- Samson Mow predicts Bitcoin will eventually reach $1 million, although the timing and speed remain uncertain.

- Bitcoin’s recent halving event has reduced supply, potentially amplifying future price increases due to increased demand.

Bitcoin supporter Samson Mow, CEO of Jan3, recently predicted on social media that Bitcoin would eventually reach $1 million per unit. Mow emphasized that the exact timing and speed of this increase are uncertain, despite his confidence in the eventual outcome.

I know #Bitcoin is going to $1.0M

You know #Bitcoin is going to $1.0M

The only questions are when and how rapidly.

— Samson Mow (@Excellion) June 17, 2024

This year, his prediction coincided with the fourth Bitcoin halving event in late April, which reduced the block rewards by half, effectively limiting the supply of new Bitcoins.

Mow argues that this reduction in supply, coupled with increased demand following the U.S. Securities and Exchange Commission’s approval of spot Bitcoin ETFs in January, will drive Bitcoin’s price upward, even though we have covered it in its entirety in ETHNews.

Mow also speculated that Bitcoin could experience a sudden and large increase in price, suggesting that it might jump from $70,000 to $200,000 virtually overnight. He describes this potential price movement using the metaphor of an “Omega candle” indicating a rapid and large increase.

Current Market Data Presents a Less Optimistic Scenario

On-chain data from Santiment showed a significant decrease in the number of active Bitcoin wallets, marking the largest drop since the days before Bitcoin reached its highest price point in March. This trend indicates that some holders are selling their Bitcoins, possibly due to the recent decline in price.

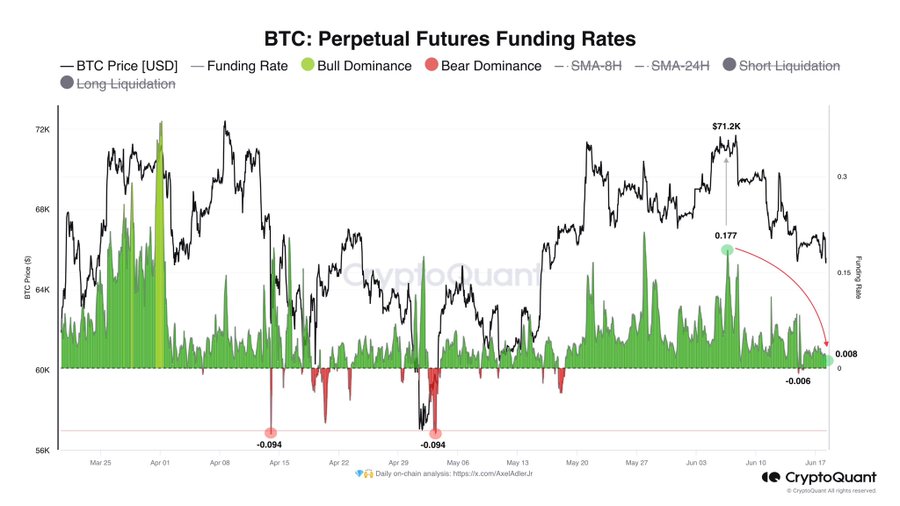

The futures market data also reveals a shift in investor sentiment. The funding rate, which reflects the balance of bullish and bearish positions, has decreased significantly, suggesting a less confident outlook among investors regarding the immediate future of Bitcoin’s price.

Despite these challenges, Mow maintains his long-term positive outlook for Bitcoin, underscoring his view with a belief in the fundamental impact of the supply and demand set in motion by recent and upcoming changes in the market structure.