- PEPE’s value rose to $0.000011, gaining 3.35% despite its close correlation with Ethereum’s more stable market position.

- Ethereum’s steady price at $3,502 contrasts with PEPE’s fluctuations, highlighting the impact of their high correlation coefficient.

Recently, PEPE, a cryptocurrency with a frog theme, has seen an increase in its market price, climbing to $0.000011, a rise of 3.35% as of June 21.

This increment comes despite the close relationship PEPE shares with Ethereum (ETH), which has remained relatively stable in price, currently trading at $3,502.

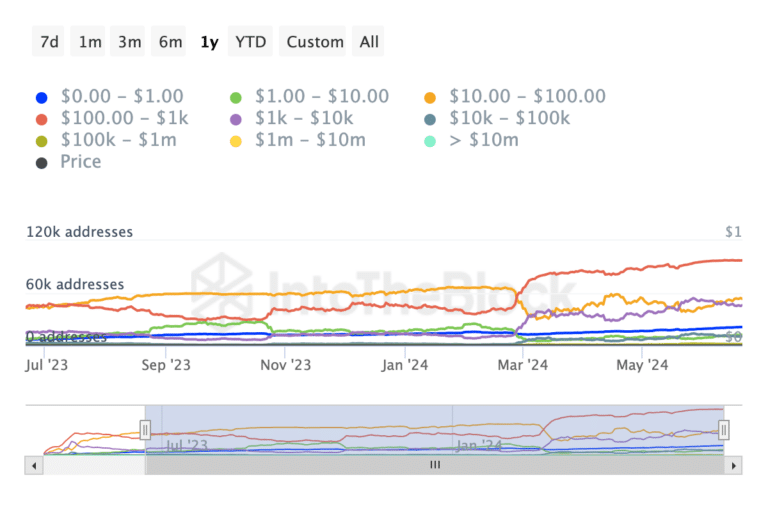

Data from IntoTheBlock indicates that PEPE’s price closely tracks Ethereum’s, with a correlation coefficient of 0.91.

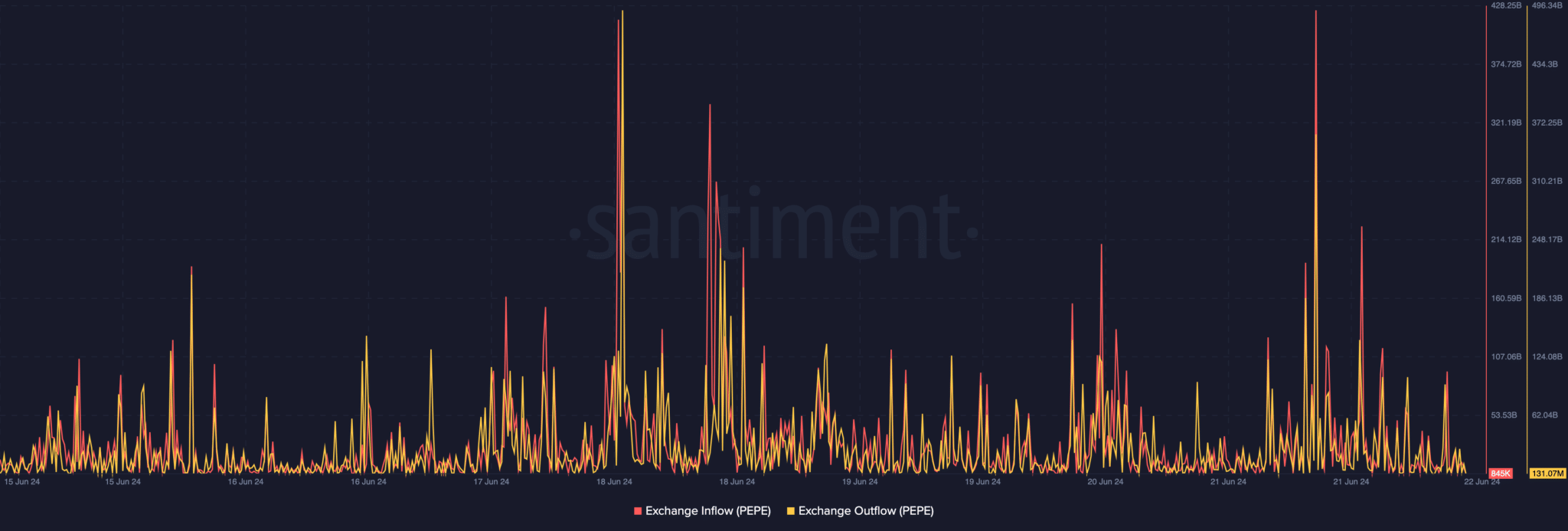

Exchange activity presents a nuanced view

PEPE’s inflow on exchanges stands at 845,000, hinting at possible selling pressure. However, a contrasting and substantial outflow of 131.07 million suggests that many investors are moving their holdings to safer, non-custodial wallets, potentially cushioning any immediate downward price movements.

Further Complexity is Added by the Distribution of PEPE Holdings

Analysis shows a reduction in large-holder addresses over the past month, which might reduce the influence of investors on the price. Historically, these investors tend to impact the market more substantially than smaller retail investors.

Despite these trends, there is cautious optimism that PEPE may resist the gravitational pull of Ethereum’s stagnation and potentially elevate its price to $0.000013 shortly. However, this potential is tempered by the broader market context and the reduced activity of major investors.

While there is a hopeful sentiment that PEPE could achieve a modest price gain, the prevailing market conditions tied to Ethereum’s performance and investor behaviors offer a mixed outlook.

PEPE’s immediate future price trajectory will likely hinge on these intertwined factors, with a possible stabilization at its current price level if no favorable market shifts occur.