- Bitcoin’s price fluctuates between $53,500 and $58,900, indicating a stable trading range without clear dominance.

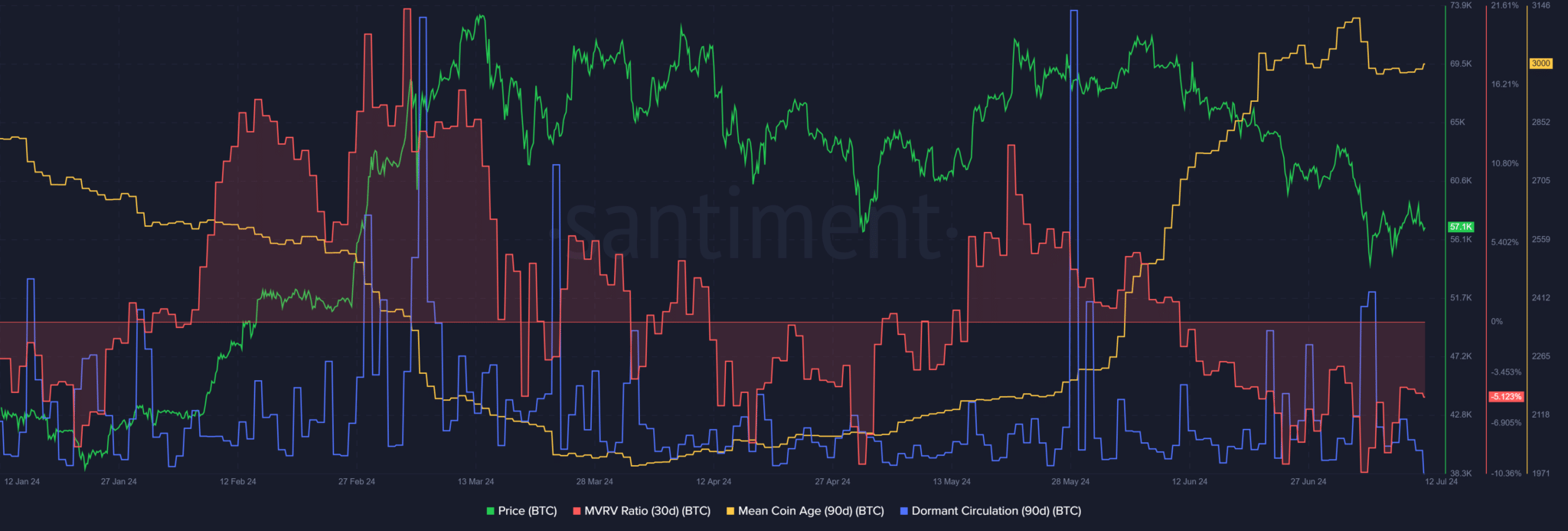

- Accumulation trends have increased but have not significantly influenced Bitcoin’s market price or led to recovery.

Bitcoin’s current market behavior is characterized by oscillations within a defined price range of $53,500 to $58,900. This pattern reflects a state of equilibrium where neither buyers or sellers have clear dominance.

The recent increase in Bitcoin accumulation activities has yet to trigger a substantial upward movement in its price. This situation has led market observers to closely monitor for any signs of change that could indicate a future trend.

Technical analyses reveal subdued buying pressure, as indicated by the On-Balance Volume (OBV), which aligns with a Relative Strength Index (RSI) below the midpoint of 50 following a rejection at higher price levels. This suggests that the buying strength necessary to sustain higher prices is lacking.

ETHNews further data points reveal that the influx of coins into the market has not significantly altered the overall trading volume or affected the market’s stability.

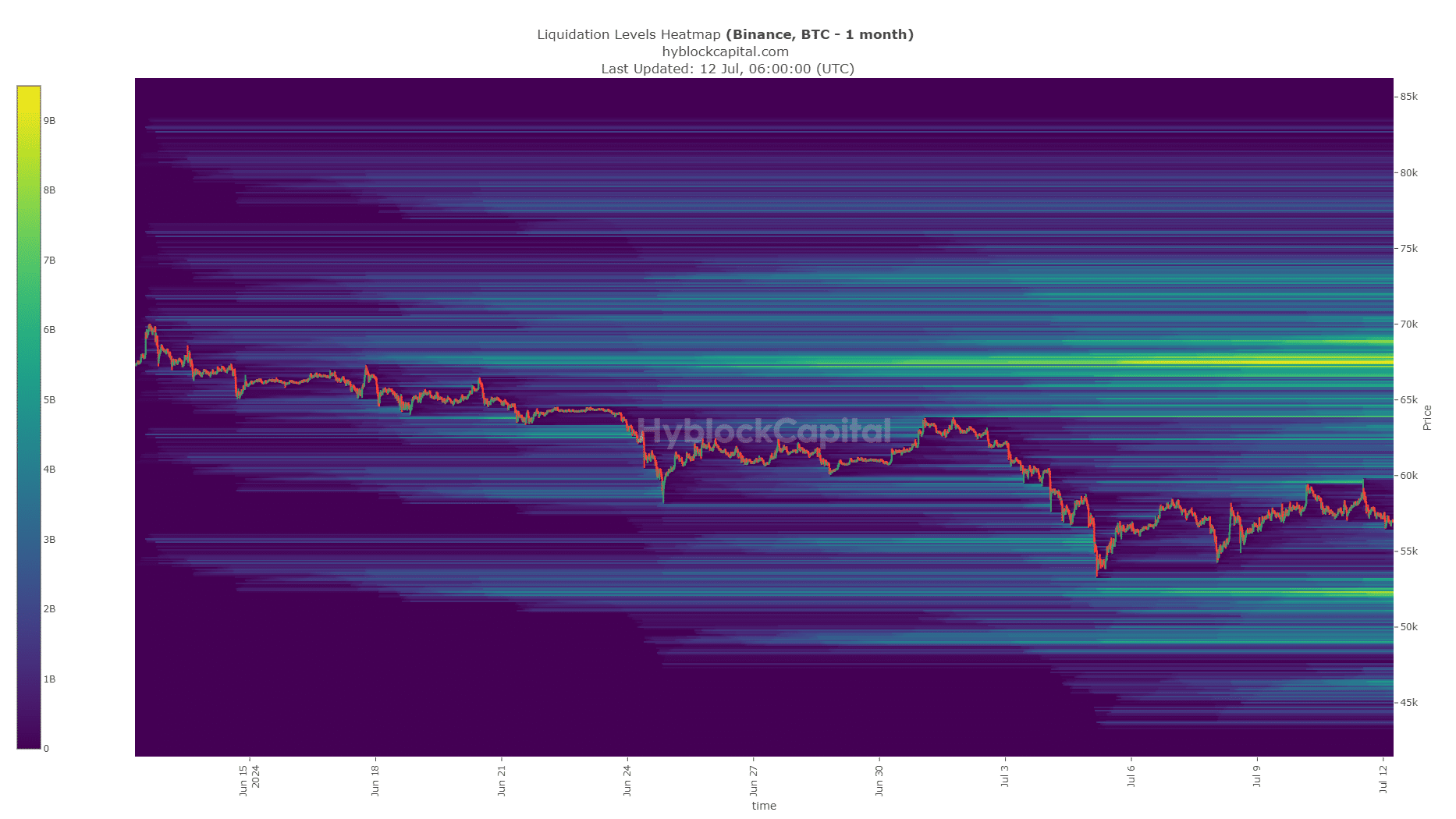

The analysis of liquidation events and market resistance levels suggests that while the lower price threshold of $52.1k may act as a new focal point for market activities, there is potential for further decline if investor sentiment weakens, possibly extending down to around $46k.

In this environment, investors might consider strategic entries, as lower price points could present buying opportunities should the market stabilize or begin to ascend again.