- Solana’s current trading price under $200 is viewed as a bargain by analysts, hinting at a good buying opportunity.

- Despite a 30% gain in May, Solana didn’t revisit the $200 mark, showing lack of upward price momentum.

Solana (SOL) presents an interesting case this summer, according to market analysts. With its value sitting below $200, experts consider this a bargain for potential investors. Currently, SOL trades at approximately $164, a drop from its all-time high of $259, presenting a potentially lucrative buying opportunity.

Despite the attractive price, the cryptocurrency lacks strong upward momentum. In May, Solana provided investors with over 30% gains, though it failed to revisit the $200 mark, a psychological threshold it had previously crossed in March. This indicates a hesitancy among traders to push the price upwards aggressively.

Best HTF chart for simplicity right now is probably $SOL.

Still cheap, you’re targeting ATHs, and it’s from a spot perspective I just don’t think you can really go wrong.

I’ve been saying the same since $135s and nothing changes on the cheapness with the target.

— Cold Blooded Shiller (@ColdBloodShill) May 30, 2024

A cryptocurrency analyst has labeled the current price of SOL as ‘cheap’ and suggests it as a prime buying opportunity for spot traders aiming to reach or surpass the previous peak of $259. Another analyst, known pseudonymously as Ansem, has outlined a promising short-term strategy for Solana.

buying more $SOL w/ options profits @ $169, still think chop for rest of the summer but adding to spot position here

reason for $ETH short hedge I have w/ $4100 as invalidation is because I don't want to sell my spot solana bags & others

if sol holds $154 then range highs next pic.twitter.com/hXjiud0meA

— Ansem 🐂🀄️ (@blknoiz06) May 30, 2024

Ansem’s approach recommends entering the market just above the $160 support level, targeting a profit slightly above May’s high. He also set a stop-loss at $159, to protect against potential declines.

This setup reflects a solid foundation in technical analysis and appears to be a favorable strategy for those looking to take a long position in the spot market.

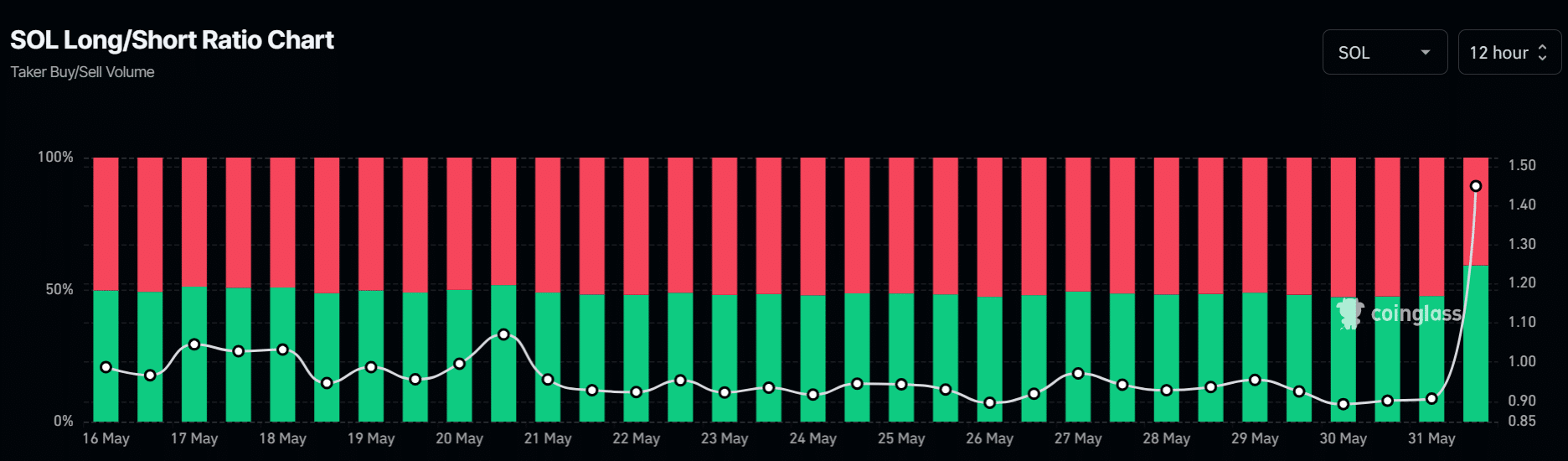

Additionally, recent data shows an increase in the number of traders taking long positions on Solana, from 47% at the end of May to 59% the following day, suggesting a growing optimism about the price increasing from its current level.

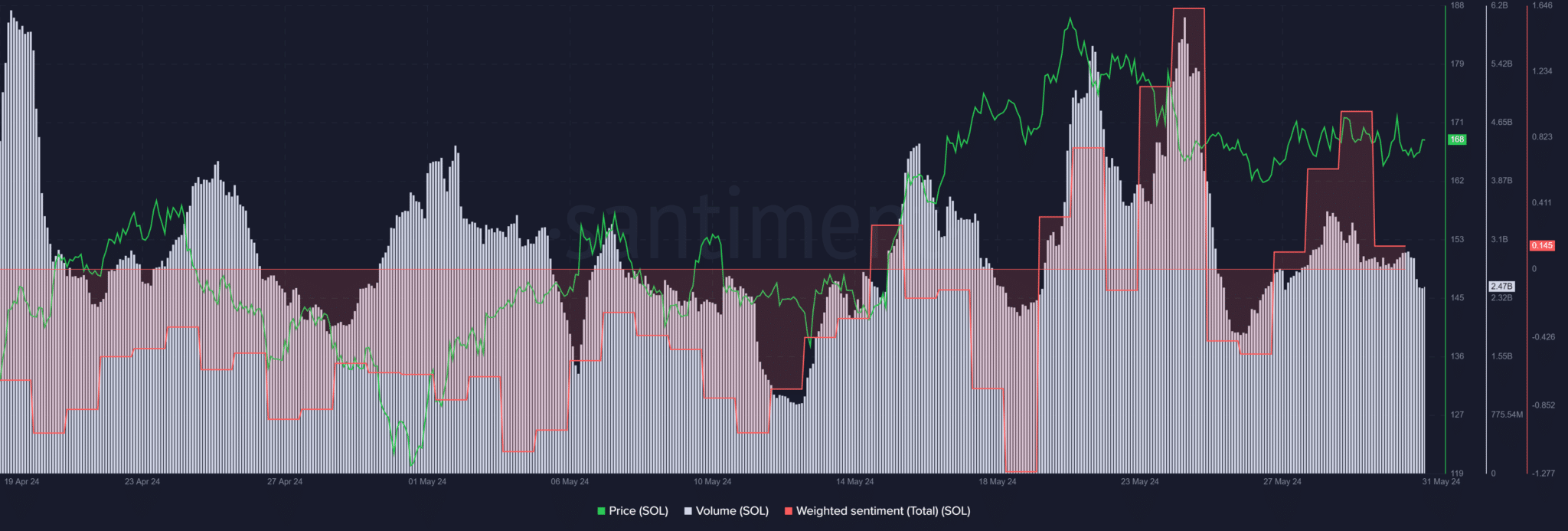

However, despite the favorable setup, the broader market sentiment towards Solana remains cautious. The declining on-chain volume and muted market reactions to external influences, such as PayPal’s recent updates, hint at a potential delay in Solana’s price recovery.

Moreover, key technical indicators remain neutral, indicating that the price could move in either direction, which requires traders to remain patient and vigilant.