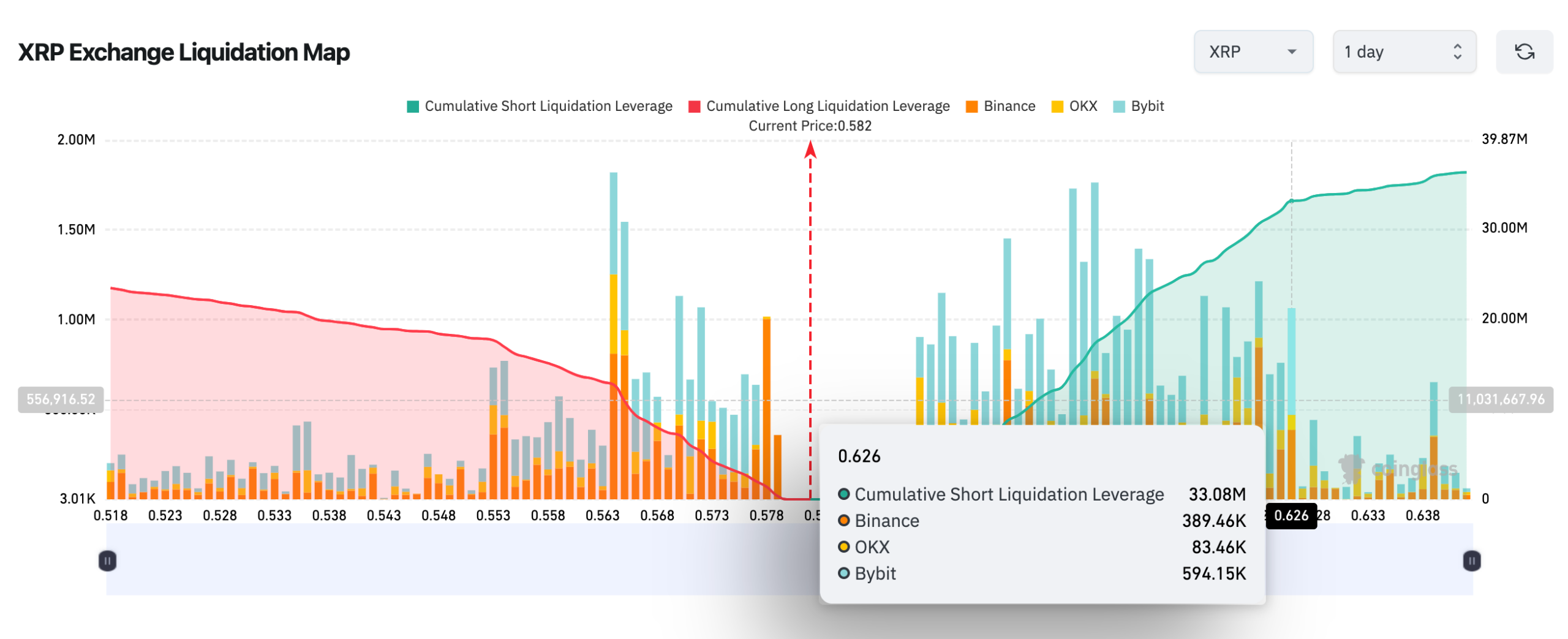

However, bulls must first overcome resistance at the $0.63 level, where a substantial sell-wall could slow down the rally.

A decisive breakout above $0.65 could lead to a 17% rally from the current price level towards $0.70, showcasing Ripple’s stablecoin launch as a pivotal moment for XRP and the broader crypto ecosystem.

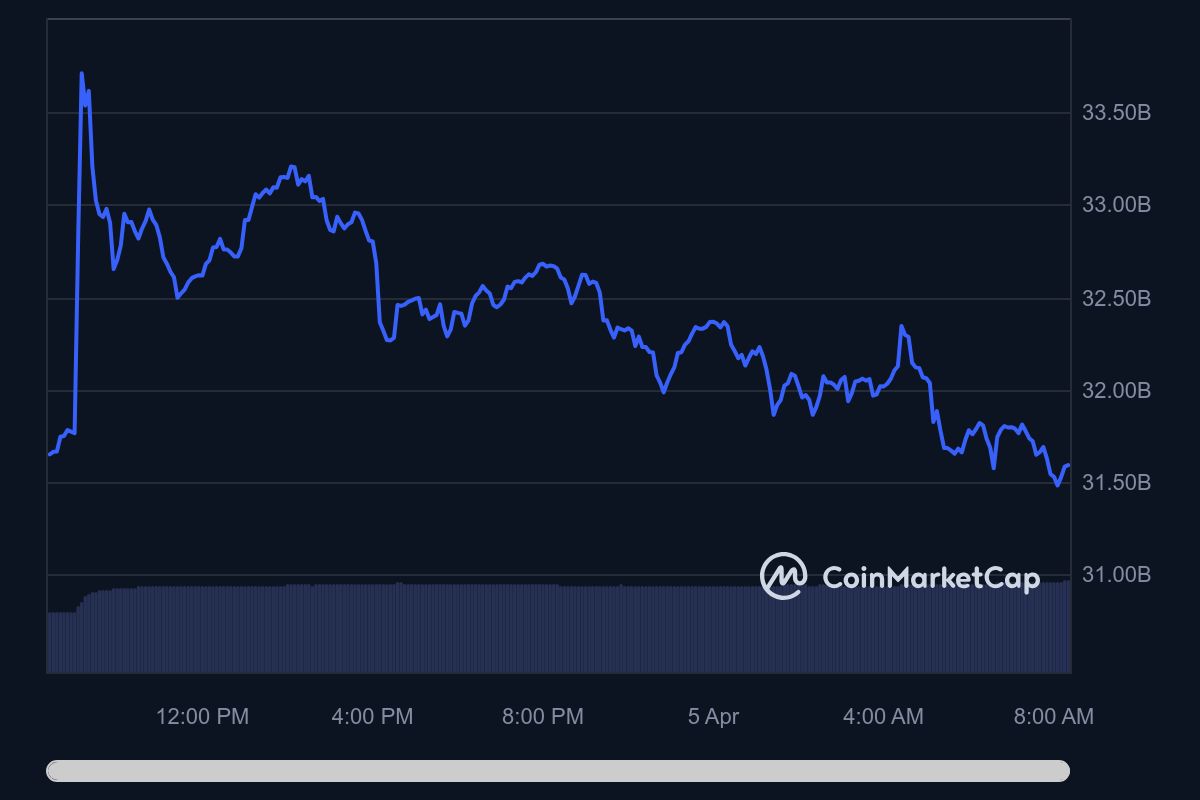

The current price of XRP (XRP-USD) is approximately $0.571816, experiencing a minor decrease of $0.003514 or -0.61% from its previous position.

The trading activity for XRP today has spanned from $0.571816 to $0.593621, with its price over the past 52 weeks ranging from $0.412962 to $0.887511.

The market capitalization for XRP stands at around $31.479 billion, with a circulating supply of approximately 55.05 billion XRP.

Over the last 24 hours, XRP has seen a trading volume of about $2.27 billion, indicating active trading on the 1281 markets where it’s available.