- Ethereum boasts a 94.3% upside direction, reflecting confidence and predicted continued upside in its valuation.

- Technical improvements and potential inclusion in spot ETFs augur massive adoption and institutional appreciation for Ethereum.

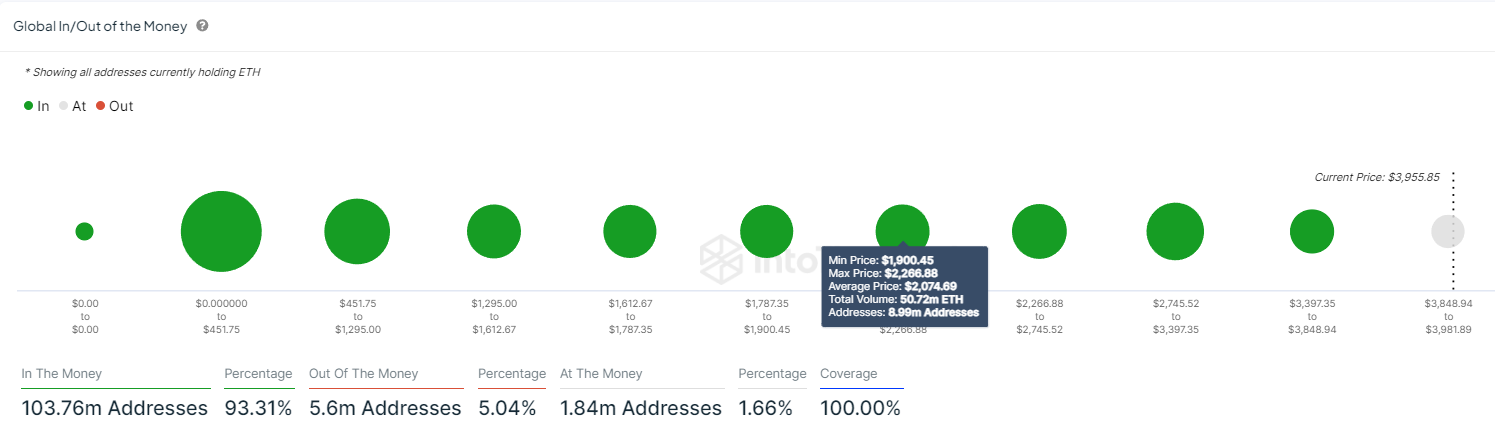

Did you know that 94.3% of Ethereum’s addresses are currently in profit after an impressive rally? This fact not only reflects investor confidence in the network, but also anticipates good growth in the price range.

The break-even price range ranges from $3,903.45 to $4,811.59. Given that Ethereum is currently trading at $3,949.90, experiencing a 4.31% jump in one day, the 2.83 million ETH held by 6.33 million addresses stays away from massive sales.

The current low selling pressure favors the possibility of sustained upward momentum in Ethereum’s price. The $10.4 billion in transaction volume by large investors reflects positive market sentiment, potentially propelling ETH toward a new record high.

The limited selling pressure on Ethereum is a noteworthy phenomenon. This signals a tendency for investors to hold on to their assets in anticipation of future appreciation. Could this be a prelude to a continuation of the rally? Asobserved, the possibility of retesting its all-time high near $4,891.70 is a realistic expectation.

Ethereum's $190M+ in weekly fees puts it at an annualized rate of over $10B for the first time since early 2022.

Due to Ethereum's fee-burn mechanism, this also has an impact on the supply, decreasing it by 33k ETH (~$125M) this week. pic.twitter.com/iAibEvzh4j— IntoTheBlock (@intotheblock) March 8, 2024

As ETHNews previously noted, the Dencun upgrade is shaping up to be a catalyst for making Ethereum more accessible and scalable. This upgrade promises to catapult the usability and demand for the network, paving the way for mass adoption. In addition, the inclusion of Ethereum in a spot ETF product represents an unprecedented opportunity to attract institutional investors, further strengthening its position in the market.

Ethereum and Bitcoin: A Beneficial Correlation

The symbiotic relationship with Bitcoin is another factor that plays in Ethereum’s favor. In a context where Bitcoin is also showing positive signs, Ethereum could benefit in the short term. In addition, the increase in trading volume by whales reflects optimism towards ETH.

Competition Stimulates Growth

We cannot ignore the appreciation potential of Ethereum’s competitors, such as Solana. This competitive environment fosters crucial aspects for the development of the industry.

A pattern of ‘higher lows’ is observed preceding a significant peak, reflecting an increase in investor confidence and potential cumulative interest. Trading volume, indicated by the bars at the bottom, shows peaks coinciding with upward price movements, suggesting strong market participation at these levels.

The recent weekly candle closed higher, which could foresee a continuation of the short-term uptrend.

According to a previous ETHNews story, innovations in one network can positively influence others, especially market leaders like Ethereum.