- Solana’s recent price surge to $150 highlights its growth, spurred by Pantera Capital’s plan and increased DEX activity.

- Despite competition, Solana’s TVL reaching a 16-month high and DApp volume surge underscore its expanding market presence and potential.

The recent ascent of Solana (SOL) to $150 marks a pivotal moment, reflecting its highest valuation since January 2022.

📈 #Solana is on the brink of crossing $150 for the first time since January 16th, 2022. Crowd sentiment is leaning slightly #bullish toward #5 market cap $SOL, but not to the extent where #FOMO could halt a rally. Doubt historically fuels prices higher. https://t.co/DDtDxlCT6F pic.twitter.com/XP22cQxdkl

— Santiment (@santimentfeed) March 7, 2024

This 19.5% uptick between March 5 and March 7 was catalyzed, in part, by Bloomberg’s report on Pantera Capital’s strategy to invest $250 million in SOL tokens from the bankrupt FTX’s assets.

This development leads to speculation about SOL’s capacity to maintain its 47% gain over twelve days and the possibility of it breaking the $200 threshold.

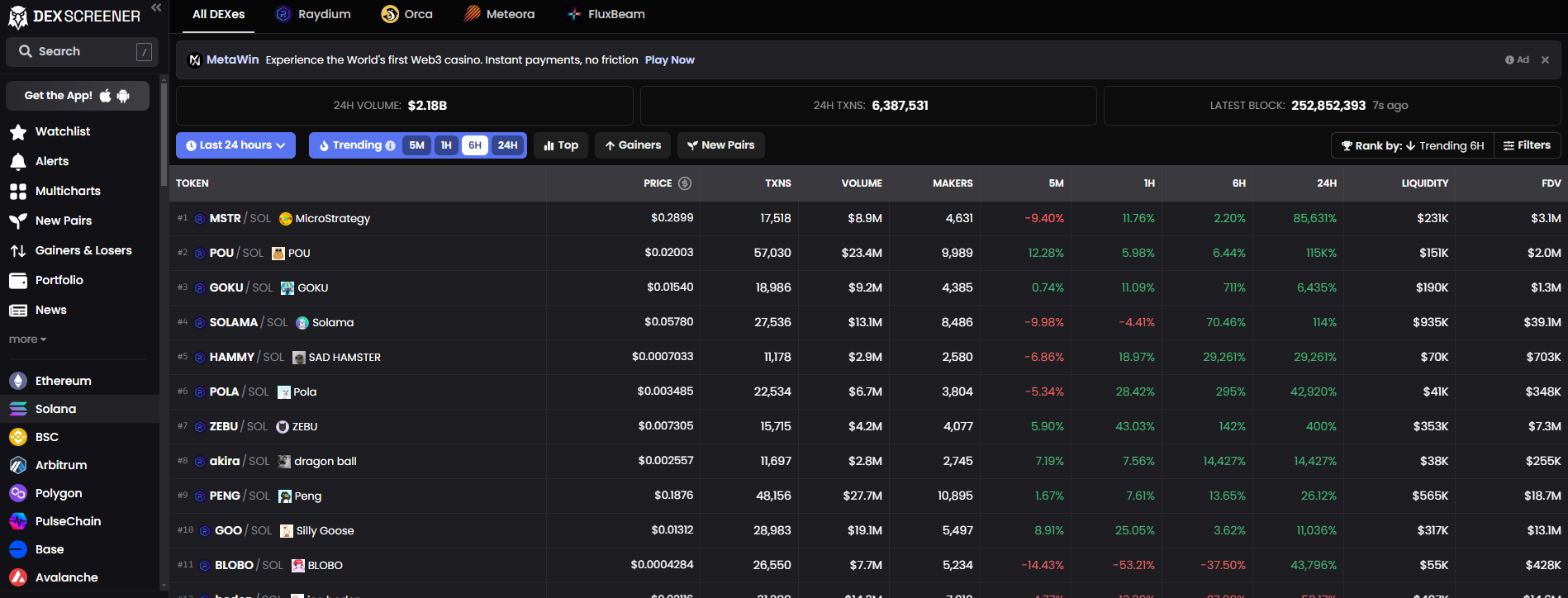

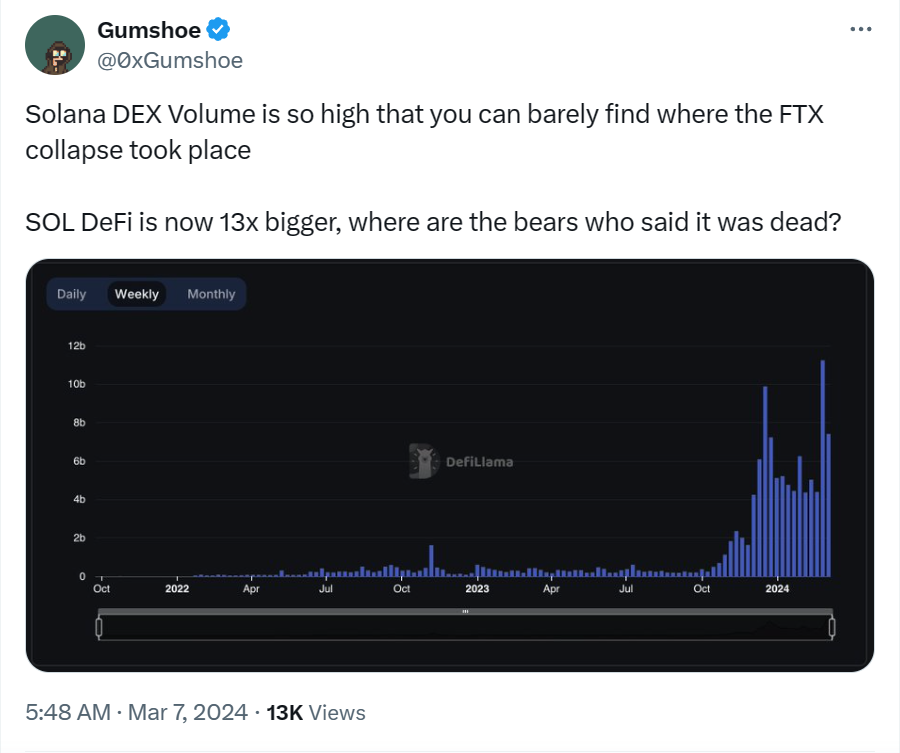

The surge is not solely due to Pantera Capital’s acquisition plans; it also arises from significant activity on Solana’s decentralized exchanges (DEXs), particularly driven by the popularity of memecoins on the platform.

The interest in tokens, influenced by various themes and humor, contributed notably to the trading volume and performance on Solana’s DEXs. This phenomenon not only stimulates demand for SOL tokens but also enhances the utility and visibility of Solana’s DEX ecosystem, attracting both new entrants and those less focused on the blockchain’s decentralization aspects.

Moreover, the appreciation in value of other Solana Protocol Ledger (SPL) tokens, tied to practical applications, between March 5 and March 7 by nearly 30%, reinforces the network’s broader appeal beyond just speculative trading. The excitement around upcoming airdrops continues to propel SOL demand, indicating a robust and dynamic ecosystem.

The fundamental driver behind SOL’s bullish trend is the ongoing expansion and activity within the Solana network.

Breaking: @PanteraCapital – the largest crypto fund is raising funds to buy Solana holding from the @FTX_Official estate 👀

Massive bullish news.https://t.co/HuupIaeRL8 pic.twitter.com/EQWnL1laLn

— MartyParty (@martypartymusic) March 7, 2024

Despite concerns that the enthusiasm for airdrops and memecoins might be temporary, or that the repercussions from the FTX bankruptcy could pose limitations, the consistent surge in volumes and development of new protocols presents a more substantial measure of Solana’s market stance and growth potential.

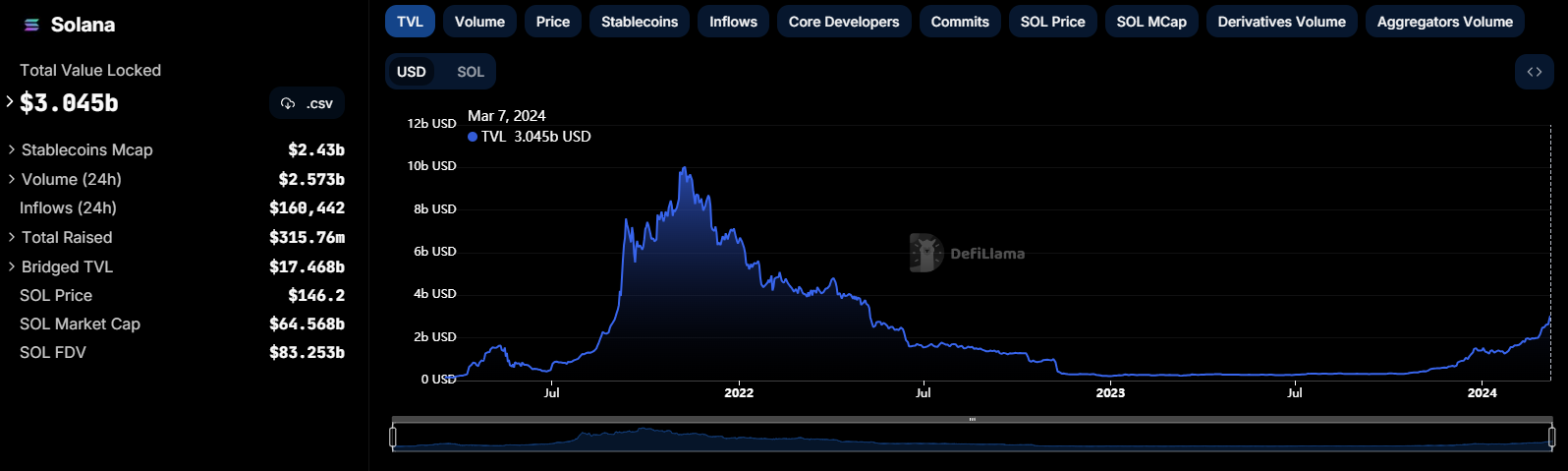

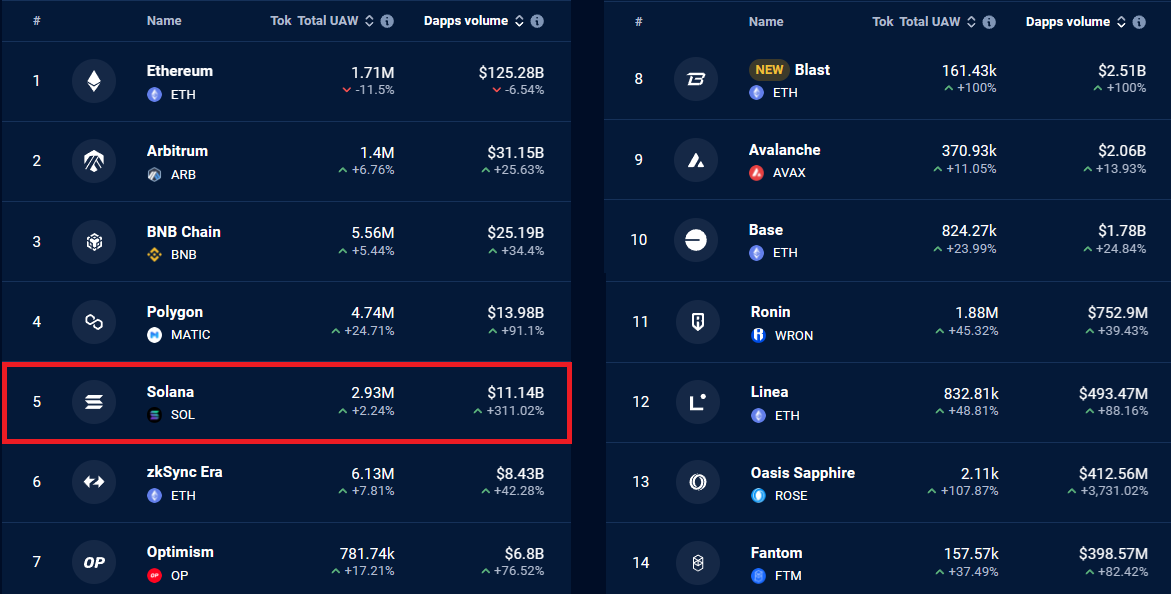

Solana’s total value locked (TVL) in smart contracts achieving a 16-month peak on March 6 underscores the network’s robust engagement and trust in its decentralized applications (DApps). This contrasts with the performance metrics of competitors, highlighting Solana’s distinct position in the marketplace.

Solana’s DApp volume witnessed a 311% increase in the past 30 days, outperforming Ethereum and other top-10 blockchain networks, further emphasizing its expanding influence.

The current price of Solana (SOL) is approximately 146.01 USD, experiencing an increase of 4.14%.

The potential for SOL to reach or exceed the $200 mark ultimately depends on sustained demand for and growth of the Solana network.

The current trajectory suggests a promising future, albeit within a highly competitive digital asset environment.