- BNB experiences a 20% jump in price in two weeks, reaching new two-month highs at $366.

- The data suggests a possible price correction, with BNB potentially retesting the $340 resistance level soon.

Have you been following the cryptocurrency market lately? Well, if Binance Coin (BNB) is on your radar, here’s something that might interest you. In the past two weeks, BNB has seen an impressive 20% jump in price – can you believe it? Suddenly, everyone is talking about whether this rally will lead BNB to break the $400 barrier.

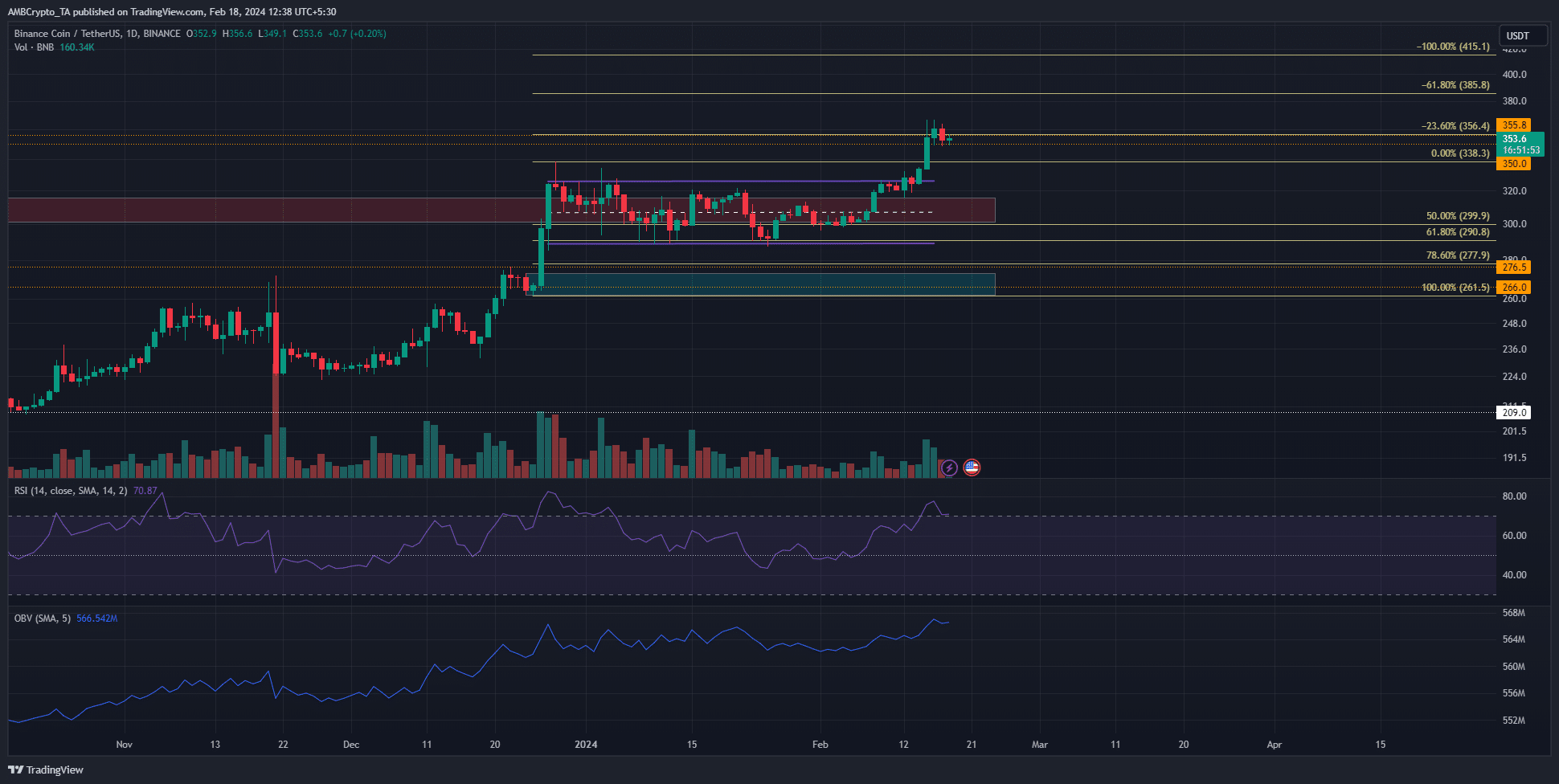

Let’s break down the numbers a bit. Not too long ago, BNB broke above $325, setting new two-month highs and reaching as high as $366. This is no small feat; we’re talking almost 20% up in the blink of an eye.

Now, let me tell you about something called Binance Smart Chain. This year, it’s been quite busy, showing constant activity and trading volume that we can’t ignore. Also, with Bitcoin (BTC) recovering from $42.5k, BNB has been on a bit of a roller coaster ride, only this time, upward.

Analyzing the charts, those Fibonacci retracement and extension levels tell us that BNB has been playing for keeps. Defended by its buyers at the 61.8% retracement level, this token has proven that it is not just a temporary player in this market.

Since February 8, things got even more interesting. The price jumped above $313.1, with the RSI and OBV giving clear signals that there is more room for gains. And while some might think that reaching the $350-$380 zone would take time, BNB is proving otherwise.

But wait, it’s not all plain sailing. Coinalyze data tells us that futures market participants are somewhat skeptical. With the Open Interest and Funding Rate showing some reluctance, there seems to be a mix of emotions in the air.

And here comes the interesting part. Despite this momentum, the spot CVD has seen a notable decline over the past three days. This could indicate a possible correction in price, perhaps leading BNB to revisit the $340 level, which was resistance in December 2023.

So what do you think, are we seeing the prelude to a new era for BNB, or is it just another day at the office for cryptocurrency traders? With the market as volatile as ever, only time will tell. But one thing is for sure: BNB is making a lot of waves, and for good reason.