- Despite a little weekly decline, Ethereum shows resiliency with a 2.31% gain in a single day, suggesting bullish potential.

- Ethereum’s performance depends on Bitcoin’s in order for Ethereum to be able to cross the $4,000 threshold.

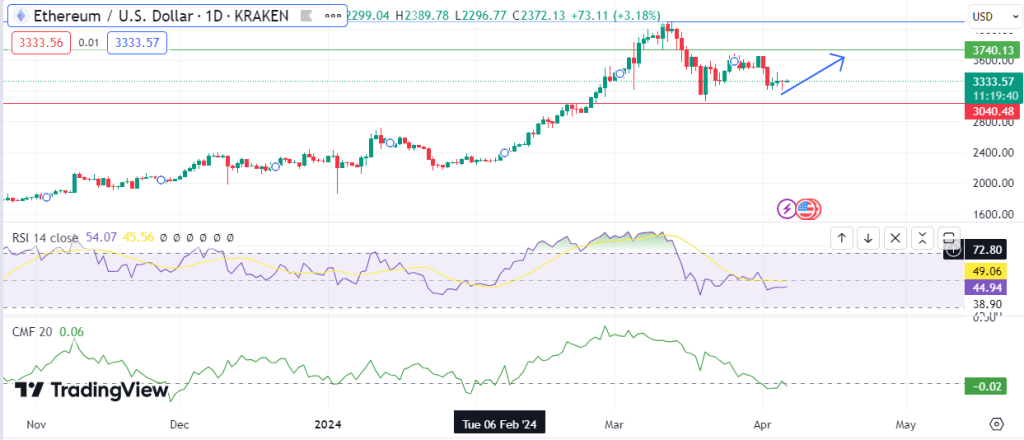

With a substantial presence above an ascending trendline, Ethereum (ETH) has emerged as a resilient lighthouse. The price of the digital currency has risen by 2.31% in the last day to an astounding $3,476.42.

Ethereum’s positive overtones are unabated despite a slight 2.23% decline during the last week, suggesting a strong possibility of surpassing the substantial $4,000 milestone.

Bitcoin and Ethereum: A Connected Dance

Ethereum’s path to this significant milestone is inextricably linked to Bitcoin’s success and is not just a reflection of its own market dynamics.

Since Bitcoin is attempting to hold its leadership over $69,000, its performance is a critical factor that has the potential to either accelerate or impede ETH’s growth, in line with what ETHNews previously disclosed. Ethereum’s future climb depends on Bitcoin’s positive momentum, highlighting their complex link.

A Consistent Position Against Bitcoin

Even in the midst of market fluctuations, ETH has exhibited remarkable stability in comparison to BTC. With a current ratio of 0.0492, the ETH/BTC trading pair is a good example of Ethereum’s durability.

This stable equilibrium points to a more developed perception in the market, where ETH is seen as keeping up with Bitcoin’s advancements and preserving a healthy balance between the two crypto titans.

The narrow band oscillation of the ETH/BTC pair indicates that Ethereum is relatively stable, but there are signs of market hesitancy. This hesitancy indicates that the market is waiting for a clear catalyst that could change the course.

With Bitcoin, Ethereum has managed to hold above the crucial 0.0490 support line, suggesting underlying resilience and maybe paving the way for an eventuality in which ETH surpasses BTC.

On the other hand, Spot Ethereum ETFs, including those from Grayscale, Fidelity, and Bitwise, face SEC scrutiny, with applications now open for public comments, as previously reported by ETHNews. For further elaboration on this development, please refer to the YouTube video provided below.

Positive Will Above Critical Points

ETH’s ability to hold a steady price over $3,300 is evidence of its bullish tenacity. The position of the cryptocurrency, along with a Chaikin Money Flow (CMF) that is marginally over zero and a reasonable Relative Strength Index (RSI) of 51.60, suggest that the market is balanced and may be entering an accumulating phase.

This balance provides a positive environment for Ethereum to keep moving in the direction of the $4k psychological barrier.

Getting Around Sentiment and Foundations

With Ethereum developing what looks to be a consolidation pattern at today’s price, a road to $4,000 is looking more and more likely. The fundamental ideas that guide Ethereum’s story, as well as the current state of the market, both influence this journey.