- BlackRock’s iShares Bitcoin Trust leads with $82.4 million in inflows; contrasts with GBTC and FBTC outflows.

- Peter Schiff critiques Bitcoin ETFs’ performance, suggesting investors may face comparative losses against Gold ETFs.

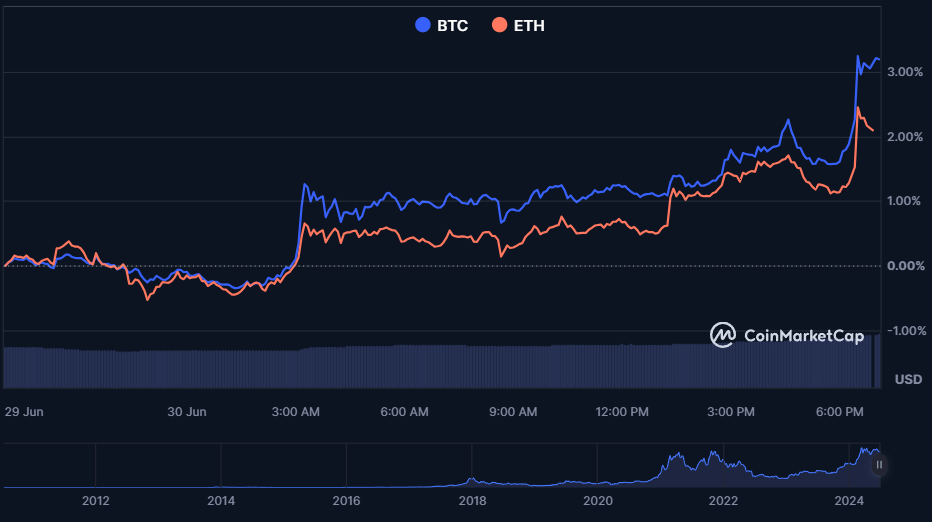

Recent developments in Bitcoin ETFs have sparked debates regarding their impact on investor outcomes and market stability. As of late June, Bitcoin ETFs have witnessed a resurgence in inflows, totaling $73 million, marking a notable reversal from previous outflows.

Among the prominent ETFs, BlackRock’s iShares Bitcoin Trust led with inflows of $82.4 million, contrasting with outflows seen in Grayscale Bitcoin Trust (GBTC) and Fidelity’s FBTC, amounting to $27.2 million and $25 million, respectively. This cash flow underscores varied investor sentiments and strategic choices amidst evolving market conditions, according to ETHNews analysis.

Critically analyzing these trends, financial commentator Peter Schiff raised concerns about the comparative performance of Bitcoin ETFs against traditional assets like Gold ETFs. Schiff’s commentary on social media highlighted a perceived underperformance of Bitcoin ETFs, suggesting potential risks for investors who switched from Gold ETFs earlier in the year.

#Gold closed Q2 with a 4% gain. #Bitcoin still has two more days left to trade, but as of now it's down over 15%. Investors who sold gold ETFs at the end of Q1 to buy Bitcoin ETFs are 20% worse off. The bad news for those investors is that it will likely get much worse from here.

— Peter Schiff (@PeterSchiff) June 28, 2024

However, skepticism surrounding Schiff’s analysis emerged within the crypto community, with observations pointing to recent positive inflows into Bitcoin ETFs over the past week.

“#Gold closed Q2 with a 4% gain. #Bitcoin still has two more days left to trade, but as of now it’s down over 15%.”

This uptick in investment activity signifies growing confidence and interest in Bitcoin ETFs despite short-term market fluctuations.

“Investors who sold gold ETFs at the end of Q1 to buy Bitcoin ETFs are 20% worse off. The bad news for those investors is that it will likely get much worse from here.”

Meanwhile, market data reflects mixed signals for major cryptocurrencies, with Bitcoin, Ethereum, and Solana experiencing slight declines in the past 24 hours. Despite these fluctuations, analysis from ETHNews indicates a decreasing trend in price volatility for Ethereum, suggesting a stabilizing market environment.

Looking ahead, uncertainties loom as Ethereum ETFs await final approval for trading, potentially influencing investor sentiments and market dynamics further. Moreover, filings for a Solana ETF introduce additional variables into the equation, complicating predictions about future market movements.

As stakeholders monitor these developments, the path forward for Bitcoin ETFs remains intertwined with market reactions and regulatory outcomes.