- Despite a minor price decrease of 0.25%, Ethereum (ETH) has gained by 1.95% this week, indicating that it is still optimistic.

- Even with the ongoing legal issues and the minor decline in long derivatives positions, whale activity is still strong and involves large acquisitions.

Ethereum (ETH) had a minor decrease of 0.25% on the last day; as of right now, CoinMarketCap data indicates that its price is roughly $3,127.43. Ethereum has gained 1.95% over the previous 7 days, exhibiting a minor bullish trend despite the decline.

Whale Movement During Price Changes

Whale investors were active in the Bitcoin market, showing no signs of slowing down despite the recent decline in price. Spot On Chain’s on-chain tracking revealed an interesting transaction involving a wallet address that bought 1,524 stETH for an average price of $3,159.

Whales appear to remain bullish with $ETH despite the recent market crash!

Will the $ETH price recover soon? 🤔

Follow @spotonchain and set alerts for $ETH to know the next significant whale activity now: https://t.co/js2Cq7crji pic.twitter.com/fLbWyLDJ3I

— Spot On Chain (@spotonchain) April 25, 2024

In addition, a second whale made a large investment, purchasing 7,128 ETH for $22 million at a price of $3,111 per ETH.

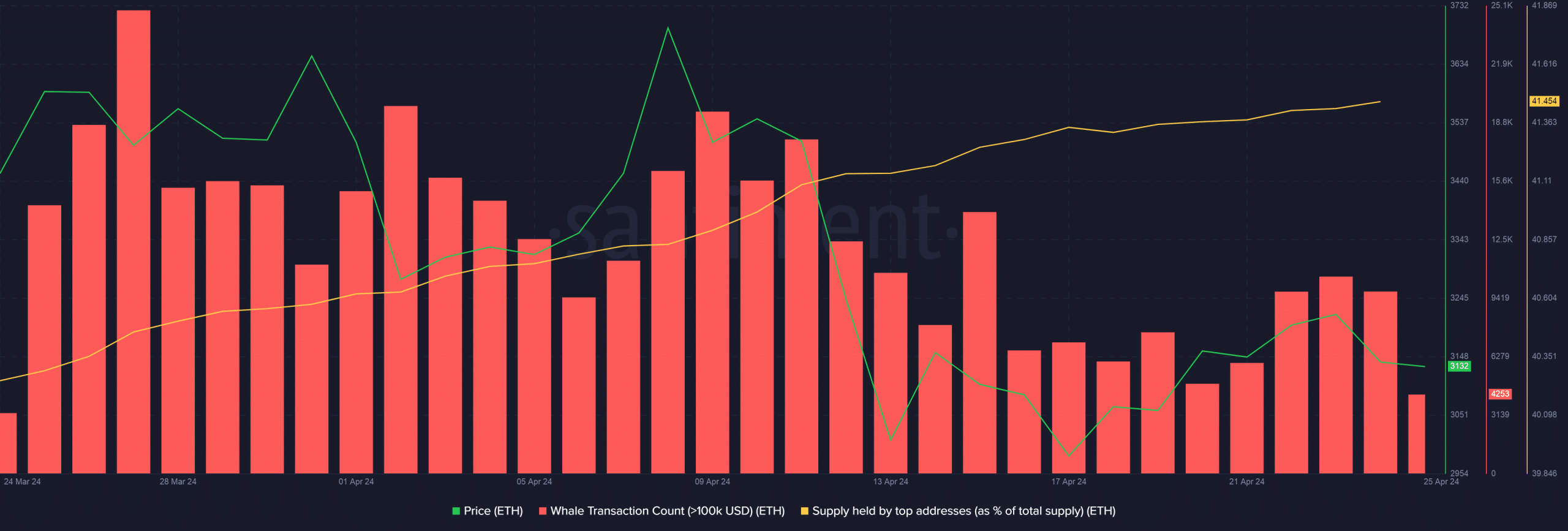

These purchases fit into a larger pattern in which top addresses increased their holdings of the entire ETH supply from 41.37% to 41.45% shortly after Bitcoin’s halving, according to data from Santiment.

Legal activities rocked Ethereum’s landscape, adding to the market’s complexity. Accusing the SEC of overregulating Ethereum and so creating an additional layer of uncertainty in the market dynamics, ConsenSys has filed a complaint against the agency, as previously reported by ETHNews.

Derivatives Market Optimism

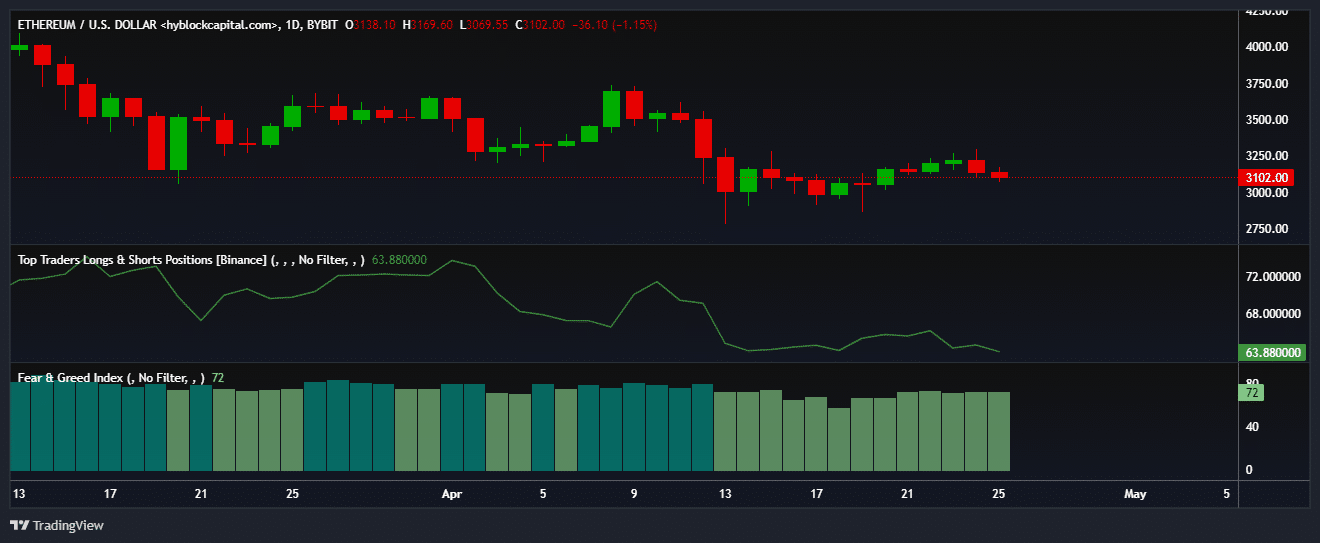

Ethereum whales are still optimistic about the derivatives markets. On Binance, about 63% of whale holdings were long, indicating a high level of confidence in Ethereum’s potential performance. It is noticeable, nonetheless, that after the halving event, the share of long positions somewhat declined.

The overwhelming greedy feeling in the market right now points to an anticipated rise in buying pressure. In spite of the continuous legal hurdles and market instability, this mentality may help Ethereum’s price rise in the next few days.