- In March, Solana saw notable growth, processing 2.4 billion transactions and generating over $34 million.

- Despite its successes, high rates of transaction failure and network congestion had a negative impact on the market perception of SOL.

With the highest industry utilization rate, Solana (SOL) emerged as the preferred blockchain at the end of the first quarter of 2024. In a recent piece, well-known cryptocurrency influencer Lark Davis claimed that Solana has enabled an astounding 2.4 billion transactions throughout this time.

In Q1 2024, Solana has settled more transactions onchain than TRON, Near, BNB, Sei, Polygon, Injective, Sui, zkSync and Ethereum combined.

Nuts! pic.twitter.com/Rl4Xj1Haea

— Lark Davis (@TheCryptoLark) April 10, 2024

Solana Transaction Volume and Market Effect

This volume demonstrates Solana’s dominance in the Web3 space, since it is significantly higher than the total transactions processed by the following nine top networks.

Last month’s memecoin frenzy, which saw a big influx of new coins and retail traders scurrying to get in on the action, was a major contributing factor to the spike in transactions, as previously reported by ETHNews.

In addition to demonstrating Solana’s scalability, this frenzy also drove the network to its limits.

According to Token Terminal data, Solana generated over $34 million in revenue in March alone, making it the Web3 ecosystem’s third-highest revenue-generating platform. The roughly six-fold increase in income from February indicates that the network had a profitable quarter.

There has been a noticeable increase in the number of users actively participating on the Solana network. From February to March, active participants increased from 426,000 to 932,000. The following YouTube video delves deeper into this development.

Technical Difficulties During Expansion

Even with its achievements, the quarter wasn’t without difficulties. High network usage exposed several vulnerabilities, one of which was increased transaction failure rates. The inability of Solana’s creators to deliver a prompt resolution alarmed several members of its user base.

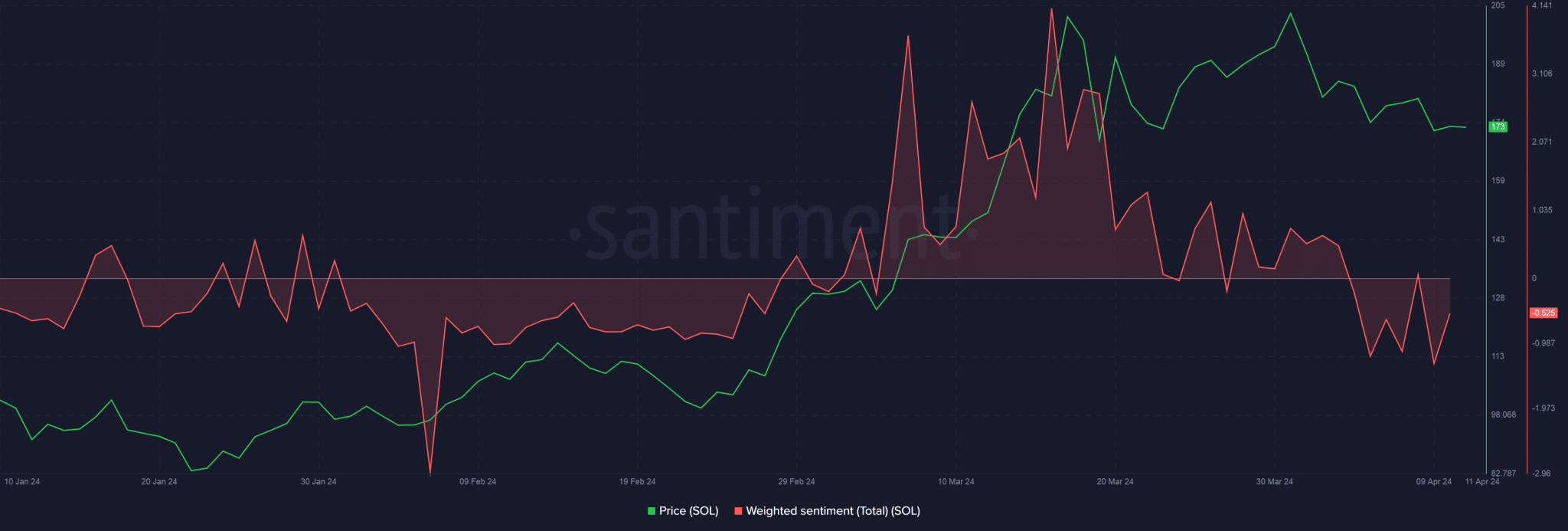

Source: Santiment

These network congestions negatively impacted market sentiment, with more pessimistic remarks on Solana’s native token, SOL, especially during the final week of the quarter.

Nonetheless, according to CoinMarketCap, SOL’s price at the time of writing was $175.19, up 1.10% from the previous day. Even with this recent increase, SOL’s price has dropped 3% over the last seven days.