- Bitcoin spot ETF inflows rise as gold ETFs see outflows, fueling debate on Bitcoin as a store of value.

- Despite historic inflows into gold ETFs, Bitcoin’s inclusion in model portfolios could accelerate its acceptance as an asset.

In the current financial market, the growing attraction to cryptocurrencies, particularly Bitcoin exchange-traded funds (ETFs), highlights a transition in investment preferences, marking a contrast to the trend observed in gold funds .

This inclination towards digital assets suggests a strategic adjustment by investors, who are looking for options with higher projected returns in the face of market fluctuations.

Investment Reorientation: From Gold to Bitcoin

Leading gold mutual funds, such as SPDR Gold Shares (GLD) and iShares Gold Trust (IAU), have experienced declines in their assets under management (AUM), evidencing net outflows .

This phenomenon intensified following the introduction of Bitcoin ETFs, which managed to capture a significant volume of investments, adding nearly $10 billion in AUM shortly after their launch.

During the last week of February, capital inflows into Bitcoin ETFs were recorded at $777.79 million, while gold funds experienced net outflows of $608.24 million, accumulating large outflows since the beginning of the year.

This pattern indicates a diversification of portfolios into digital assets, rather than a direct transfer of investments from gold to bitcoin.

Gold and Bitcoin Comparison: Evolution of Investments

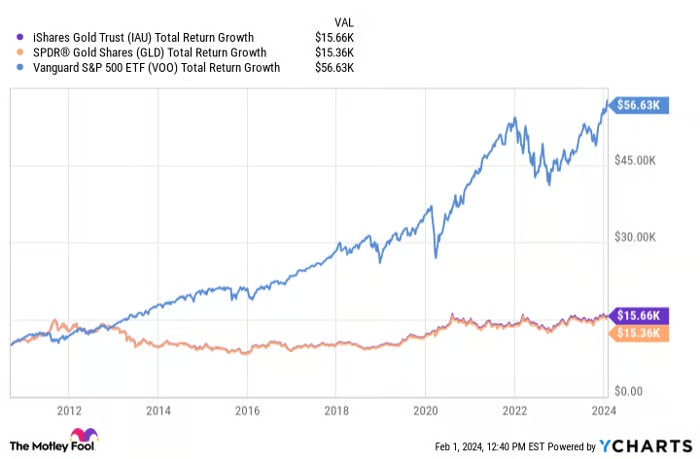

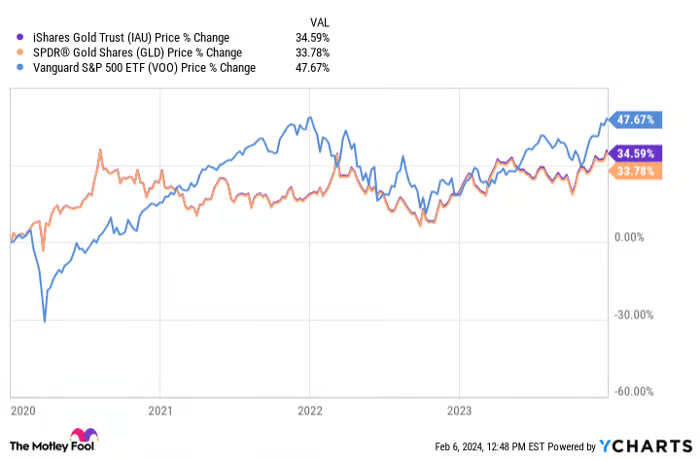

Although gold ETFs have provided consistent returns, investing in funds that replicate the S&P 500 has proven to be more profitable. However, Bitcoin ETFs, despite being more speculative, represent a comparable investment alternative to gold ETFs, albeit with a potentially more volatile risk and return profile.

Gold ETFs have a long track record of analyzing past trends, while spot Bitcoin ETFs are relatively new and their long-term performance is yet to be defined.

Bitcoin ETF inflows keep accelerating with $50,000 taken out, coincidentally (or not!?) at the expense of Gold ETF outflows.

Total assets in all US Bitcoin ETFs = $38bn

Total assets in the GLD ETF = $54bn

Total assets in all global Gold ETFs = $166bnSo, physical buyers will… pic.twitter.com/baYzg4dF9F

— Nicky Shiels (@nixsa84) February 14, 2024

This shift in investment preferences reflects an evolution in the financial market, where digital assets are beginning to occupy a larger role, offering new opportunities for investors looking to diversify their portfolios beyond conventional assets.

Combining the Best of Both Worlds

Mike McGlone, senior commodities strategist at Bloomberg Intelligence, suggests that the future of investing could lie in the combination of gold and Bitcoin. The duo could offer an effective hedge against inflation and a growth opportunity, respectively.

The current price of Bitcoin (BTCUSD) is approximately 52,407.00 USD, experiencing an increase of 1.32%

The current price of Gold (XAU) is 2026.06 USD, with a recent change of -9.38 USD (-0.46%). Recent price movements suggest a neutral trend in the short term.