- The Avalanche network experienced a 16.88% decline in transactions, affecting gas usage and activity in AVAX-based dApps.

- Falling trading and deflationary pressure on AVAX led to a 1.1% reduction in its price in the last week.

In the last week, blockchain network Avalanche (AVAX) experienced a notable decline in its network usage, as reported in a recent post on social platform X (formerly Twitter).

This change has sparked diverse opinions in the market about AVAX, a cryptocurrency that has captured the attention of investors and cryptocurrency enthusiasts for its focus on scalability and efficiency.

Drop in Network Activity

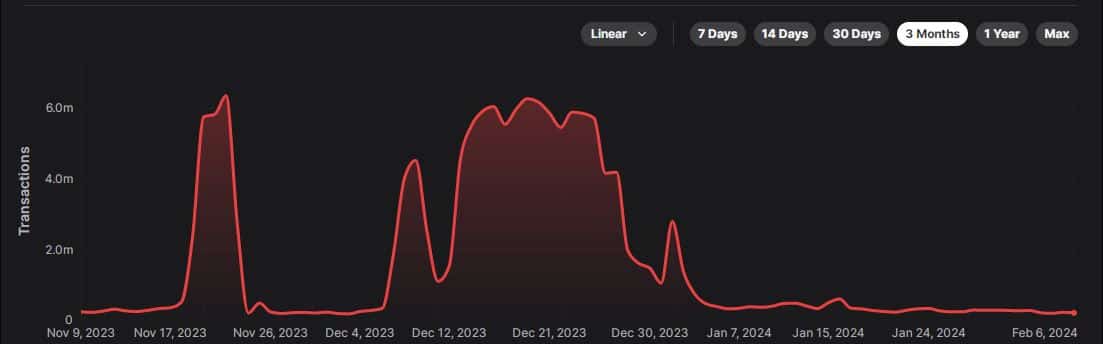

Avalanche’s C-chain, designed to execute smart contracts, processed a cumulative total of 7.66 million transactions in the last week, representing a 16.88% decrease compared to the previous week .

This drop in transactions also led to a 2.74% reduction in gas usage, an important indicator as smart contract interactions require larger amounts of gas due to their complexity. This decrease suggests less activity in Avalanche-based decentralized applications (dApps).

Impact on AVAX

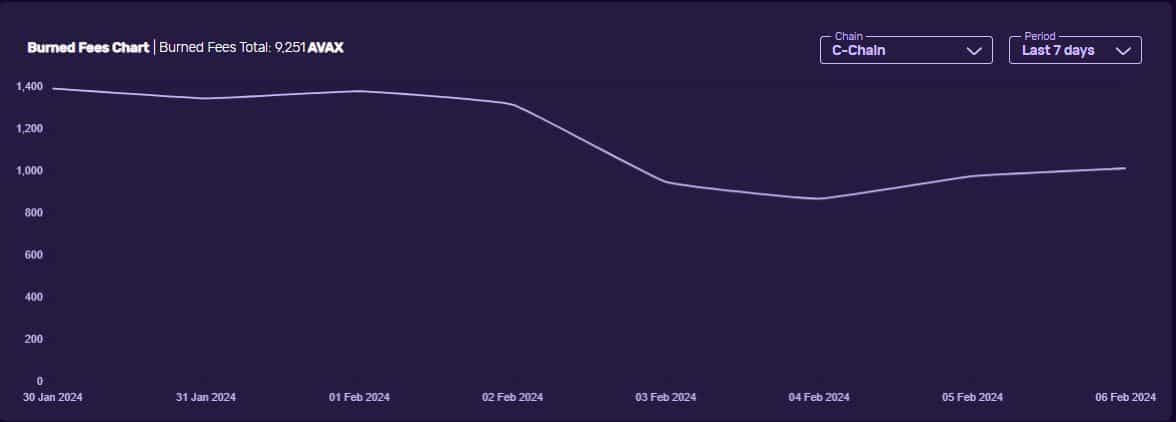

Avalanche has a mechanism whereby it burns all revenue generated by transaction fees, meaning that the higher the fees, the greater the deflationary pressure on AVAX.

However, with the decline in transactions in the last week, the amount of AVAX that actually went out of circulationalso declined , according to Avascan data. This phenomenon could be responsible for the 1.1% weekly drop in the cryptocurrency’s price.

Derivatives Traders’ Perspective

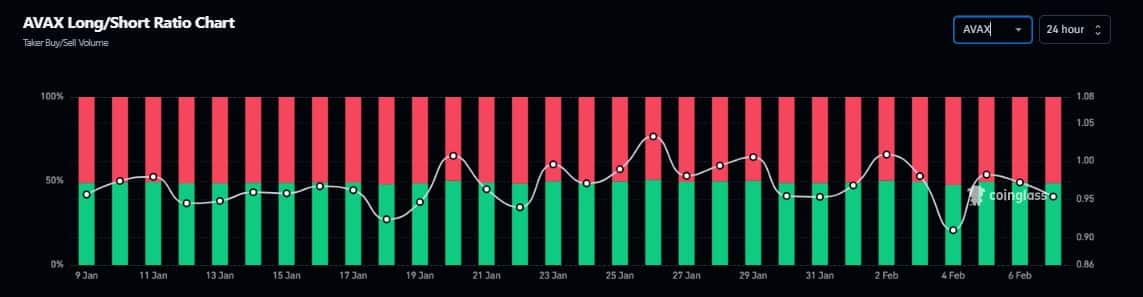

With the falling price in the market, money invested in the speculative market for AVAX also declined, data from Coinglass showed.

At the time of this writing, the Open Interest (OI) on AVAX futures contracts was $193 million, representing a drop of nearly 5% from the previous week. A decline in OI, coupled with a drop in price, reflects bearish sentiment in the market.

In addition, the number of short positions taken for the currency has continued to increase compared to long positions, reinforcing the bearish narrative.