- Dogecoin has seen a sharp increase in demand and active transactions in the last day, as well as a 14.94% price increase.

- As DOGE breaks out of a descending triangle pattern and has a significant correction, popular analyst Ali Martinez predicts a new rebound.

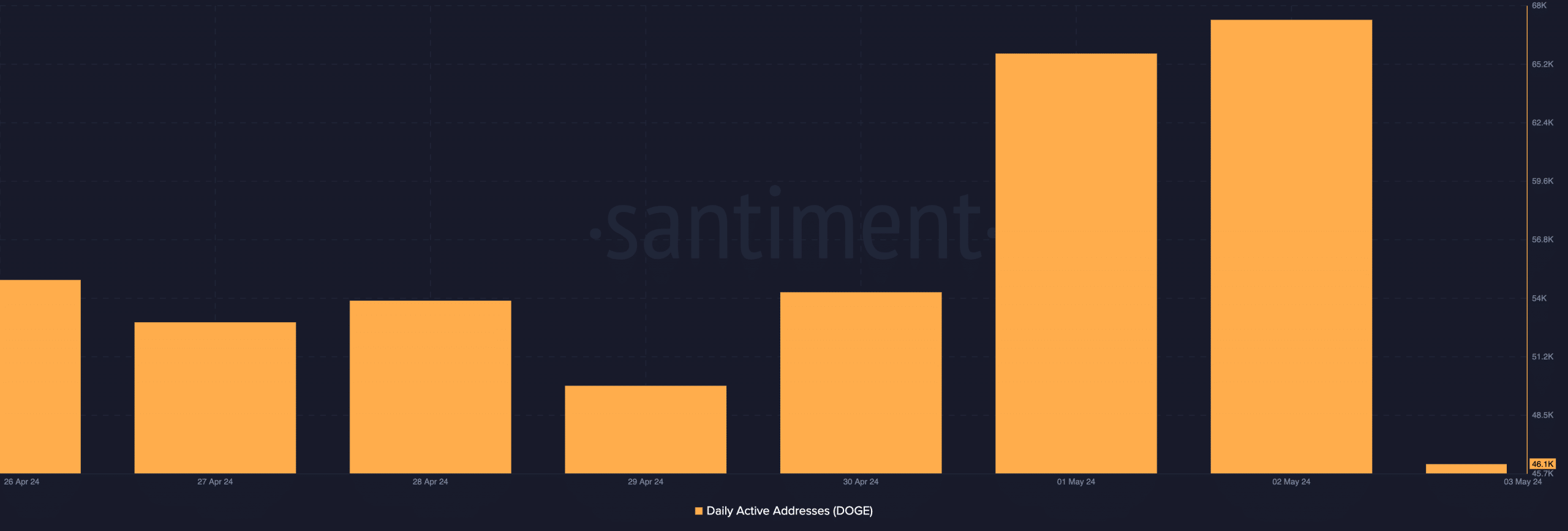

With 28,000 new addresses generated for trading Dogecoin (DOGE) on May 2, there was a notable spike in interest from new users, up 102% from the previous monthly low on April 29, in line with what ETHNews previously disclosed.

Increase in DOGE Transaction Activity and Demand

According to data from Santiment, this spike in new demand coincided with a 27% rise in the daily count of addresses doing DOGE transactions during the previous week. Dogecoin’s price stayed comparatively steady despite this spike in activity, which frequently surprises analysts and investors alike.

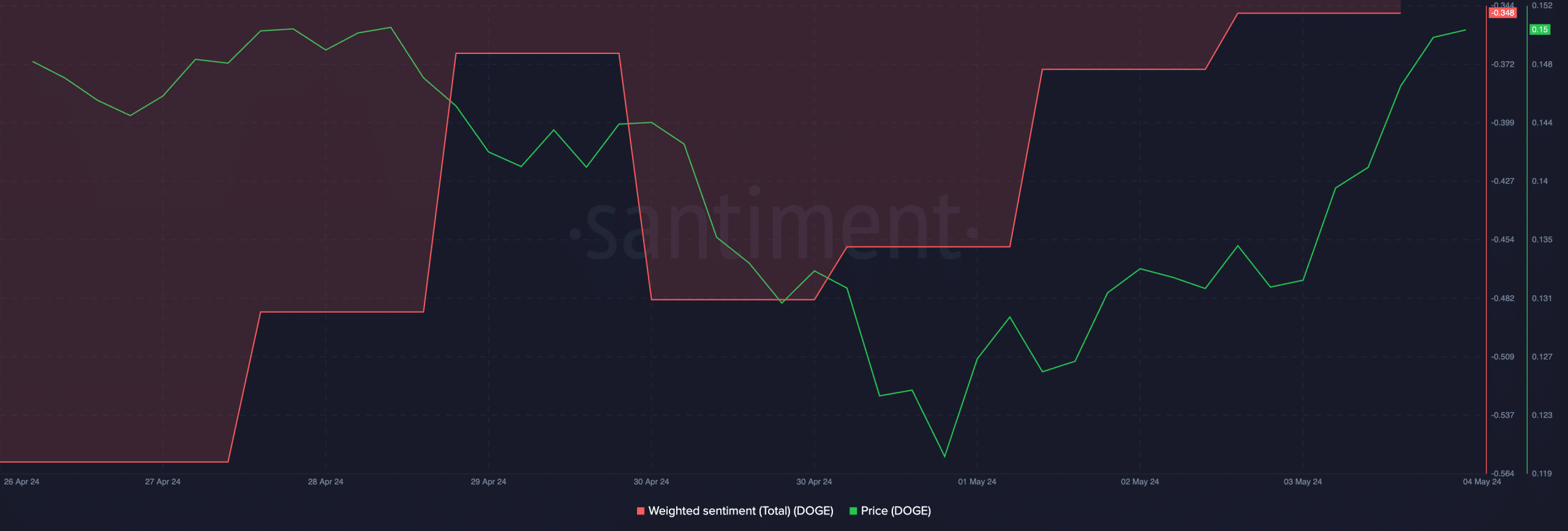

The steadiness, however, was only temporary, as the latest data from CoinMarketCap shows a strong 14.94% price increase in the previous day, with the current price at roughly $0.1524. This increase is a continuation of the bullish trend that has seen DOGE’s value grow by 5.16% overall over the last week.

Also, popular cryptocurrency analyst Ali Martinez added to the positive outlook by pointing out that Dogecoin has broken out of a descending triangle pattern, a move that is comparable to its prior cycles.

Now, in 2024, #DOGE has yet again broken out of a descending triangle!

It is currently undergoing a 47% price correction, very similar to previous cycles, which could ignite the next $DOGE bull run! pic.twitter.com/ZmuHmvIwei

— Ali (@ali_charts) May 1, 2024

The 47% price drop that DOGE is currently experiencing is similar to its previous pattern, which frequently comes before notable rallies.

Additionally, according to Santiment’s sentiment research, DOGE’s weighted sentiment, which is now at -0.348, is about to cross its center line and begin an upward trajectory. This indicator gauges the general sentiment of the market and, should it rise above zero, would suggest a change in investor sentiment from negative to bullish.

MVRV Ratio’s Significance as a Buy Signal

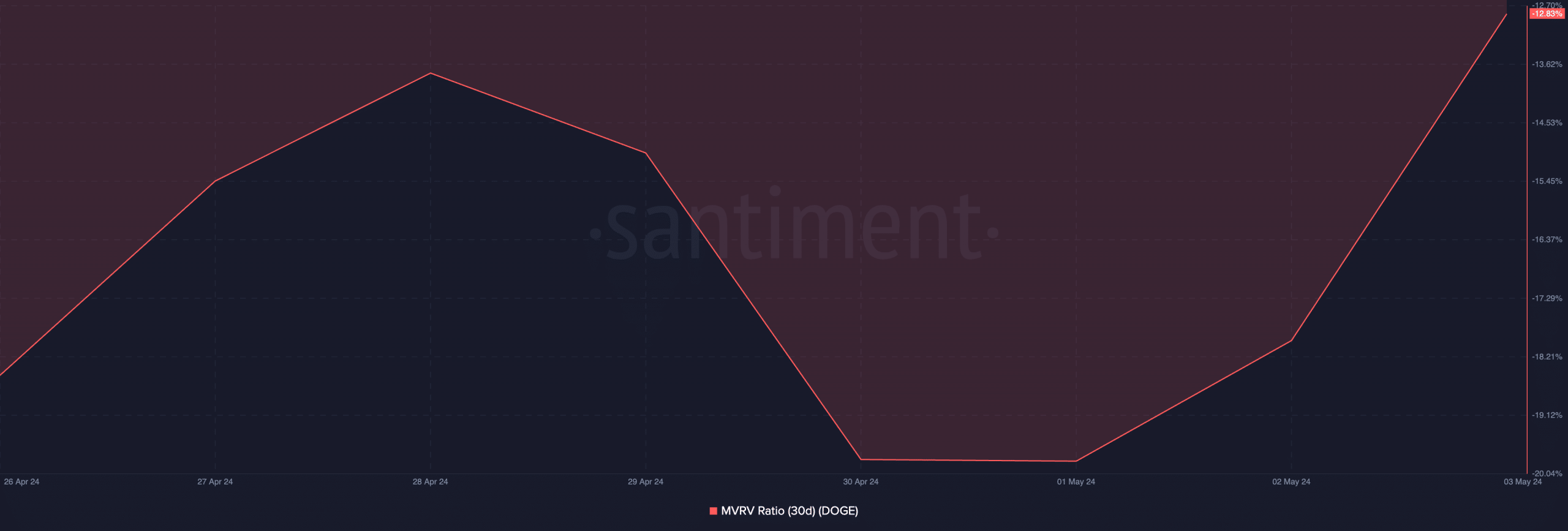

Dogecoin’s Market Value to Realized Value (MVRV) ratio is another important indicator supporting the bullish trend.

With a ratio of -12.83% at the moment, DOGE may be undervalued. In the past, traders have used these negative numbers as a sign to buy the dip in anticipation of future price rises.

Comparing an asset’s current market price to its average purchase price allows one to determine if it is undervalued or overvalued. This may be done with the help of the MVRV ratio.

A ratio that is negative, like the one that Dogecoin is currently seeing, usually indicates that there may be room for price growth because the asset’s market value is less than the average cost of acquisition for all tokens in circulation.