- Since the Shapella update, Ethereum doubles its staked supply, strengthening security and offering passive income to users.

- The increase in validators and staking-locked supply positions Ethereum as an attractive asset for conservative investors.

Since the introduction of the Shapella update last year, the Ethereum network has seen a considerable increase in the amount of circulating ETH, doubling the supply in this sector.

This development marks a shift in the Ethereum network, indicating an increase in staking participation and strengthening its security and decentralization structure.

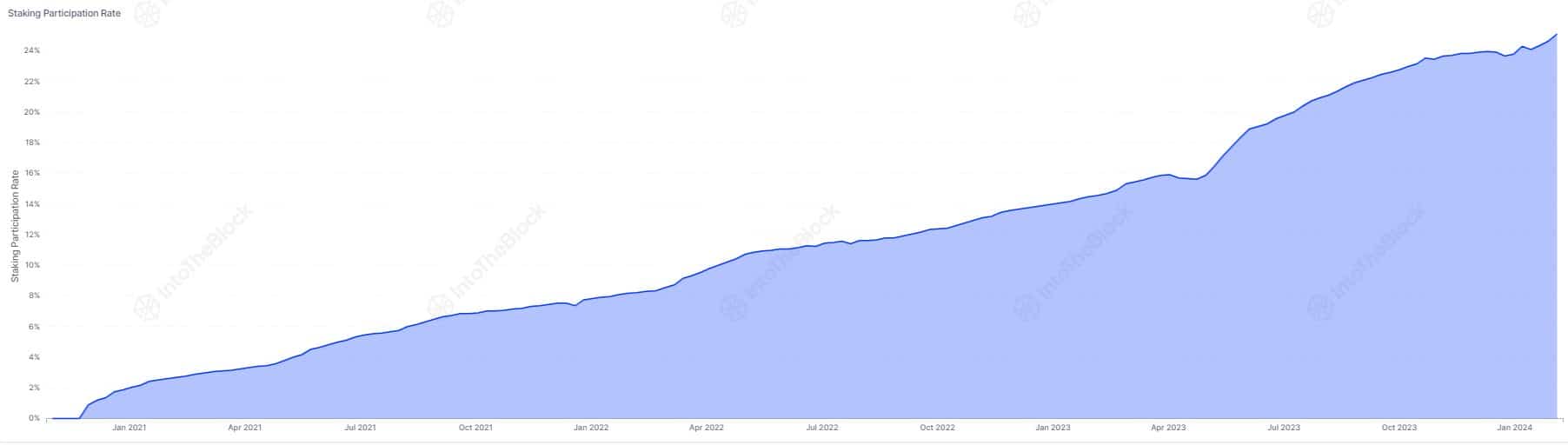

IntoTheBlock’s on-chain research revealed that Ethereum’s staking participation rate has exceeded 25% recently, meaning that about a quarter of the circulating supply of ETH is locked in the network.

This growth in participation not only improves the security of the network, but also allows users to generate passive income from their deposits, positioning Ethereum as an asset for long-term returns beyond quick gains in the secondary market.

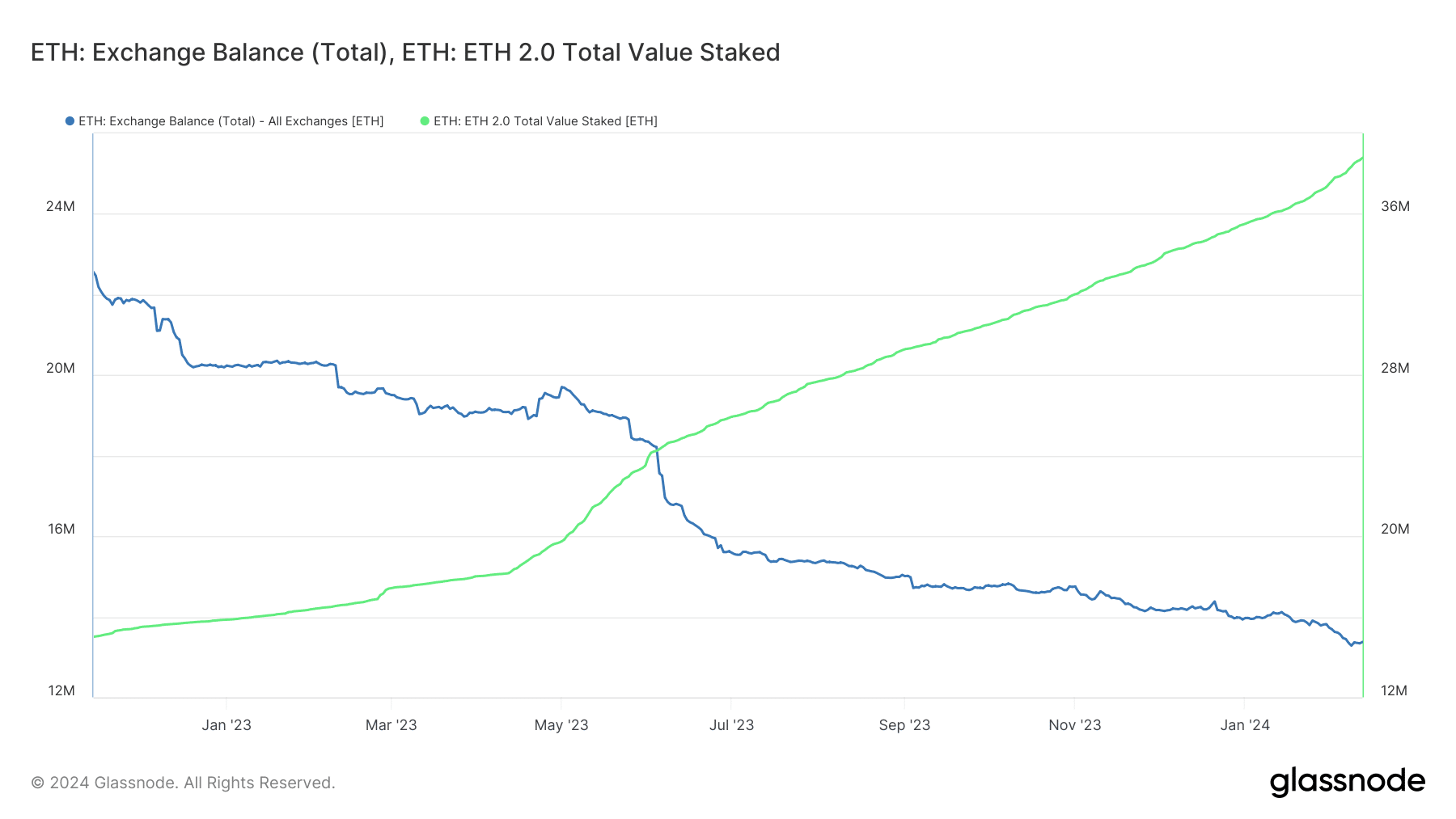

The Shapella update has been key to this shift by facilitating the unlocking of staked ETH in April 2023, removing uncertainty about withdrawals and promoting greater staking participation.

Since that time, the staked supply has more than doubled, reaching 38.7 million ETH as of Feb. 12, according to Glassnode. At the same time, the supply of ETH on exchanges has fallen to multi-year lows, representing just 11.1% of the total circulating supply.

This shift toward staking reflects a preference for stable, safe returns compared to trading in high-risk markets. The growing perception of ETH as an asset that offers long-term returns could capture the attention of investors who were previously reticent due to the high volatility of the cryptocurrency market.

The lower amount of ETH available for trade could contribute to greater stability in the Ethereum market. With fewer coins in circulation, ETH volatility is likely to decrease, which could increase demand from more conservative investors.

At the time of writing, Ethereum is trading at $2,748.94, marking a 6.78% growth in the last 24 hours, according to CoinMarketCap.

This increase reflects Ethereum’s appeal not only as a platform for decentralized applications and finance, but also as an investment asset that provides stable returns through staking.

The growth in the number of validators wanting to join the network to the highest level in four months evidences a positive trend towards adoption and strengthening of the Ethereum network.

This promises a future in which Ethereum is valued for both its technological capabilities and its ability to serve as a passive income-generating asset for its community.