- Cathie Wood from ARK Invest asserts Bitcoin’s potential to surpass gold as a secure asset in economic turmoil.

- Bitcoin’s resilience shown through a 40% rise amid banking crises, challenging traditional assets like gold in stability

Have you ever thought that Bitcoin might become the new gold? Well, Cathie Wood from ARK Invest has, and her insights are stirring up the cryptocurrency sector. Let’s discuss how Bitcoin is changing the game.

Wood shares something fascinating: in times of economic crisis, Bitcoin outshines gold. Remember last year’s banking crisis? As banks were faltering, Bitcoin surged by 40%. Surprising, isn’t it? This trend isn’t an isolated incident. After the introduction of 11 Bitcoin ETFs, despite a slight setback, Bitcoin regained its strength.

But why does this happen? Wood explains that following the ETFs’ launch, there was an increase in Bitcoin buying, followed by a typical sell-off after major announcements. It’s like a roller coaster: up and down, but in the end, Bitcoin always seems to rise.

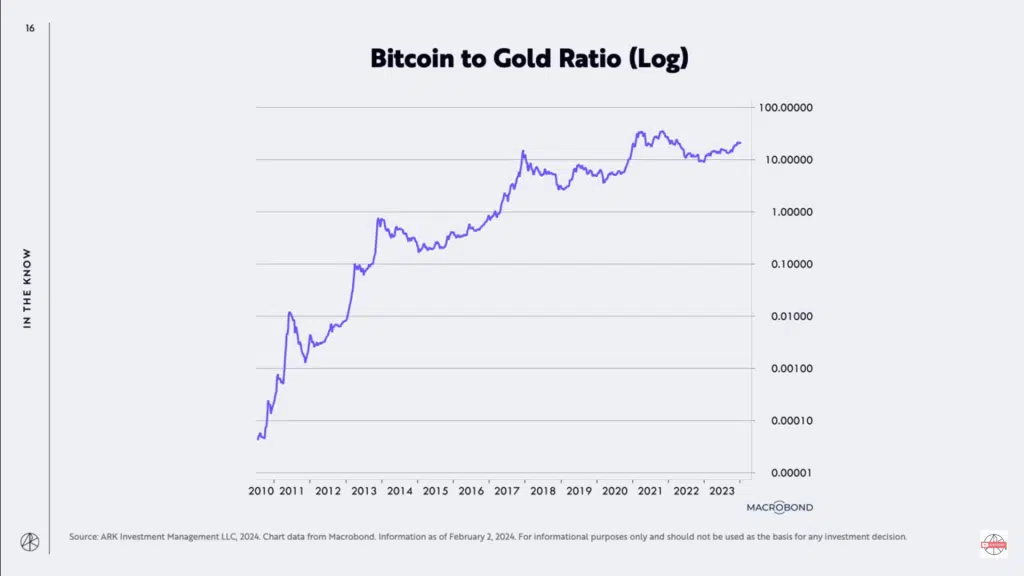

And here’s the most intriguing part: Wood shares a chart comparing Bitcoin’s value to gold’s. What does it show? An impressive upward trend for Bitcoin. It seems Bitcoin is gradually taking over gold’s place as a safe haven asset.

So, what does all this tell us? We’re witnessing a monumental shift. Bitcoin is no longer just a passing trend; it’s becoming a serious option for those seeking security in their investments. And the best part is that accessing Bitcoin is now easier than ever.

Cathie Wood is opening our eyes to a new reality: Bitcoin is here to stay and play a significant, watchful, if not the best role in today’s global economy.