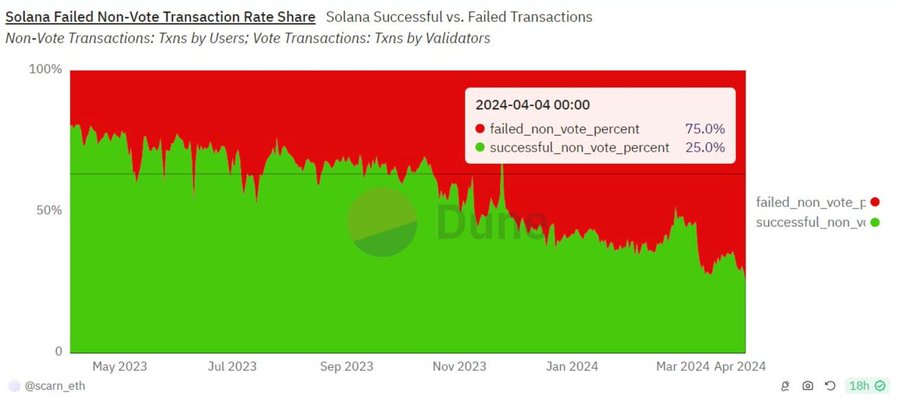

- Solana experienced severe congestion, causing delays or failures in approximately 75% of transactions, impacting meme coin markets.

- The update targets issues with the QUIC implementation and Agave validator client behaviors; testing is ongoing on the testnet.

The Solana network recently encountered congestion, impacting its ecosystem’s operations. In response, Anza, a development shop focused on Solana, released an update designed to mitigate these issues.

This update, version v1.18.11, has been implemented on Solana’s devnet to stabilize network performance and support the ecosystem’s recovery.

Approximately 75% of transactions on the blockchain were delayed or failed, leading to a market sell-off affecting these tokens.

Anza identified the primary sources of the congestion as issues with the QUIC implementation and the behavior of their Agave validator client.

$Solana's volume exploded by a factor of 10, same applies to unique users.

Ofc this comes with a cost, extreme congestion, causing transactions not to land as they should. But it's part of the process—the process of becoming the one and only preferred blockchain to trade by… pic.twitter.com/lY71mxz5vR

— Ree-th-mos (@Reethmos) April 4, 2024

The development team has requested that validators on the Solana testnet adopt this new release to start evaluating the proposed fixes for these congestion issues.

Read more: Solcraft Ecosystem Preparing to Launch the $SOFT Utility Token on Solana Blockchain

The update is currently being tested on the testnet before any deployment on the mainnet, which is expected to take about two days to achieve majority validation after release.

In addition to these technical solutions, Anza engineers, along with other core contributors, are actively working to diagnose and resolve underlying bottlenecks, aiming to enhance the overall performance of the Solana network.

Transaction Failures on Solana’s Blockchain

The Solana blockchain, recognized for its rapid processing speeds, is currently experiencing a high rate of transaction failures. Data analysis by Scarn_eth from Dune shows that on April 4, approximately 75.3% of non-vote transactions failed. Non-vote transactions are defined as movements of SOL currency between different accounts on the Solana network.

This high failure rate coincides with an increase in network activity and trading volumes, particularly involving memecoins.

Related: Solana Validators Overwhelmingly Approve ‘Timely Vote Credits’ Plan to Accelerate Transactions

Critics have questioned Solana’s scalability, which is a fundamental attribute promoted by the blockchain. This scalability issue has become apparent during times of increased activity, leading to significant congestion.

In contrast, proponents of Solana maintain that such congestion phases are typical during periods of exponential growth in network activity and user base.

Impact of Bots on Network Performance

The increase in failed transactions has been largely attributed to the activities of trading bots. These bots are programmed to execute transactions quickly, exploiting potential arbitrage opportunities.

However, when these opportunities are absent, the transactions often fail to execute. According to the data, bots were responsible for 55% of all swaps recorded at the time, totaling $30.2 million in trading volume.

Mert Mumtaz, CEO of Helius Labs, noted that bots generally submit transactions at a rate that exceeds the blockchain’s capacity to process them in real time, resulting in a high number of dropped transactions from human users.

rough TL;DR of what's happening:

– the networking stack (QUIC) on Solana is implemented poorly and does not handle spam well

– if everyone spams, a lot of connections get dropped since a block leader can only handle so many connections at once

– bots spam better than humans,…

— mert | helius.dev (@0xMert_) April 4, 2024

He emphasized that the existing metrics, which frequently cite high failure rates, do not accurately represent the average user’s experience since most genuine user transactions are dropped before reaching the blockchain.

Mumtaz estimates that about 95% of all failed transactions shown in these metrics are due to bots attempting unsuccessful arbitrage trades, underscoring the disproportionate impact of automated trading on Solana’s network congestion and transaction failure rates.

The current price of Solana (SOL-USD) is approximately $151.00, experiencing a notable decline of about 9.50% as of the latest update.