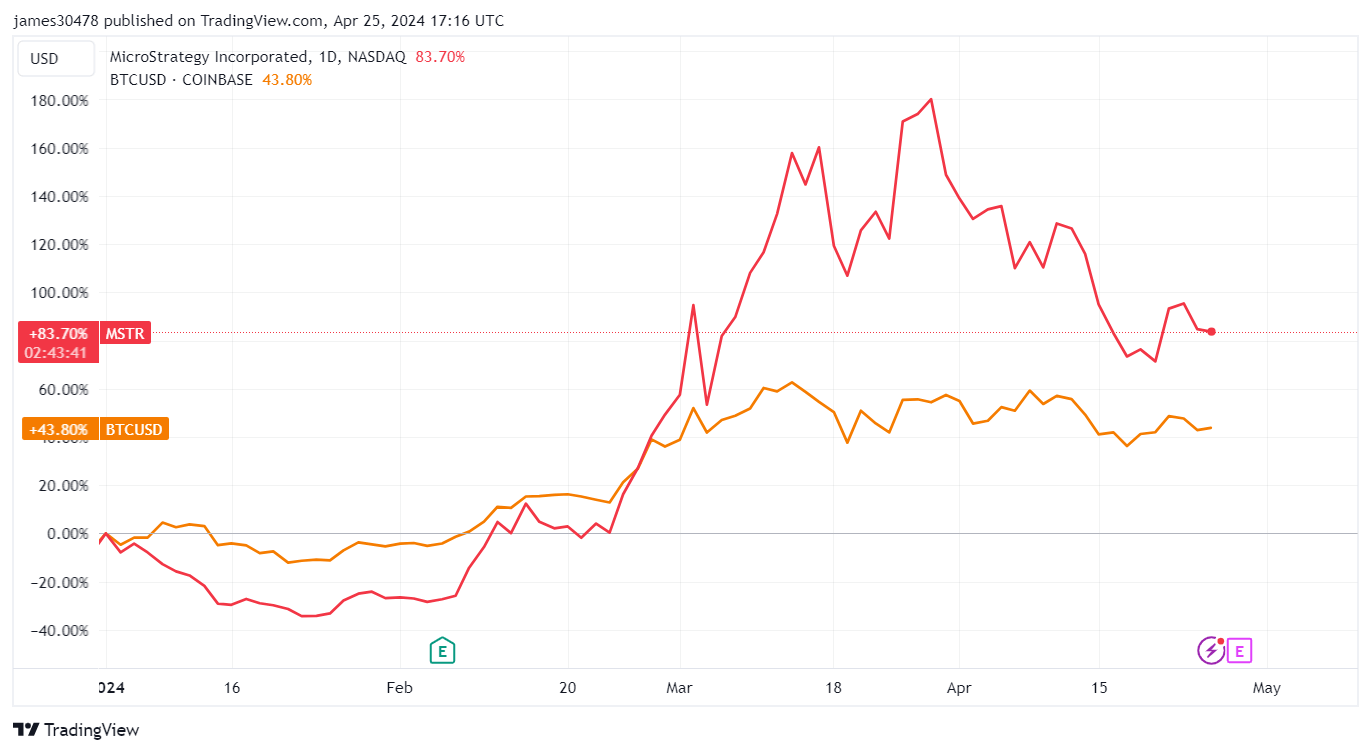

- MicroStrategy’s share price has recently declined in tandem with Bitcoin, but so far this year, MSTR has outperformed BTC by a wide margin.

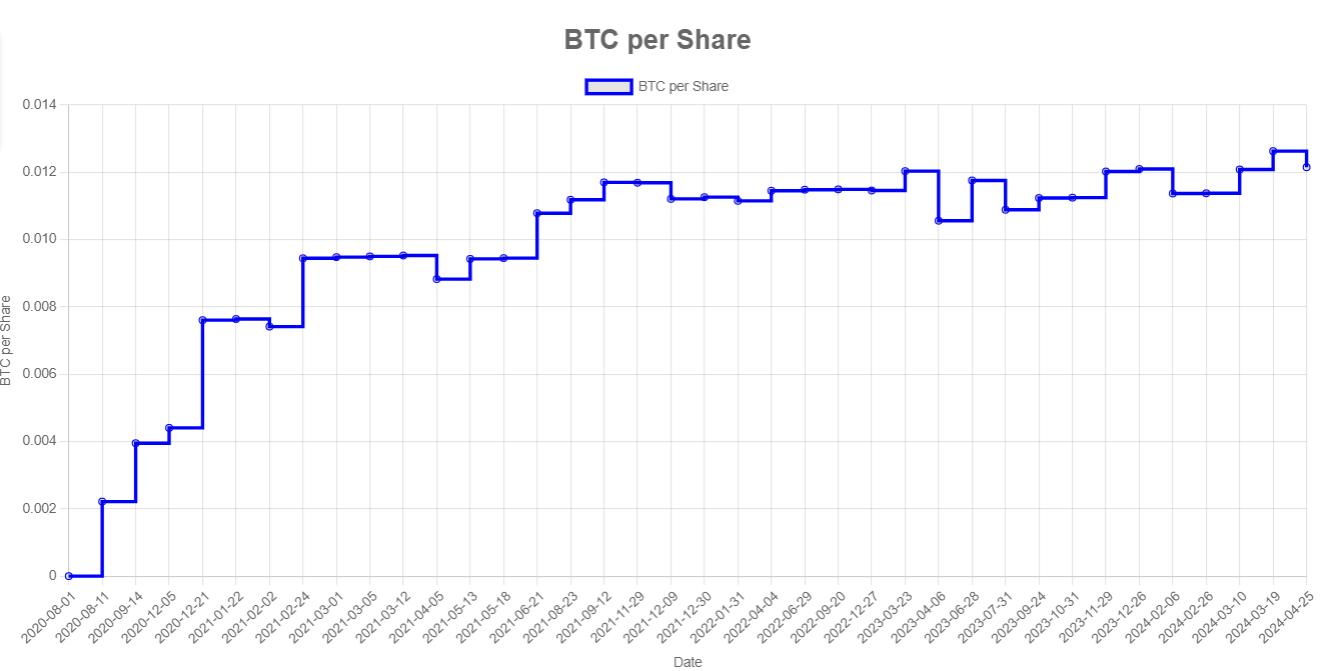

- MicroStrategy’s ‘BTC per share’ statistic is almost at an all-time high, indicating that the company is steadily increasing its Bitcoin holdings despite market volatility.

Recently, MicroStrategy (MSTR) had a notable decline in the value of its shares in the volatile world of cryptocurrency investments. Although the company’s performance has declined recently, investors are still drawn to its clever moves in the Bitcoin market.

Correlation between MicroStrategy Stock Performance and Bitcoin

MicroStrategy’s stock has experienced a significant decrease, currently selling at approx. $1,260 per share, which represents a 35% decline from its over $2,000 peak. The 8% decline in Bitcoin’s value during the same period that mirrored this slump serves as evidence of the close correlation between MSTR’s stock performance and Bitcoin’s market movements.

The price of BTC is currently $64,402.42, up 0.62% over the previous day and almost unchanged over the last week, according to data from CMC.

MicroStrategy has shown remarkable strength so far this year, rising 84%, while Bitcoin has gained 44%. This is in spite of the recent drops. After adjusting to 0.02, the “MSTR/BTC Ratio” chart shows a peak at 0.028, similar to its 2021 high.

Taking into account its Bitcoin holdings, these measures point to a sophisticated valuation of MicroStrategy’s stock.

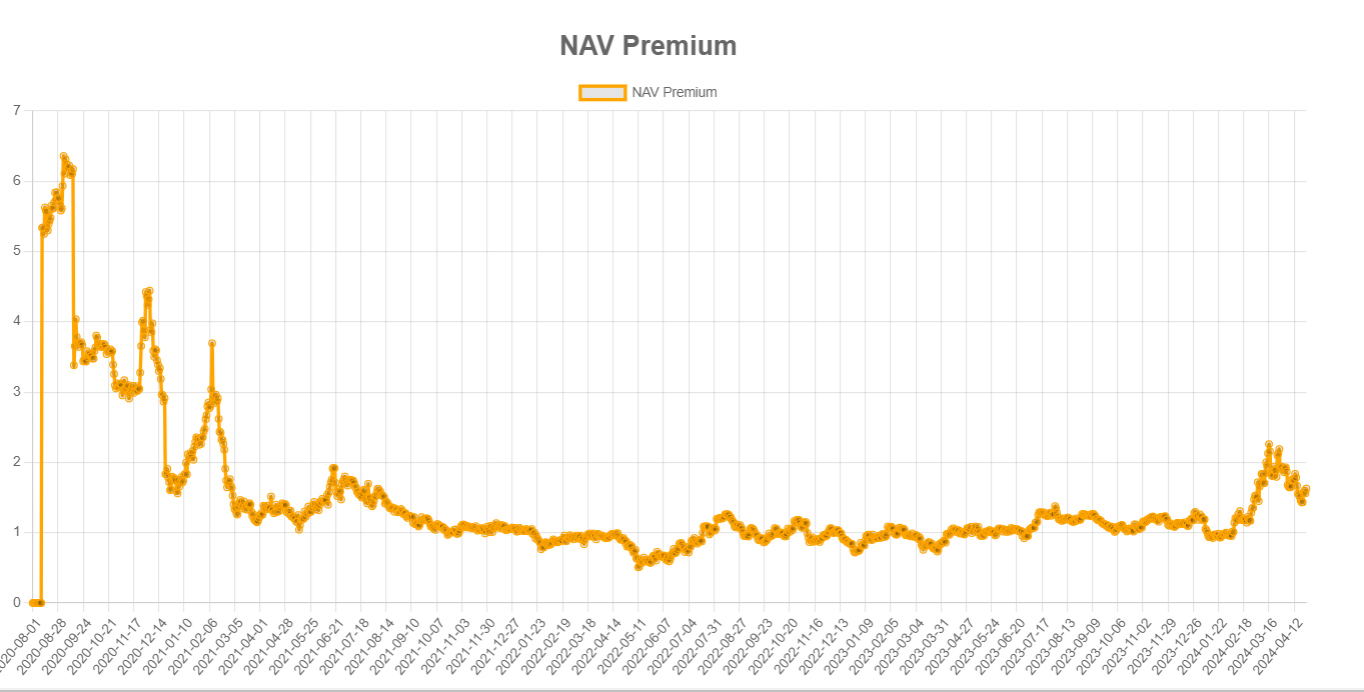

Evaluating the NAV Premium and BTC per Share

The “NAV Premium” chart showcases further analysis by highlighting the difference between MicroStrategy’s stock price and its Net Asset Value, which is based on Bitcoin. This premium, which was previously approximating 2.3, has dropped to 1.4, suggesting a market reevaluation of the company’s Bitcoin investments’ inherent value.

One important measure, “BTC per Share,” which shows how much Bitcoin is equivalent to each outstanding MicroStrategy share, is still very close to its all-time high of 0.012. With the potential to mitigate future market volatility, this indicator highlights the long-term strategy of accumulating more BTC per share.

Onward, MicroStrategy has not indicated that it will abandon its aggressive approach to investing in Bitcoin. A $500 million convertible note issuance was launched by the corporation in order to finance additional Bitcoin purchases as well as other expenses, in line with what ETHNews previously disclosed.