- Bitcoin price falls to $65,875, down 10.5% from its recent all-time high of $73,797.

- Analysts remain optimistic about future flows into Bitcoin ETFs, despite recent outflows and market adjustments.

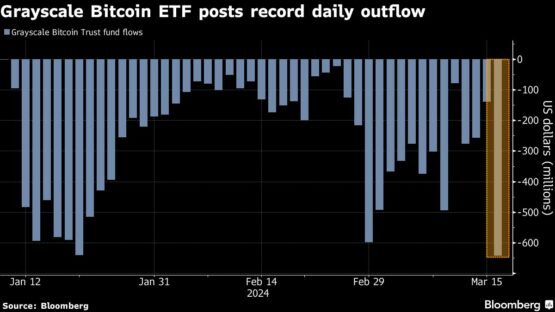

Grayscale’s Bitcoin Trust (GBTC) experienced a substantial outflow of over $640 million on March 18, marking this event as the most considerable withdrawal since its change to a spot Bitcoin Exchange-Traded Fund (ETF) on January 11.

At the same time, Fidelity’s Bitcoin ETF saw its lowest day of inflows, managing to attract just $5.9 million, according to Farside Investors. These movements led to a collective decrease of $154.3 million from the total assets managed by spot Bitcoin ETFs.

In the aftermath of these financial shifts, the market price of Bitcoin adjusted to $64,489.72, showing a decrease of 11.5% from its high at $73,797 on March 14.

Analysts have connected this downturn in price to a mix of factors, including the recent ETF outflows, the anticipation surrounding the next Bitcoin halving event, and the upcoming Federal Open Market Committee (FOMC) meeting convened by the United States Federal Reserve on March 20.

Amid these fluctuations, some analysts remain hopeful about future investments into Bitcoin ETFs. For instance, Grant Englebart from Carlson Group shared with Bloomberg TV that only a small percentage of their advisors have recommended investments into Bitcoin ETFs to their clients, with such investments averaging at 3.5% of total assets.

Eric Balchunas, an ETF analyst for Bloomberg, relayed via social media that the adoption of spot Bitcoin ETFs has thus far been modest, largely taken up by a select group of early investors.

Only a “handful” of advisors have allocated to bitcoin ETFs but the avg allocation was 3.5%, according to Carson Gp, one of the earliest advisor platforms to onboard the ETFs via ETF IQ https://t.co/VIAVw9BAGc

— Eric Balchunas (@EricBalchunas) March 18, 2024

The broader cryptocurrency market, including Ethereum, Solana, and Dogecoin, has also reacted to these financial shifts. Adding insight from a global viewpoint, a Singapore-based crypto trading firm, QCP Capital, expressed its intent to monitor the ETF flow numbers closely, mentioning that a net negative flow could serve as a strong bearish indicator.

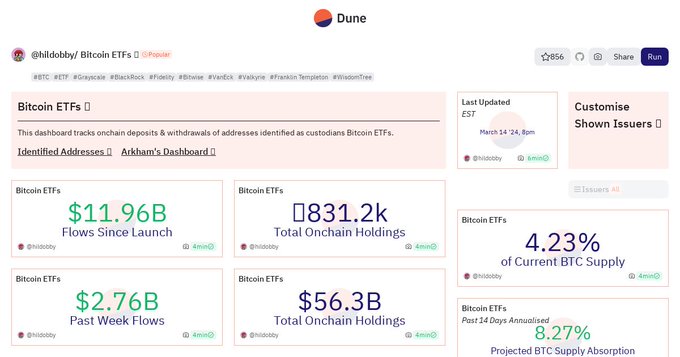

Since launching, the suite of Bitcoin ETFs has attracted a net $12 billion, pushing Bitcoin to a recent peak. However, enthusiasm has tapered, amidst cautious narratives around bubble-like characteristics in some assets.

Additionally, adjustments in global monetary policies introduce further complexity into the market’s trajectory.