- Low demand and pessimistic attitude towards Cardano fuel possible losses even further.

- In contrast to low user involvement and unfavorable attitude, there is high development activity.

Technical analysis indicates that Cardano (ADA) will probably suffer more losses since it has not been able to overcome its negative bias. A bullish attitude and a lack of demand are the main contributors to this tendency.

Influence of Bitcoin and On-Chain Statistics

Cardano has been mired between $0.43 and $0.47, while Bitcoin has found it difficult to escape the $60.8k–$63.3k area. Reiterating the gloomy assumptions, on-chain measures show no indication of a positive breakout for Cardano.

As of writing, ADA was trading at about $0.4338, down 1.70% in the previous day and 3.18% over the previous week, according to CoinMarketCap.

Long-term investors should be pleased with high development activity since it shows that the project is always resolving problems and getting ready to release new features.

To improve peer-sharing capabilities and get itself ready for upgrades following the Conway era shift, Cardano has released node v.8.9.2, as previously reported by ETHNews.

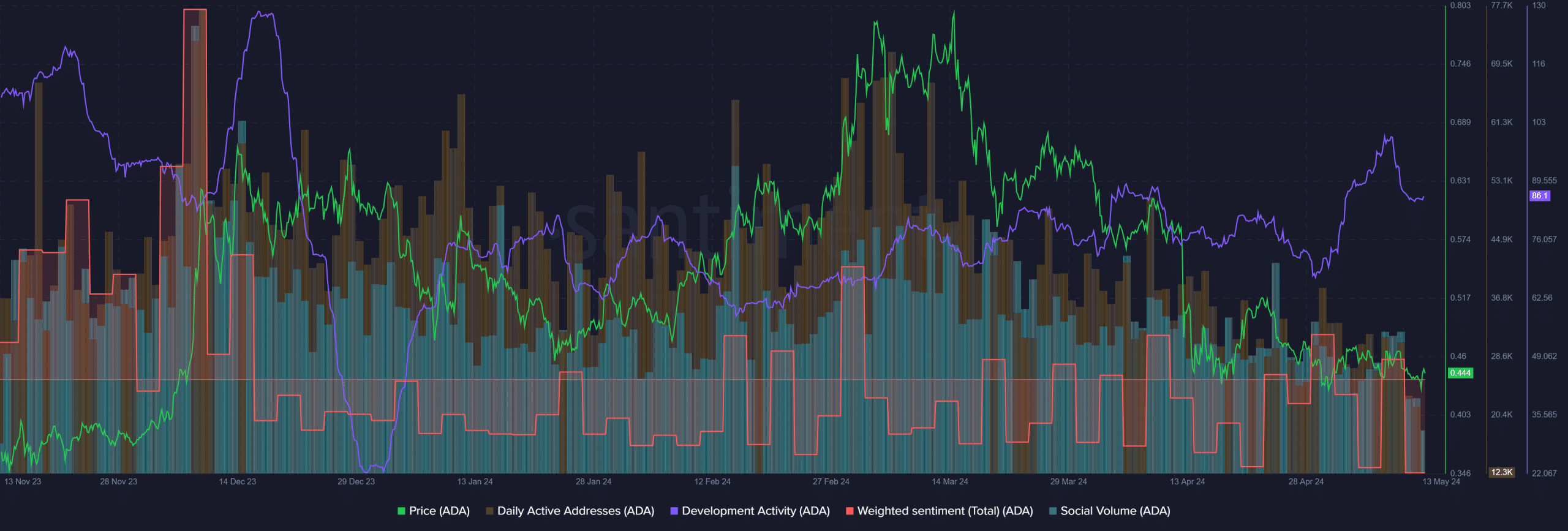

Though development activity has been robust, since mid-March, other indicators like daily active addresses and social traffic have been falling.

Raising User Involvement and Sentiment

Social media interactions have decreased and daily active addresses show that fewer people are using the network for transactions. Furthermore, for the majority of the last six weeks, the Weighted Sentiment has been down.

Though it does not always mean a quick decline, this negative or bearish internet activity does not look good for the short-term price prospects.

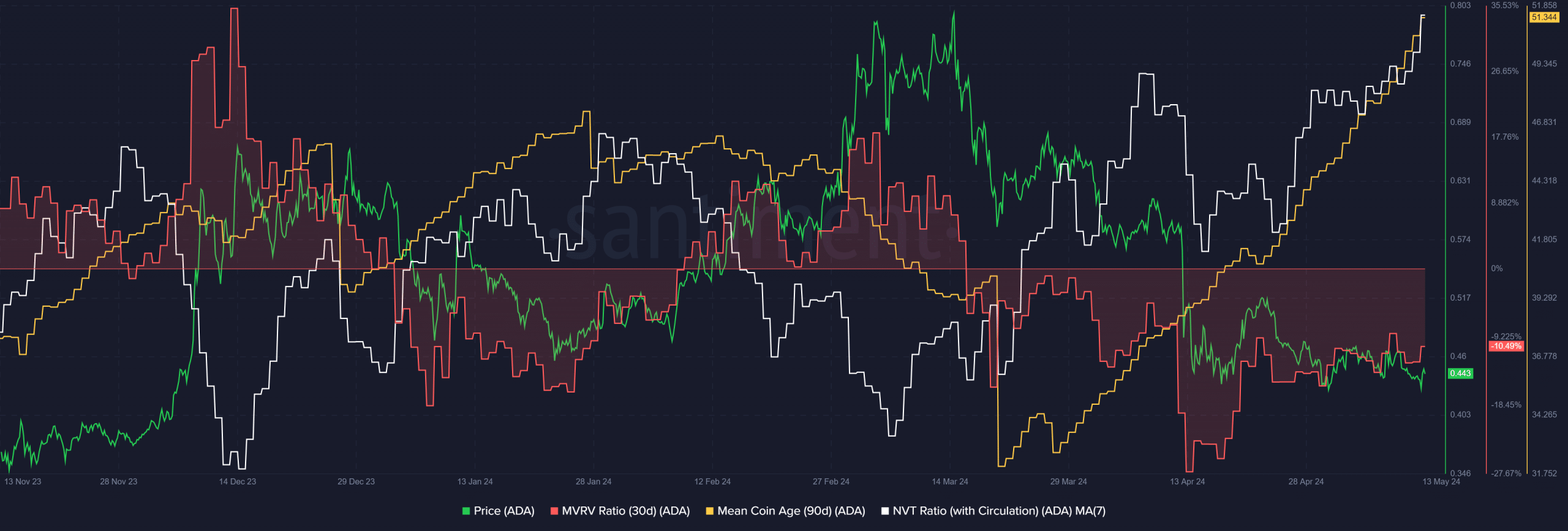

Since mid-March, the 30-day MVRV ratio has been negative, indicating an acutely undervalued asset. This undervaluation hasn’t changed the unfavorable price trend. Ongoing accumulation is indicated, nonetheless, by the fast rising mean coin age. Swing traders had a nice chance to purchase as ADA approached the range bottom.

The Network Value to Transactions (NVT) ratio, which is based on daily circulation, has also been trending higher since mid-March.

This implies that, given its poor capacity for token transactions, the network is either overpriced or costly. Bearish consequences follow for network utilization and, hence, future demand.

Ahead for Cardano

Combining technical analysis with these hints, it seems that Cardano is probably going to suffer greater losses. But this downturn might stop or turn around if Bitcoin breaks out.

Still, there is no bullish evidence at hand. Whale transactions started to rise earlier, indicating possible interest from big investors, when Cardano’s trading volume reached a yearly low, in line with what ETHNews previously disclosed.