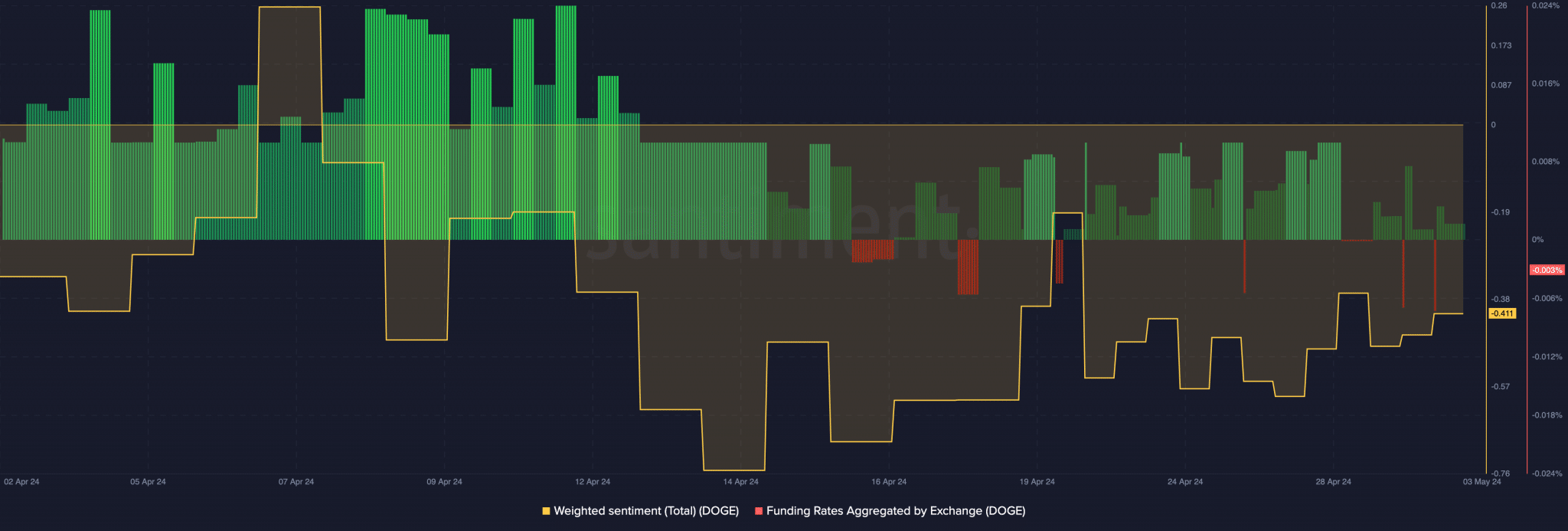

- Market sentiment reflects little expectation of short-term recovery, as indicated by Dogecoin’s Weighted Sentiment of -0.411.

- Declining Funding Rate diminishes confidence from long positions, hindering DOGE’s potential to surpass overhead resistance.

Dogecoin (DOGE) faces the possibility of slipping below the $0.13 mark as liquidity in derivatives markets declines, signaling a pause in the cryptocurrency’s recent run.

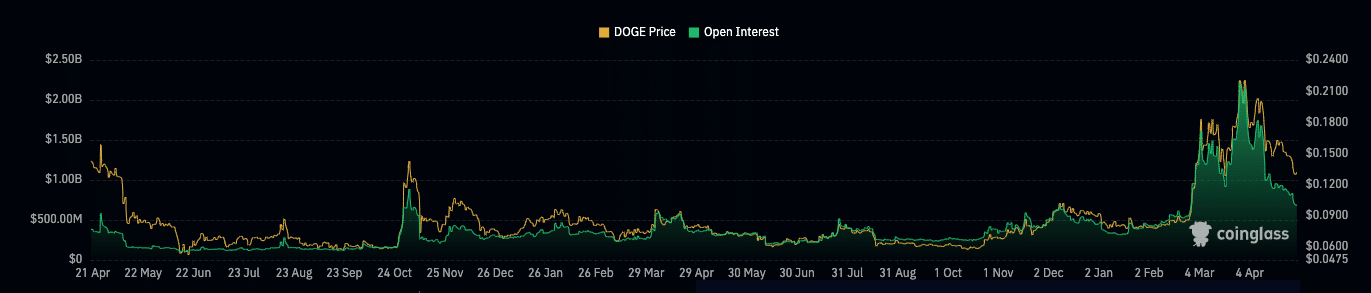

Coinglass data reveals that DOGE’s Open Interest (OI) has plummeted from $2.11 billion to $780 million since April 1. OI represents the value of open positions in a contract and fluctuates based on net positioning.

A decrease in OI suggests that contracts worth over $1 billion were closed in just over 30 days, indicating aggressive selling pressure and liquidity withdrawal from DOGE.

This inefficiency has also impacted DOGE’s price, which has dropped by 28.11% in the last month alone, according to CoinMarketCap data.

Related: Descending Triangle Breakout: Is Dogecoin Poised for a Skyrocketing Comeback?

Despite a slight uptick in price over the last 24 hours, the declining OI suggests that DOGE’s downward momentum may persist. If this trend continues, DOGE could either stabilize around $0.13 or experience a further decline to $0.11.

Market sentiment aligns with this outlook, as indicated by Dogecoin’s Weighted Sentiment of -0.411, suggesting little expectation of a short-term recovery. Furthermore, the Funding Rate, which reflects the cost of holding an open perp position, has been decreasing.

This indicates diminishing confidence from long positions, making it unlikely for DOGE to surpass overhead resistance and reach $0.15 in the near future.

Read more: The Road to $1: Dogecoin’s Journey Amidst Market Speculations

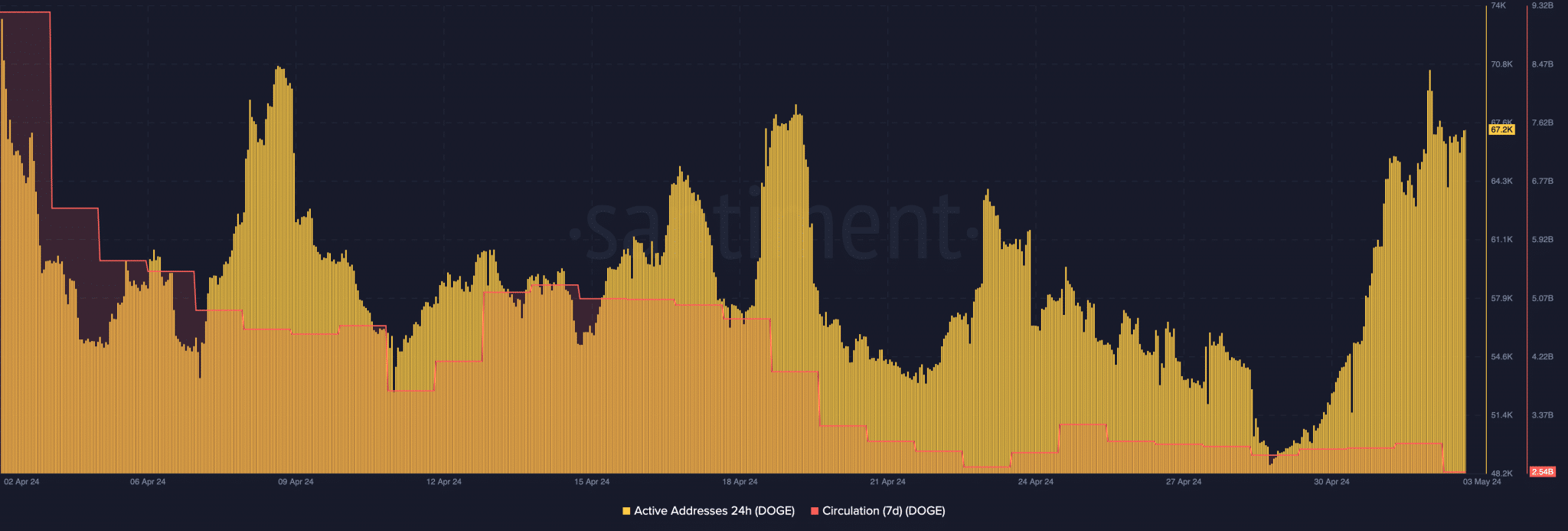

While network activity has seen a slight increase, with the number of active addresses rising from less than 50,000 to 67,200, it remains significantly below levels seen during DOGE’s peak at $0.20.

This suggests that any potential price hike driven by increased network activity may be short-lived.

Additionally, one-day circulation data indicates a decline in DOGE’s usage, further reinforcing the likelihood of the cryptocurrency remaining range-bound as fewer coins are moved.

As such, DOGE may continue to face challenges in breaking out of its current price range amidst declining liquidity and subdued market sentiment.