- Amidst market corrections, ENA’s price increased by 96.57% in just one week, outpacing other altcoins.

- With regard to ENA, analysts at X recommend a “Buy High, Sell High” approach, which reflects elevated market expectations.

The value of ENA, Ethena’s native token, has increased by an astounding 96.57%. This surge coincides with a period of corrections in the altcoin market as a whole, making ENA’s performance all the more remarkable.

A New Dawn in DeFi Banking: Ethena

Ethena is using the decentralized finance (DeFi) concept to carve out a position for itself as a strong contender to traditional banks. Ethena’s main goal is to transform savings by providing a high-yield substitute for the traditional banking system with its dollar-denominated protocol.

The launch of the US dollar-pegged stablecoin Ethena USDe (USDe) demonstrates the project’s dedication to delivering stability and dependability in the erratic cryptocurrency market.

Ethena has placed its USDe stablecoin strategically, with substantial collateral backing in well-known cryptocurrencies like Bitcoin and Ethereum, drawing comparisons to the pre-crash TerraLuna.

With Ethena offering an astounding 37.1% Annual Percentage Yield (APY) on USDe deposits, this move is considered a vital step towards minimizing the risks associated with high yield offerings.

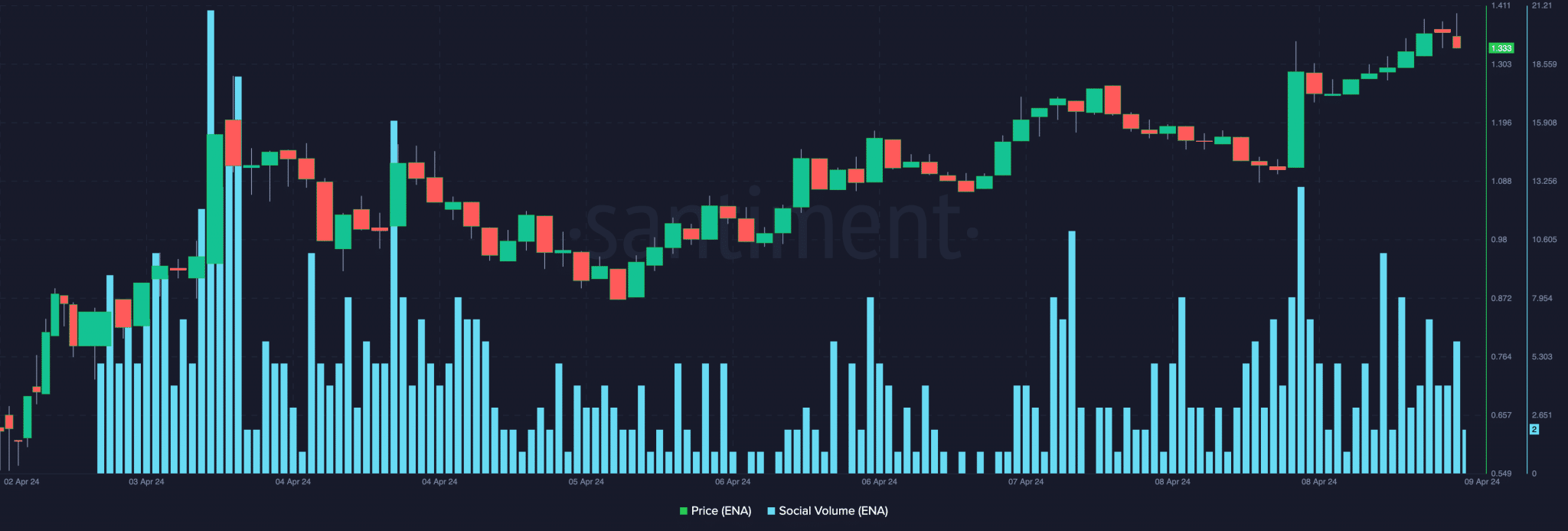

Confidence in the Market and Social Buzz

Ethena’s social volume has increased since its launch, demonstrating the market’s undying confidence in the platform. This increasing interest is evidence of the community’s belief in the project’s foundation and long-term viability.

The growing popularity of USDe, which has a value of over $2 billion right now, has increased the enthusiasm for Ethena. This might herald a new era in the altcoin market.

The cryptocurrency community hasn’t held back when sharing its thoughts about Ethena. Notably, BitMEX co-founder Arthur Hayes has voiced a bullish perspective, speculating that ENA may hit $10.

Conversely, Andre Cronje of Fantom has brought attention to the differing viewpoints in the sector by voicing worries regarding the sustainability of such high yields. stated:

“The core issue I see with this protocol is the assumptions around the persistence of yield – they rely on the short leg paying out bigly, and this is far from a guarantee.”

Nonetheless, he did offer his congratulations and acknowledge that the initiative is both intriguing and ambitious.

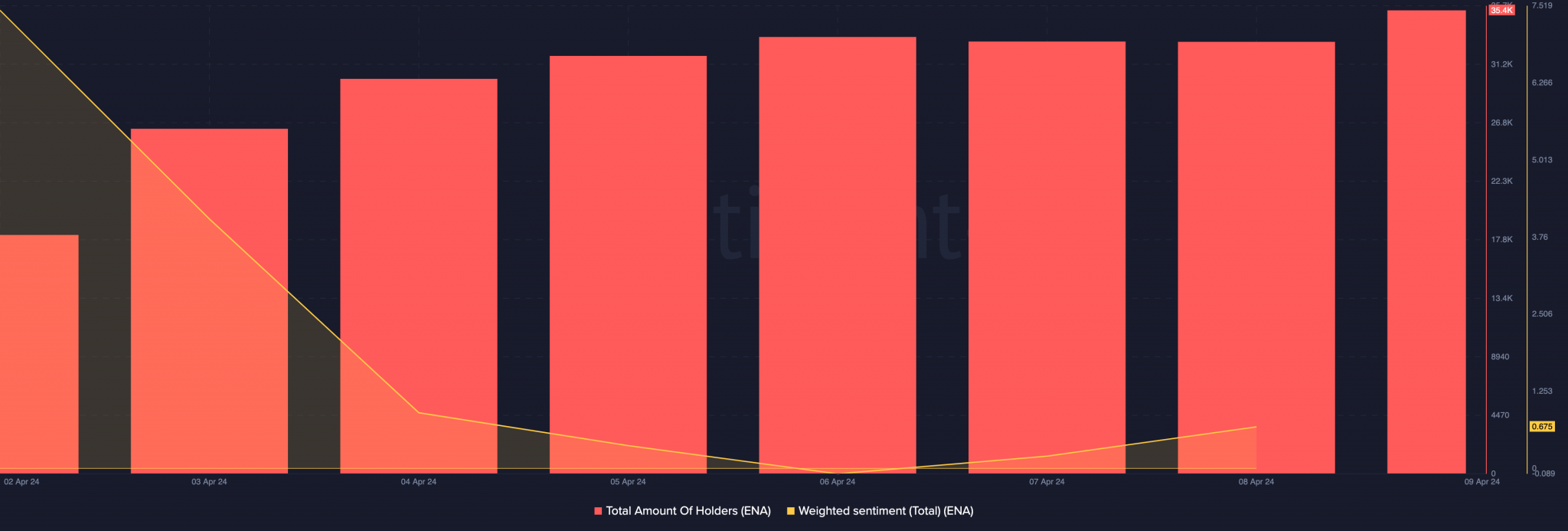

What is interesting is that the number of holders actually increased, according to on-chain data. Outside of that, there was no change to the positive Weighted Sentiment around ENA.

An Optimistic Approach: Buy High, Sell High

Analysts at X have suggested a “Buy High, Sell High” approach in the midst of the excitement around ENA’s explosive surge. This strategy reflects the great expectations and possibilities that analysts see in this emerging coin. This view points to a bullish future for ENA and is consistent with the optimism of the larger community.

Ethena is positioned as a possible industry game-changer due to its creative approach to banking and savings, which is supported by strong collateral and high yields, as it continues to negotiate the challenging DeFi landscape. The following video has taken a deeper look at this development, giving you more insight.