- Ethereum shows a robust increase in its price and trading volume, indicating growing interest and activity around ETH.

- The decline in ETH on exchanges and increased staking suggest limited supply, potentially driving the price higher.

With a rally that leaves us all gasping, ETH has not only seen its price soar, but its trading volume is accompanying this upward dance. What is this surge telling us? Crystal clear: interest in Ethereum is skyrocketing. Are we witnessing the prelude to an era where ETH breaks the $4,000 barrier?

A sign we can’t ignore

Have you wondered why Ethereum feels stronger than ever? Let’s go beyond the numbers. One of the keys is the decline of ETH on exchanges. Yes, as you read it. There is less and less Ethereum available to buy and sell on exchange platforms.

This is not child’s play; we’re talking about investors deciding not to sell, anticipating future price increases. As ETHNews noted in previous reports, this trend only fuels the flames of a possible increase in ETH’s value.

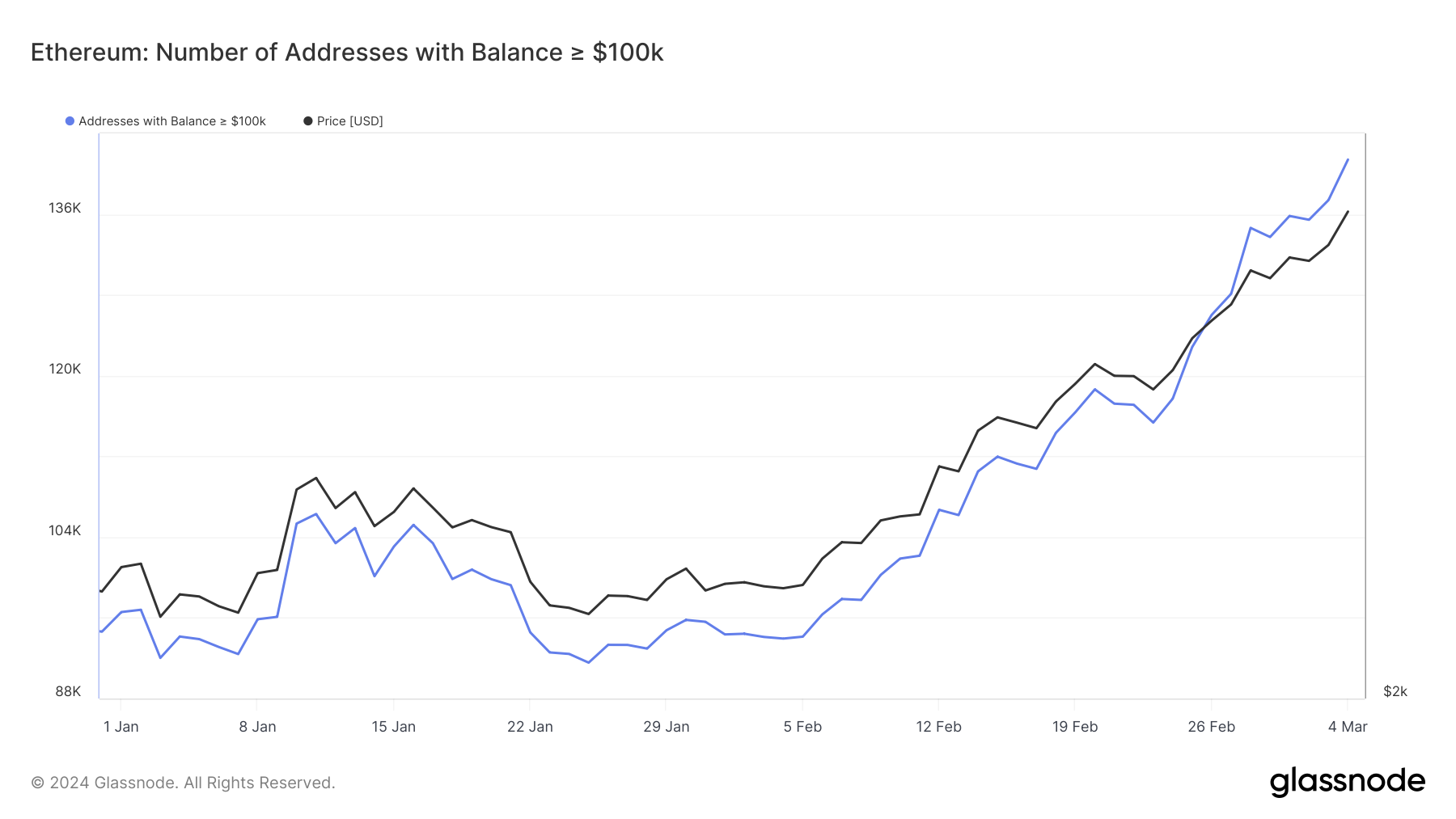

But that’s not where the story ends. Ethereum’s big forks are playing their cards shrewdly. With a noticeable increase in wallets holding significant amounts of ETH, it’s clear that confidence in Ethereum’s long-term value is not mere speculation.

These strategic moves further reduce the available supply, pushing the price higher. Following ETHNews reports, this accumulation behavior suggests an expectation of future gains by these investors.

Staking and futures: two sides of the same coin

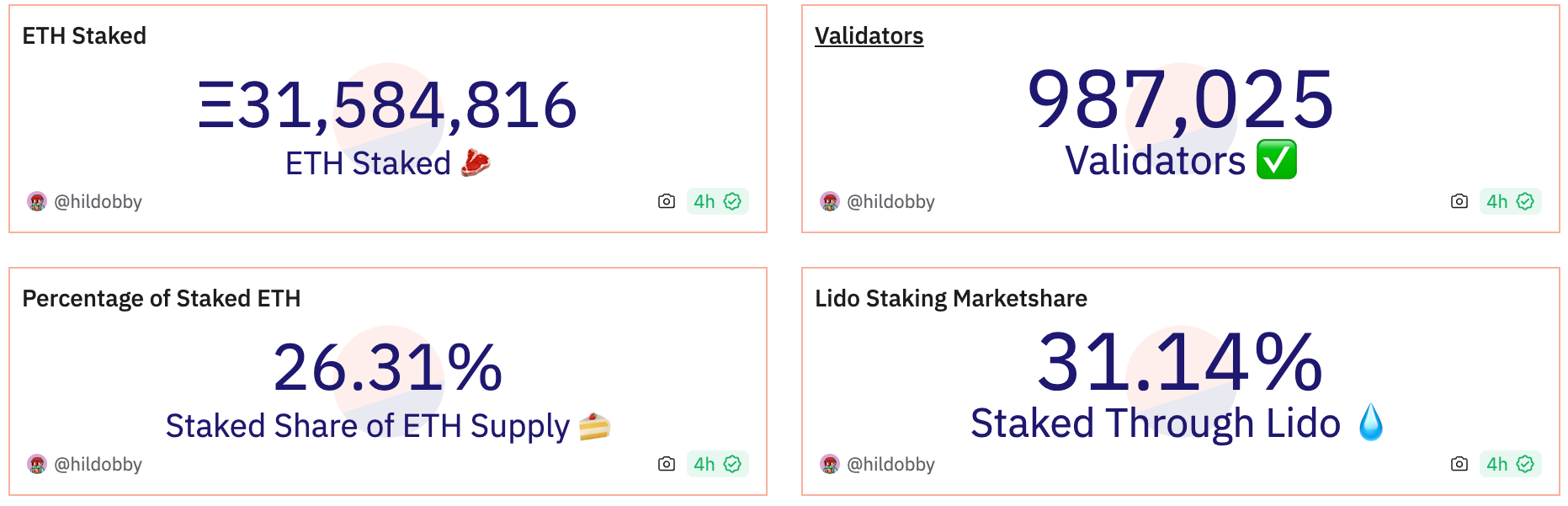

We can’t talk about Ethereum without mentioning staking. With a substantial portion of ETH locked in the proof-of-stake protocol, Ethereum’s supply in the market is significantly reduced.

This, as we well know, plays in favor of an increase in price. But that’s not where it ends; the open interest in ETH futures gives us a glimpse into the growing appetite for speculation and the use of leverage within the Ethereum ecosystem, which could signal a path to higher volatility, but also to greater heights in its valuation.

What can we expect from Ethereum?

Ethereum’s future seems to be written in the stars, and these shine with the possibility of technical upgrades and regulatory developments such as the long-awaited Ether ETF. These improvements would not only boost the network’s efficiency and capacity but could also open the doors to a flood of institutional investment.

As ETHNews previously noted, these expectations are not unfounded and could be the fuel Ethereum needs to propel its price toward and beyond $4,000.

Against this backdrop, it is safe to say that Ethereum is in an enviable position. With solid fundamentals and a community backing every step, projections for 2024 suggest we could be on the doorstep of new all-time highs for ETH.

Sure, the cryptocurrency market is known for its volatility and uncertainty, but with every piece of data we analyze, the path to $4,000 for Ethereum seems not only possible, but likely.

The Ethereum (ETH)price while finishing the article, is approximately 3,799.1 USD, up 239.5 USD, representing an increase of 6.73%. In recent analysis:

- Today, Ethereum has seen a 6.65% change.

- In the last week, it has seen an increase of 17.04%.

- In the last month, the price has risen 65.93%.