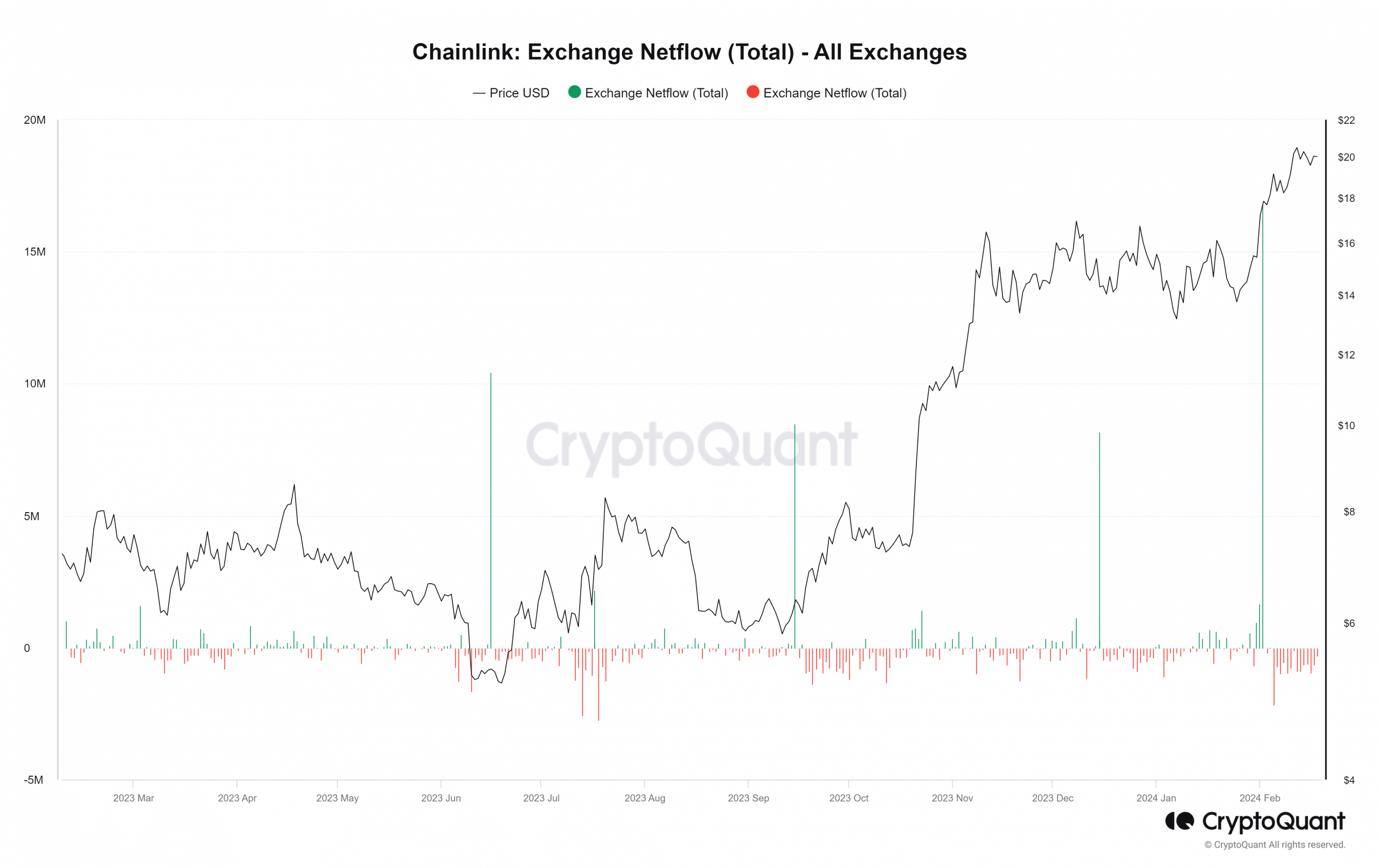

- In the past two weeks, 83 new wallets have withdrawn more than 11 million LINK from Binance, indicating confidence.

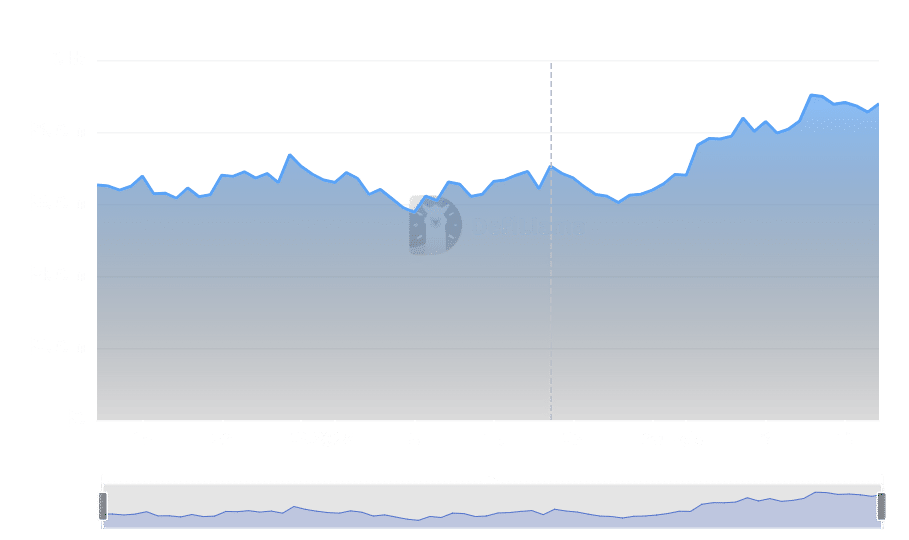

- LINK staking volume has increased from $680 million to more than $878 million since the beginning of February.

Let’s always remember that in the crypto market, where volatility is the norm, there are tokens that manage to capture the attention of investors and enthusiasts for good reasons. LINK, Chainlink’s native token, has been the protagonist of an interesting phenomenon in recent weeks. Have you wondered what’s going on with LINK?

Why is everyone talking about LINK?

Recently, 83 new wallets have decided that LINK is worth their investment, withdrawing more than 11 million tokens from Binance.Coincidence? I don’t think so. This speaks to a growing confidence in LINK. But what motivates these investors to bet on Chainlink in this way?

The Staking Play

It’s no secret that staking has become a popular strategy for earning rewards while holding cryptocurrencies. LINK is no exception. With a jump from $680 million to over $878 million in staking volume since February, it’s clear that there’s more to it than just “HODLing.” Couldthis growing interest in LINK staking be a sign that investors see a promising future?

A New Horizon for LINK

Since the beginning of February, LINK has been climbing positions, moving in a price range we have not seen before. Reaching an increase of 2.41% to settle at $20. What does the RSI tell us? With a value above 60, the indicator suggests that LINK’s uptrend could have solid foundations.

So, what does all this mean for LINK?

LINK’s accumulation, significant withdrawals from exchanges, and booming staking paint a picture of optimism among LINK holders. This behavior could be a harbinger of a sustained uptrend for LINK.

Are investors simply speculating?, or is there a long-term view behind this accumulation and staking activity? It’s hard to ignore that actions like these are not random. The decision to withdraw such a significant amount of LINK from exchanges and the growth in staking indicate an expectation of long-term value.

What do you think?

Do you think this is the time to pay attention to LINK? With the evidence in front of us, it appears that LINK is setting a new standard for itself. Between active accumulation and increased staking, LINK is sending strong signals to the market.

As the cryptocurrency market continues its steady ebullience, LINK comes as a point of interest for those looking to diversify their portfolio. The increase in accumulation and staking volume are testaments to the confidence investors have in LINK’s future.

This could be the time to take a close look at Chainlink, as its recent performance suggests a path full of possibilities.