- Lyra estimates a 20% chance of Bitcoin surpassing $70,000 before April, driving speculation and strategies.

- Bitcoin’s halving in April could transform its valuation, with investors and Lyra anticipating major changes in the market.

Bitcoin continues to capture the world’s attention, particularly now that Lyra’s decentralized options marketplace gives us a unique perspective into what the future could hold. According to Lyra, there is a 20% chance that Bitcoin will exceed $70,000 before the end of April, generating both optimism and caution among investors.

This forecast comes at a pivotal time, shortly before Bitcoin’s anticipated rewards halving, scheduled for mid-April. This event could mark a major shift in the cryptocurrency’s trajectory, considering that it has historically been a precursor to significant variations in its value.

Nick Forster, founder of Lyra and former Wall Street options trader, noted in an interview, that Lyra’s estimates indicate a 20% chance of Bitcoin reaching all-time highs above $70,000 before April 26.

Investors who have used Lyra accurately positioned themselves for Bitcoin’s recent rise above $50,000, bolstering confidence in their forecasts and strategies. However, the idea of a surge to $70,000 has surprised many, especially after Bitcoin experienced a 35% increase to $52,000 in three weeks, reaching its highest point since late 2021.

This increase has been driven by a substantial flow of investment into U.S. spot ETFs, increasing the mood among cryptocurrency investors. It is anticipated that fiscal policy in the U.S., highly expansionary in recent years, along with the reduced likelihood of a global recession to its lowest point since December 2021, will continue to incentivize risk-taking in the financial market.

Bitcoin’s halving of the mining bounty, thus slowing the rate of increase in BTC supply, is seen by many as a determining factor in its appreciation. With this event approaching, investors’ attention is focused on its possible influence on the price of this predominant cryptocurrency.

Options, derivatives that grant the right but not the obligation to buy or sell an asset at a fixed price, have emerged as essential tools for investors wishing to anticipate market trends.

Lyra, as the largest decentralized crypto options marketplace, plays a vital role in this arena, allowing investors to speculate on Bitcoin’s price before and after halving.

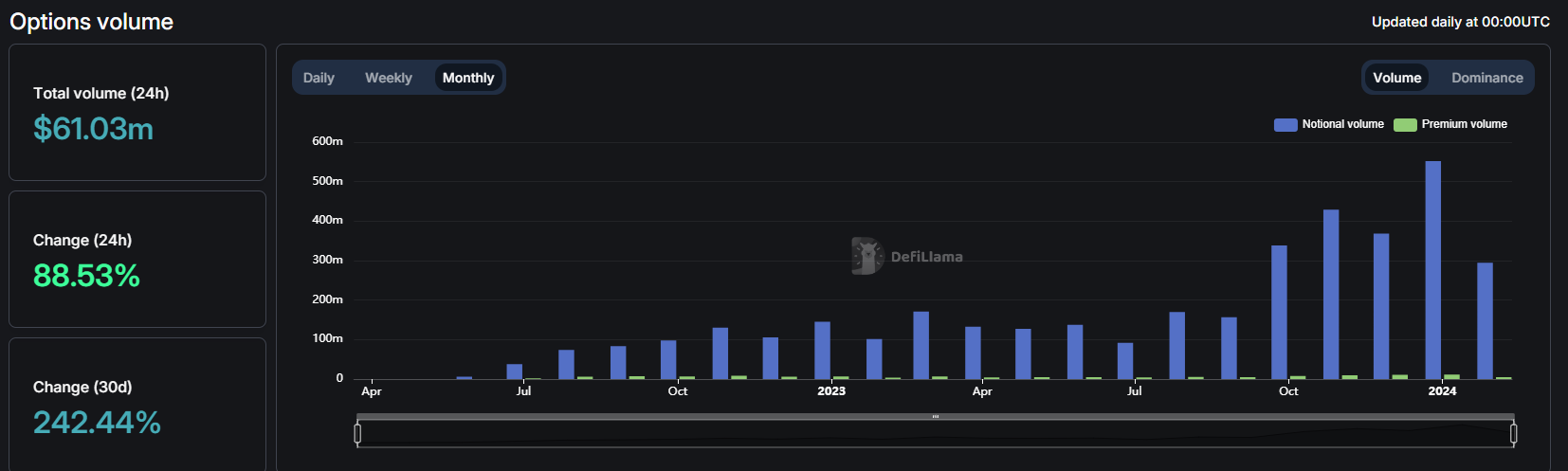

With a volume of $32 million in options in the past 24 hours, Lyra sits at the epicenter of crypto speculation, offering investors a platform to explore the uncertainty and opportunities that Bitcoin’s future could bring .

As we approach mid-April, the crypto community eagerly awaits the next chapter in Bitcoin’s evolution.