- Bitcoin surpasses $52,400 pushing its market value beyond $1 trillion, surpassing companies like Tesla.

- Ethereum hits $2,816 up 6.89% as analysts anticipate further increases for Bitcoin in March 2024.

With Bitcoin’s price rising above $52,400, anticipation is growing about the possibility of setting new highs in the next month. Bitcoin (BTC) has continued its upward trend, increasing more than 6% in the last 24 hours and surpassing the $52,400 mark.

This boost in Bitcoin’s value has propelled its market value above $1 trillion, surpassing big-name companies like Tesla.

In the recent cryptocurrency market rally, Bitcoin (BTC) has surpassed $52,000, currently reaching $51,930.82, representinga 5.9% rise in a 24-hour span.

Some industry analysts are already anticipating a further 40% increase in Bitcoin price to set new highs by March 2024.

In parallel, Ethereum (ETH) has also seen an outstanding increase, surpassing $2,800 to stand at $2,826.89, indicating a 6.89% rise over the same period. Alongside Ethereum, the top ten altcoins have all seen increases of 5% to 10%.

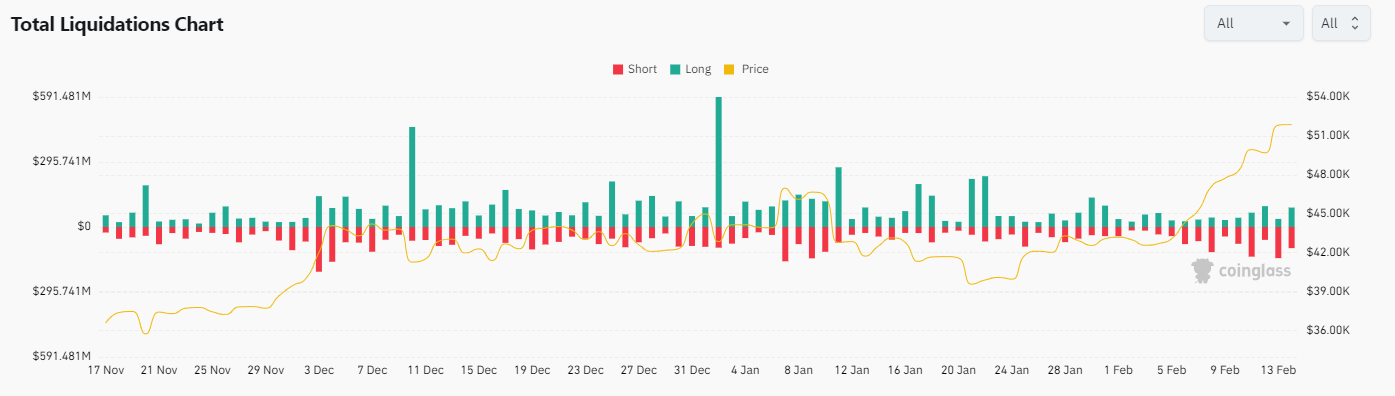

Market information provided by CoinGlass indicates a significant settlement of $225 million in the cryptocurrency market in 24 hours. Of this figure, $45.15 million is attributed to settled long orders, while $180 million is due to settled short orders.

One of the factors behind the rise in Bitcoin’s price is the intense inflow of capital into cashBitcoin ETFs. Investments in these new investment vehicles in the U.S. topped $600 million in a single day just earlier.

BTC price forecasts

In a recent analysis, cryptocurrency analyst Michael van de Poppe pointed to Bitcoin’s impressive rise, surpassing the $51,000 mark to reach a new yearly high.

Surprised by the market strength, van de Poppe indicated that we could see a high between $54,000 and $58,000 before the next halving event.

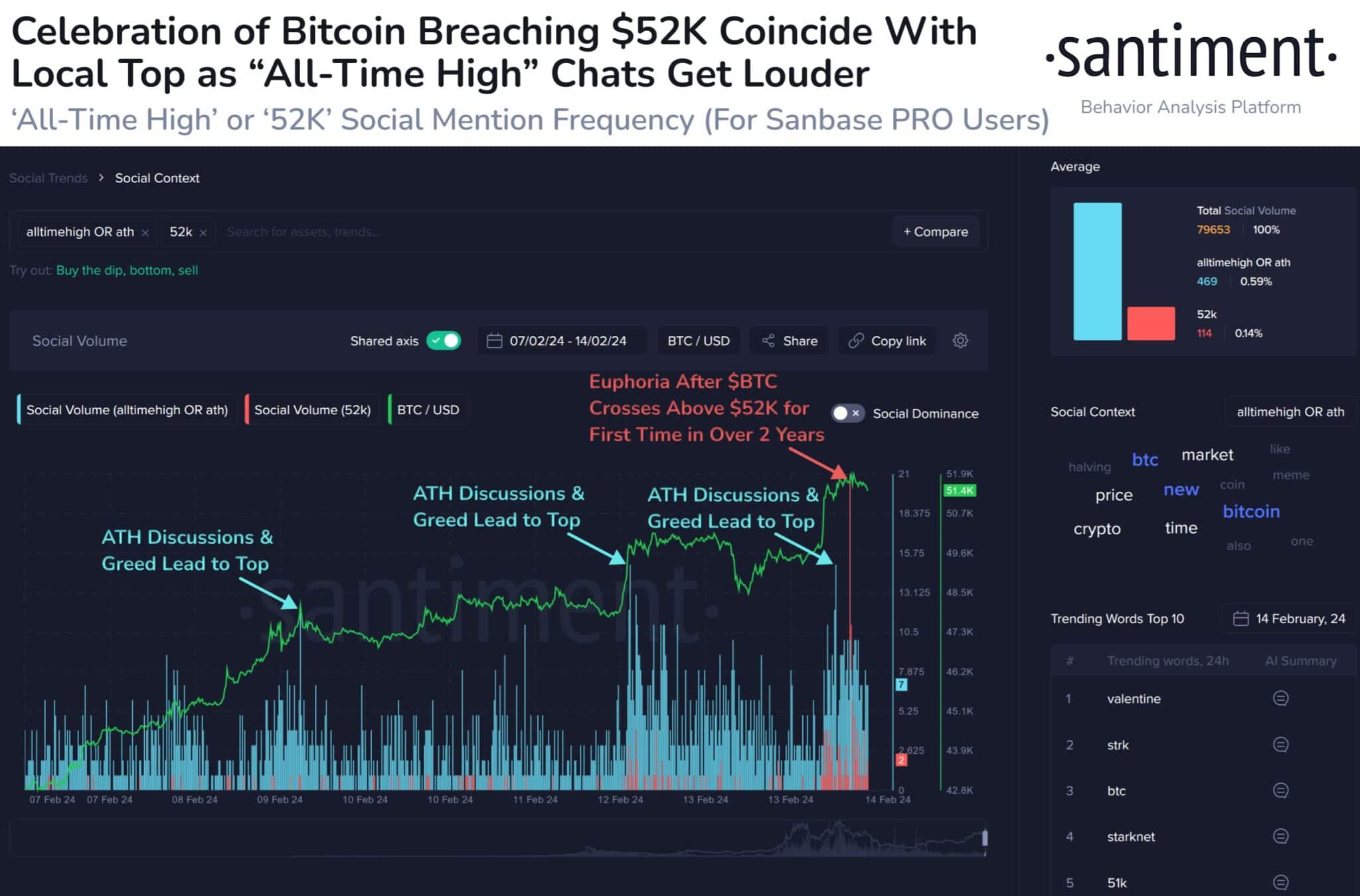

According to observations from data provider Santiment, Bitcoin has now broken back above $52,000, reaching a level not seen since December 3, 2021.

However, experts recommend caution, as excessive celebrations after reaching such levels are often followed by temporary drops in the market.

In the context of a bull market, historical records reveal an intriguing correlation between traders’ unbridled enthusiasm in social networks and the formation of local highs.