- For 30 days in a row, Polygon Proof of Stake (PoS) network has continuously recorded over 1 million daily active addresses.

- While Polygon’s DeFi sector struggles with declining performance, its NFT sector thrives with considerable increases in trading volumes and strong interest in important collections.

In the middle of the cryptocurrency market’s attempts to bounce back from post-halving, Polygon (MATIC) offers an intriguing development. The blockchain technology has difficulties with decentralized financial (DeFi) operations, while seeing significant activity in the non-fungible token (NFT) market.

Steady Development in the Polygon Ecosystem

Polygon’s momentum has persisted in spite of the crypto-ecosystem’s constantly shifting focus. Notably, for 30 days in a row, its Proof of Stake (PoS) network has continuously recorded over 1 million daily active addresses, demonstrating its robust user base and stable operations.

NEW:

Polygon PoS has recorded more than 1 million daily active addresses for 30 consecutive days. pic.twitter.com/TL1AzM0xb2

— Today In Polygon (@TodayInPolygon) April 19, 2024

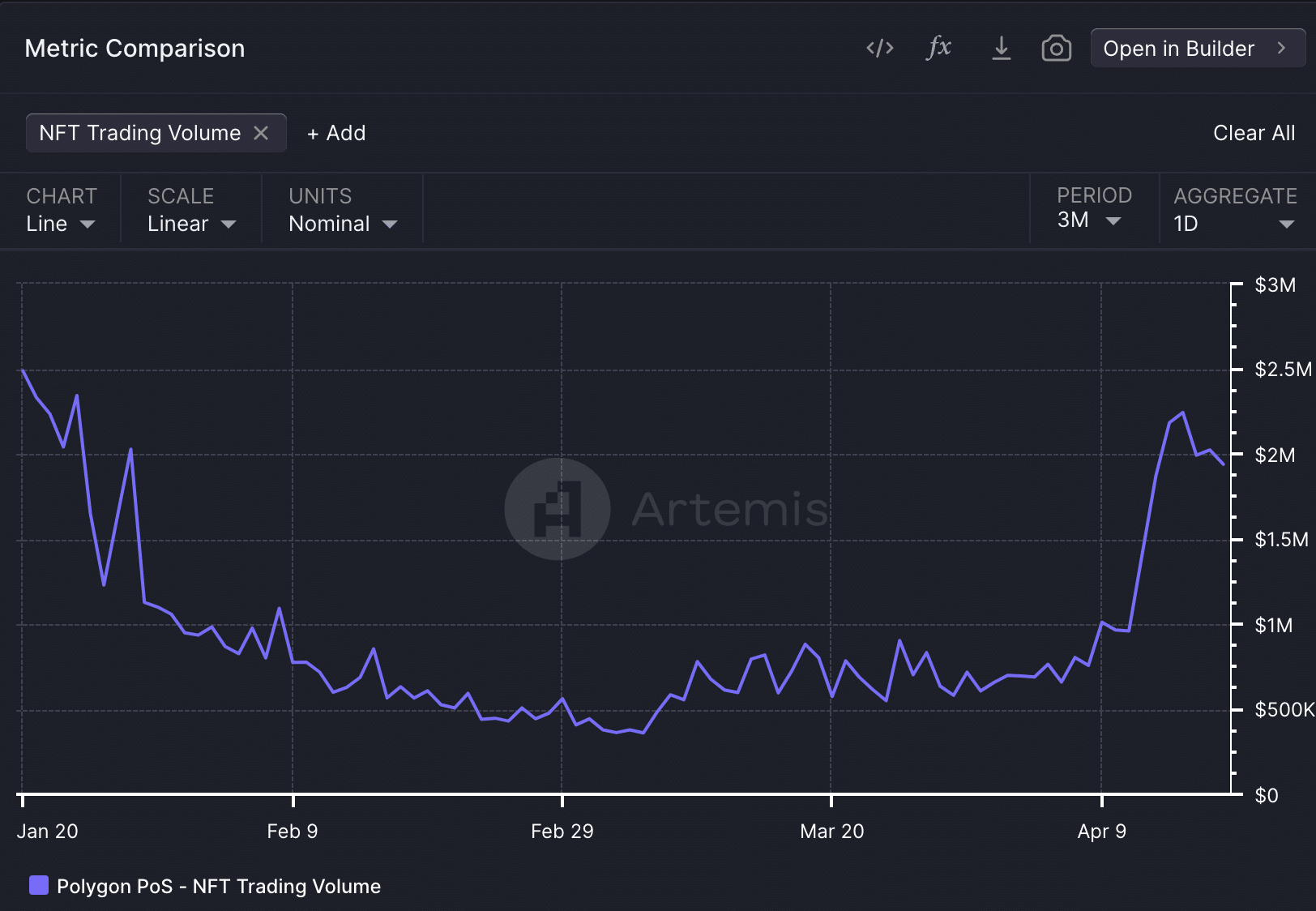

There has been a notable increase in interest in the NFT sector on Polygon. Recent data from Artemis indicates that the NFT trade volume on Polygon has increased dramatically over the last several days.

Prominent collections like CryptoKhat and CyberKongz have drawn the interest of the community in particular, which has increased trading activity.

Diminished Defense Industry

Not everything for Polygon is going well, though. The DeFi sector of the platform has seen a drop; in only one week, the Total Value Locked (TVL) dropped from $1.1 billion to $890 million.

Furthermore, there has been a decrease in the volume of decentralized exchanges (DEX) on Polygon, suggesting that users are choosing other platforms for DeFi activity.

Concerns concerning the network’s long-term survival in this market are raised by the preference for other platforms over Polygon for DeFi-related activity. In the highly competitive DeFi market, Polygon’s position could be seriously jeopardized if this trend persists. Watch the following YouTube video to learn more about this development.

MATIC’s Price Dynamics

In spite of these operational difficulties, the overall number of addresses that own MATIC is growing, indicating that the token is still being accumulated.

At the moment of writing, the price of MATIC is roughly $0.7361, up 0.93% over the last 24 hours, according to CoinMarketCap. Nevertheless, this data also shows a notable 27.3% decrease over the previous month, which is indicative of general market trends.

Despite these conflicting signs, MATIC’s future is still being supported by encouraging advancements.

On the other hand, in order to streamline its international transactions, SukuPay has used USDC Circle on Polygon, demonstrating the platform’s flexibility and usefulness in practical applications, as previously reported by ETHNews.