- Avalanche (AVAX) price surged nearly 12% due to Binance’s strategic introduction of a USDC-margined AVAX Perpetual Contract with up to 75x leverage.

- The bullish sentiment is further supported by a rare derivatives market signal, indicating the potential for further AVAX price increases.

The world’s largest cryptocurrency exchange, Binance, made a noteworthy announcement today that caused the price of Avalanche (AVAX) to rise by around 12%. It makes investors’ eyes widen.

#Binance Futures will launch the USDC-M $AVAX Perpetual Contract at

🗓Mar 20 2024, 07:00 (UTC)

Read more➡️https://t.co/t9rOxklc34 pic.twitter.com/9a6CuhcxPX

— Binance Futures (@BinanceFutures) March 18, 2024

Binance’s Support for Avalanche

Binance plans to launch an AVAX Perpetual Contract on its Futures platform that offers leverage up to 75x and is USDC-margined, demonstrating a major demonstration of support for Avalanche. With a launch date of March 20, 2024.

For your information, this contract will give traders more options and versatility, enhancing the trading dynamics on Binance Futures. Binance announced a 10% trading fee reduction for all USDC-margined futures contracts through April 3, 2024.

Additionally, the platform’s Multi-Assets Mode will add a much-needed degree of trading flexibility by allowing trading with different margin assets.

And then, the market responded favorably and quickly to Binance’s initiative, demonstrating that investors are still optimistic about Avalanche’s potential, as seen in the sharp increase in the price of AVAX. The purpose of doing this is to boost trade activity and maintain market liquidity for AVAX.

The quick price increase of AVAX that resulted from Binance’s statement highlights how important big exchanges are in shaping the attitudes and movements of the cryptocurrency market.

On the other hand, according to prior ETHNews reporting, Avalanche Wallet Integration will simplify AVAX staking through the anticipated Durango Upgrade, improving the user experience and network participation. The following video has taken a deeper look at this development, giving you more insight.

Reassurance Signals from the Derivatives Industry

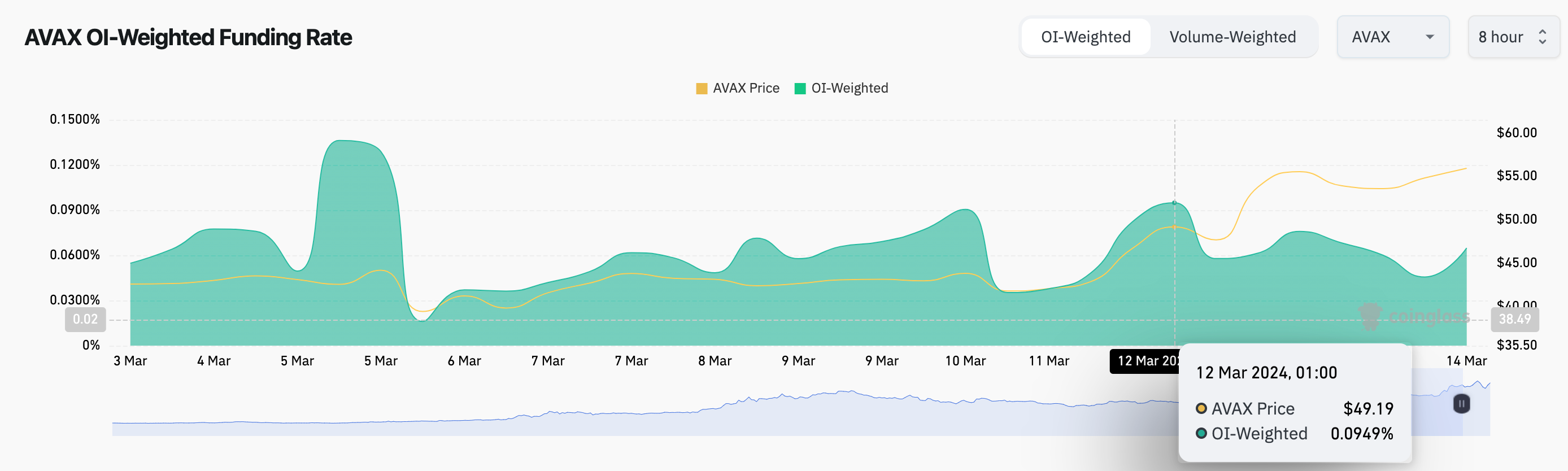

Looking at it from another point of view, the distinct signal that the derivatives market has sent would indicate that Avalanche will keep rising, strengthening the optimistic outlook.

A significant decrease has been noted in the Coinglass Funding Rate indicator, which represents the total amount of fees that LONG contract holders have paid to SHORTs, during the upward trend in AVAX’s price.

Experienced investors frequently view this dip as a bullish indicator, suggesting an excellent position for future Avalanche price gains.

Although more growth is expected, economists warn that initial resistance can be found close to the $65 mark. If AVAX overcomes this barrier, there may be a follow-up spike towards $75.

At the time of writing, the price of AVAX has risen 12.49% in the last 24 hours, reaching a price of $62.37. This represents an increase of 32.91% over the past 7 days.